|

#2

28th November 2014, 12:59 PM

| |||

| |||

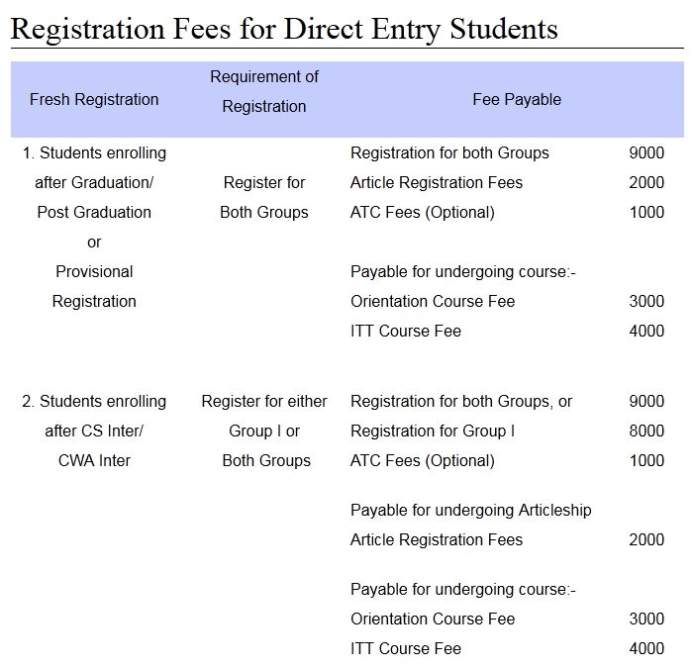

| Re: Without CPT, can I give IPCC Exam

Yes, you can give IPCC exam without CPT to become CA. The students who have completed their Graduation with specified percentage of marks are exempted from appearing for CPT Exams and can directly appear for IPCC Exams. Eligibility; Direct Entry Scheme for Graduates: The following categories of students are exempted from appearing for CPT:- Graduates or Post Graduates in Commerce having secured in aggregate a minimum of 55% of the total marks or its equivalent grade in the examination conducted by any recognized University (including Open University) by studying any three papers of 100 marks each out of Accounting, Auditing, Mercantile Laws, Corporate Laws, Economics, Management (including Financial Management), Taxation (including Direct Tax Laws and Indirect Tax Laws), Costing, Business Administration or Management Accounting. Fees  IPCC Syllabus: 1. A General Knowledge of the framing of the accounting standards, national and international accounting authorities, adoption of international financial reporting standards 2. Accounting Standards Working knowledge of: AS 1: Disclosure of Accounting Policies AS 2: Valuation of Inventories AS 3: Cash Flow Statements AS 6: Depreciation Accounting AS 7: Construction Contracts (Revised 2002) AS 9: Revenue Recognition AS 10: Accounting for Fixed Assets AS 13: Accounting for Investments AS 14: Accounting for Amalgamations 3. Company Accounts (a) Preparation of financial statements – Profit and Loss Account, Balance Sheet and Cash Flow Statement (b) Profit (Loss) prior to incorporation (c) Alteration of share capital, Conversion of fully paid shares into stock and stock into shares, Accounting for bonus issue (d) Simple problems on Accounting for business acquisition. Amalgamation and reconstruction (excluding problems of amalgamation on inter-company holding) 4. Average Due Date, Account Current, Self-Balanceing Ledgers 5. Financial Statements of Not-for-Profit Organisations 6. Accounts from Incomplete Records 7. Accounting for Special Transactions (a) Hire purchase and instalment sale transactions (b) Investment accounts (c) Insurance claims for loss of stock and loss of profit. 9. Issue in Partnership Accounts Final accounts of partnership firms – Admission, retirement and death of a partner including treatment of goodwill; 10. Accounting in Computerised Environment An overview of computerized accounting system–Salient features and significance, Concept of grouping of accounts, Codification of accounts, Maintaining the hierarchy of ledger, Accounting packages and consideration for their selection, Generating Accounting Reports. |