|

#2

20th December 2016, 11:03 AM

| |||

| |||

| Re: Audit Report of ONGC

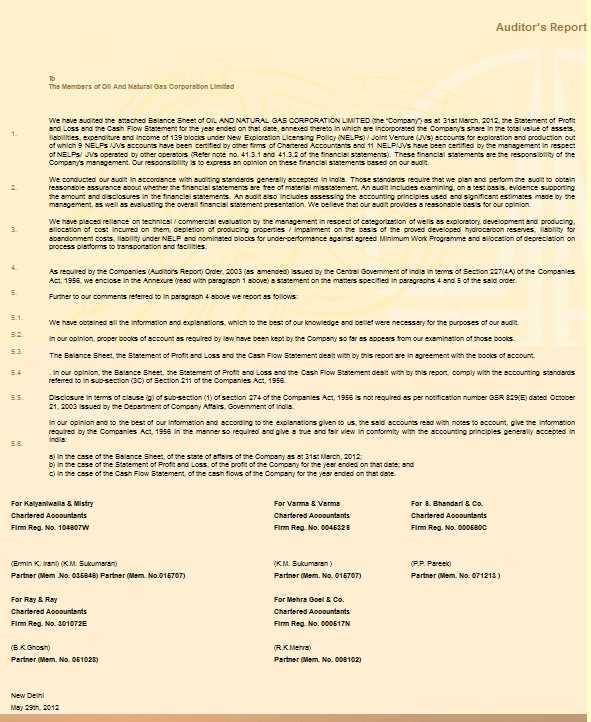

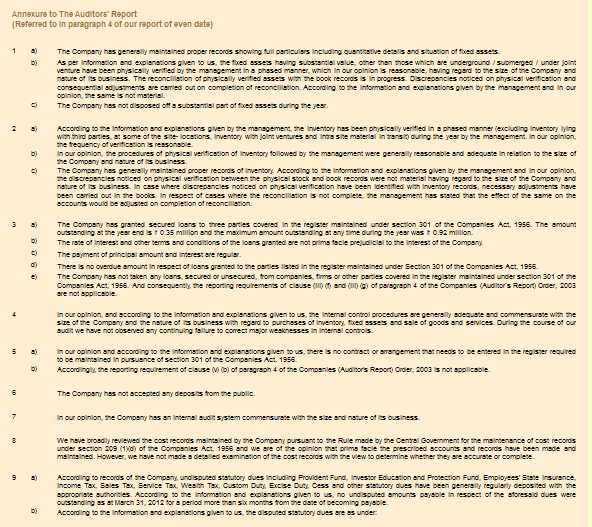

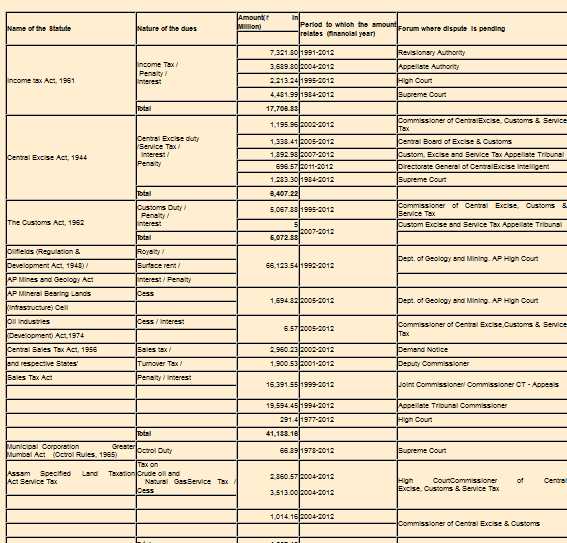

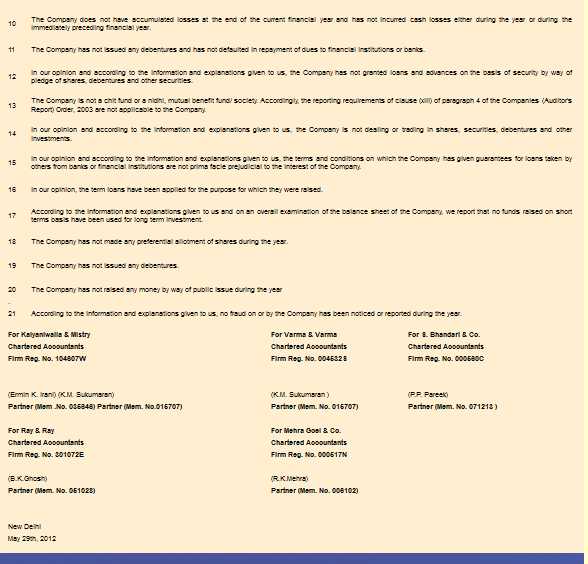

Here I am providing you some extracts from the 2011 - 2012 Auditor’s Report of ONGC or Oil And Natural Gas Corporation Limited: It has granted secured loans to 3 parties covered in the register maintained under section 301 of the Companies Act, 1956. The amount outstanding at the year end is 0.35 million and the maximum amount outstanding at any time during the year was 0.92 million. There is no overdue amount in respect of loans granted to the parties listed in the register maintained under Section 301 of the Companies Act, 1956. According to records of the Company, certain statutory dues including Provident Fund, Investor Education and Protection Fund, Employees' State Insurance, Income Tax, Sales Tax, Service Tax, Wealth Tax, Custom Duty, Excise Duty, Cess and other statutory dues have been generally regularly deposited with the appropriate authorities. According to the information and explanations given, no acknowledged amounts payable in respect of the aforesaid dues were outstanding as at March 31, 2012 for a period more than six months from the date of becoming payable. It has not taken any loans, secured or unsecured, from companies, firms or other parties covered in the register maintained under section 301 of the Companies Act, 1956. And consequently, the reporting requirements of clause (iii) (f) and (iii) (g) of paragraph 4 of the Companies (Auditor`s Report) Order, 2003 are not applicable. Audit Report of ONGC 2011-12     |