|

#4

21st November 2015, 04:59 PM

| |||

| |||

| Re: Bank of Baroda 1 Year Fixed Rate Bond

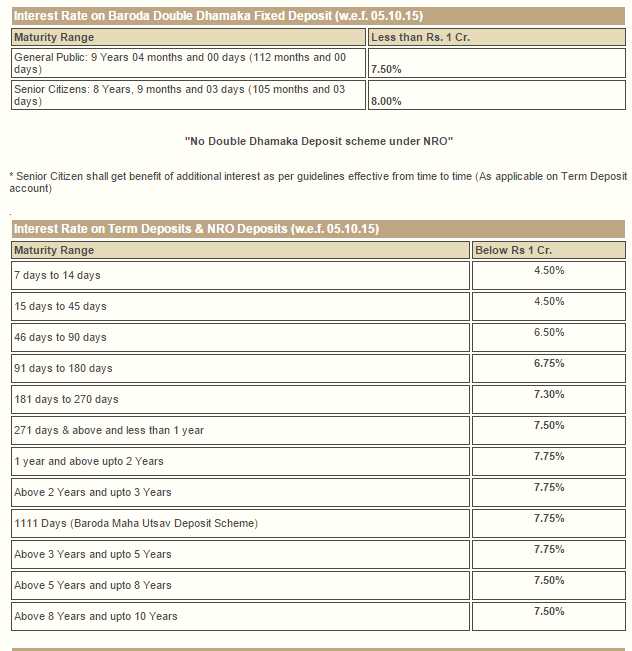

Please find the Bank of aBaroda’s Term deposit schemes as under: I. Term Deposits Terms & Conditions Minimum quantity of amount required to open an deposit account - Rs. 1,000/-. Subsequent deposits in multiples of Rs. 100. Deposit Tenure of the Deposit: Minimum - 12 months. Maximum - 120 months. Interest is reimbursed on half yearly basis. Rate of interest is decided by the maturity period. Please find the rate of Interest chart attached in the below image  Interest payments are subject to TDS (Tax Deducted at Source). Senior citizens can avail of an additional interest rate of 0.50% irrespective of the amount of deposit. Documents required: Passport size photograph Proof of residence An introduction as per Bank's norms II. Term Deposits (Over 12 months) This investment is ideal for long term investments. Secure money that earns good quality returns and can be easily liquidated. Key Benefits of the Deposit This product gives answer to two very basic requirements of a deposit keeper: Easy liquidity even with a long term period. Increasing interest in proportion to the increasing term of deposit. More Benefits Avail of Overdraft / loan against deposit up to 95% of the deposit amount (plus accrued interest) without the hassles of a guarantor or processing fee or, filling of any forms etc. Interest will be charged at 1.50 % over the deposit rate with monthly rests in case of depositor being the borrower and higher in case your friends wants to avail of the loan. No processing fee is charged on loans and advances taken aligned with Bank's Deposits. For deposits up to Rs. 5 Lakhs, no interest will be levied for premature withdrawal, provided it has remained with bank for a minimum period of 12 months. Automatic renewal of deposit on maturity, thereby avoiding interest loss in the absence of instructions from you. The Government accepts this deposit as a Security. Accepted as margin money for Non-fund based facilities. Provision for nomination. Terms & Conditions Minimum deposit required is Rs. 1000/- followed by regular deposits in multiples of Rs. 100/-. Deposit Tenure: Minimum period of deposit - 12 months. Maximum period of deposit - 120 months. Compound interest is calculated quarterly and can be paid on a monthly (discounted value of the interest amount is payable), quarterly, half-yearly basis or on maturity. Rate of interest depends on maturity period. Interest payments are subject to TDS (Tax Deducted at Source). Deposit of Rs.10000/- are subject to TDS. An additional interest of .5% is paid to the senior citizens for their deposits above Rs. 10000/-. Documents required: Passport size photograph Proof of residence An introduction as per Bank's norms Address: Corporate Centre Bank of Baroda Baroda Corporate Centre, Plot No - C-26, G - Block, Bandra - Kurla Complex, Bandra (East), Mumbai-400051 Phone  022) 6698 5000- 04 022) 6698 5000- 04Fax  022) 2652 3500 022) 2652 3500

|