|

#2

29th July 2015, 11:46 AM

| |||

| |||

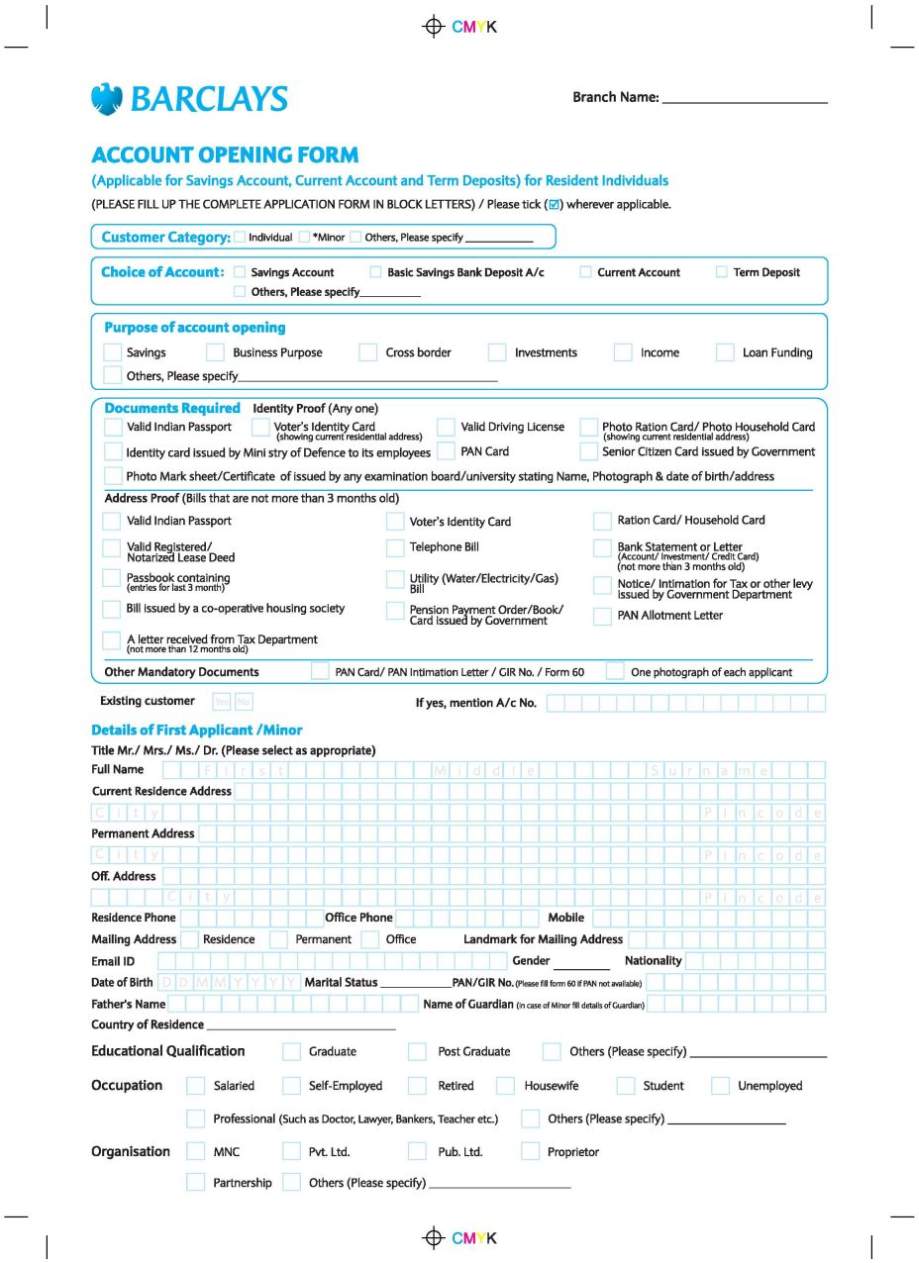

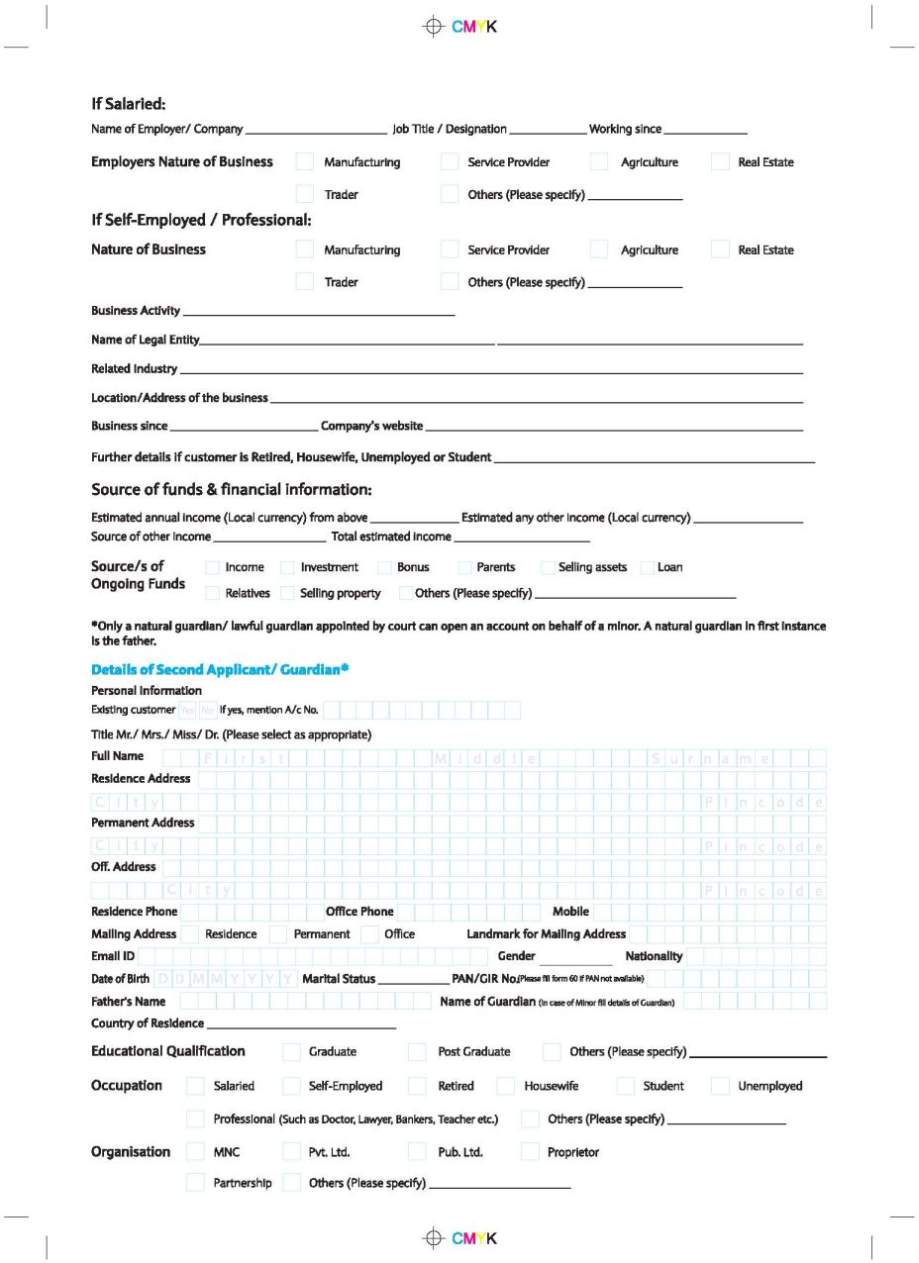

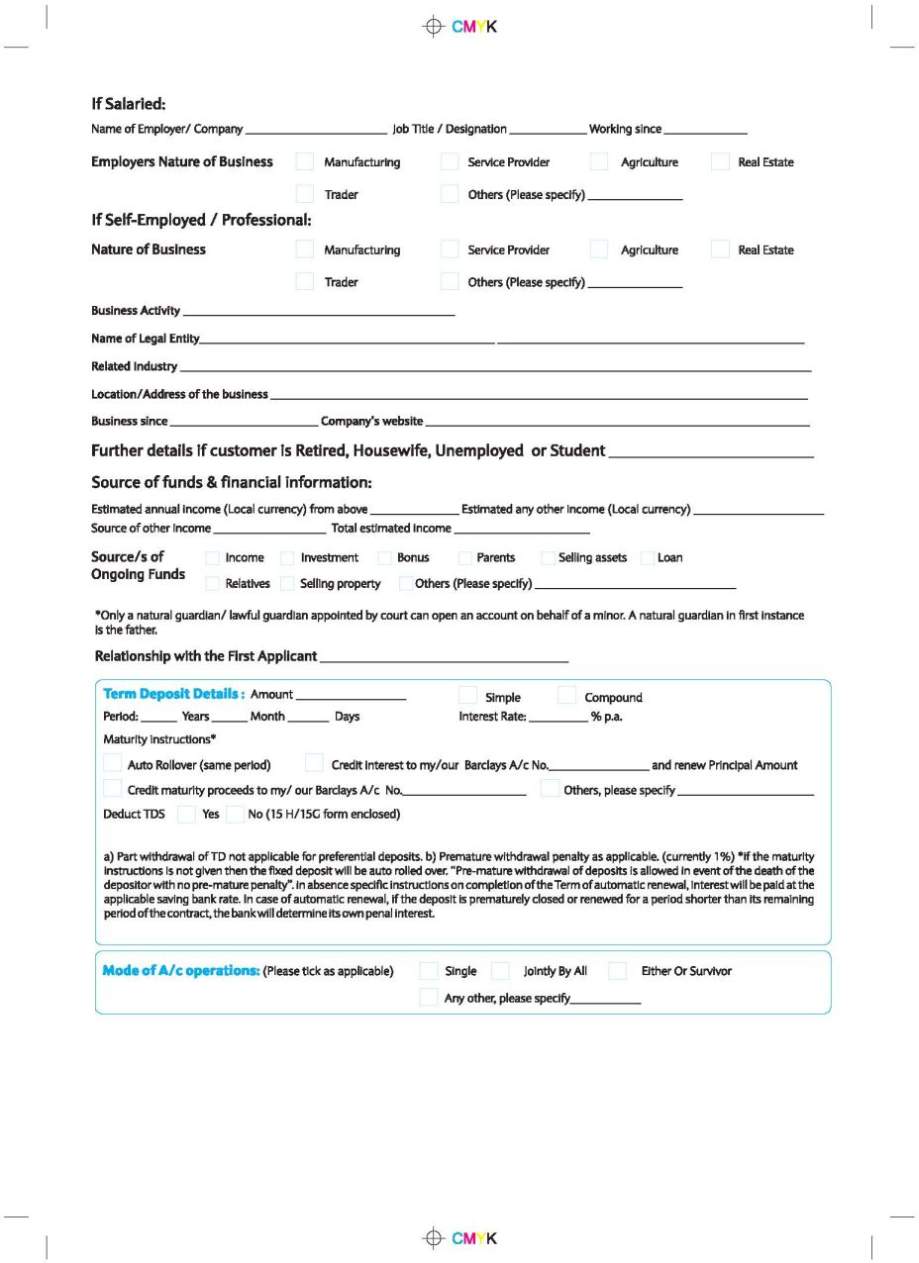

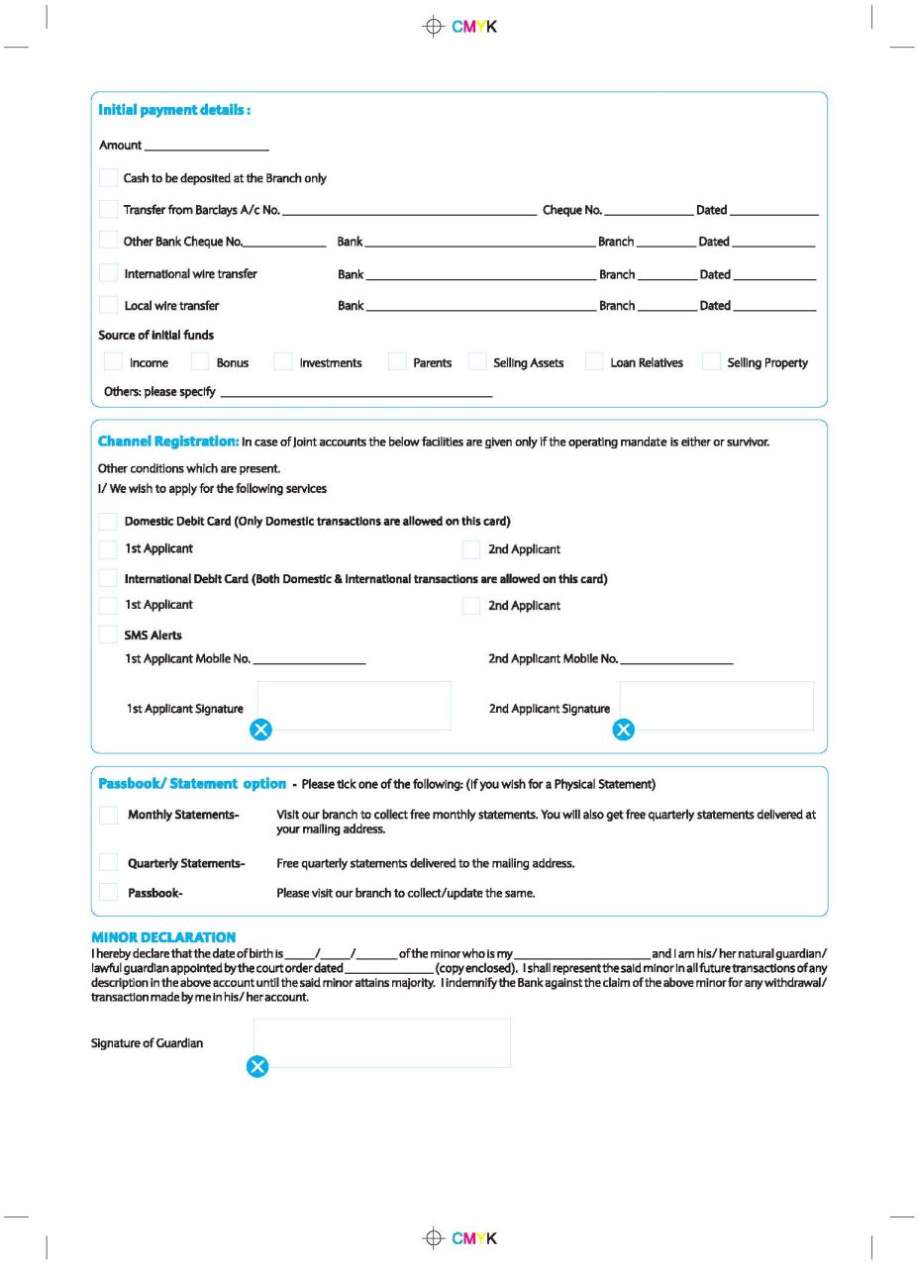

| Re: Barclays Bank Sunderland

As you want to get the contact details and different deposit accounts of Barclays Bank Sunderland so here is the information of the same for you: Barclays Savings Account: Features & Benefits* Free Payable at Par cheque book Free Classic Debit Card Free unlimited transactions for cash withdrawals at any banks' VISA/VISA Plus ATMs in India Free quarterly account statements Free demand drafts payable at Barclays Bank branches in India Free SMS Alerts Eligibility This account can be opened by individual resident Indian customers. * Facilities offered as Free are at the sole discretion of the bank and the bank may without prior notice of the same, limit such offerings. Basic Savings Bank Deposit Account: Features & Benefits* Zero Balance account Free Payable at Par cheque book Free Classic Debit Card Free quarterly account statements Free SMS Alerts Eligibility This account can be opened by individual resident Indian customers. *Facilities offered as Free are at the sole discretion of the bank and the bank may without prior notice of the same, limit such offerings. Current Accounts: Features & Benefits* Free Payable at Par cheque book Free monthly account statement Free Demand Drafts payable at Barclays locations Local cheque collections and payments Facilities offered as free are at the sole discretion of the bank and the bank may without prior notice of the same, limit such offerings. Term Deposit Account: Features & Benefits You can open a Barclays Term Deposit with a minimum of Rs. 10,00,000. Simple or cumulative interest payment – Interest can either be credited on a quarterly basis to your Savings account or be re-invested into your Term Deposit account till maturity. Auto renewal# of Term Deposit on maturity Tax Deducted at Source (TDS) TDS on deposits as applicable as per the Income Tax rules except where exemption certificate is made available to the bank for each deposit at the beginning of every financial year. Interest Rates: Term Deposit Interest Rate-Applicable for Domestic & NRO w.e.f 08.07.15 Period Rate % p.a. (Applicable for deposits less than Rs. 1 Crore) 7 days 2.00 8 days to 14 days 4.50 15 days 4.50 16 days to 30 days 4.50 31 days to 45 days 4.65 46 days to 60 days 4.75 61 days to 90 days 4.85 91 days to 120 days 4.85 121 days to 180 days 5.00 181 days to 240 days 5.00 241 days to 270 days 5.00 271 days to 364 days 5.00 365 days 5.25 366 days to 400 days 6.25 401 days to 500 days 6.25 501 days to 547 days 6.25 548 days to 730 days 6.30 731 days to 820 days 6.35 821 days to 910 days 6.40 911 days to 1000 days 6.40 1001 days to 1095 days 6.40 1096 days to 1460 days 6.40 1461 days to 1825 days 6.40 1826 days to 2190 days 6.40 2191 days to 2555 days 6.40 Application Form of Savings Account:     Contact Details: Barclays Bank PLC 135 Chester Rd Sunderland, Tyne and Wear SR4 7HP United Kingdom Map Location: [MAP]Barclays Bank PLC United Kingdom[/MAP] form detail to attached a pdf file; |