|

#2

22nd August 2017, 12:59 PM

| |||

| |||

| Re: Union Bank Of India Pension Plan

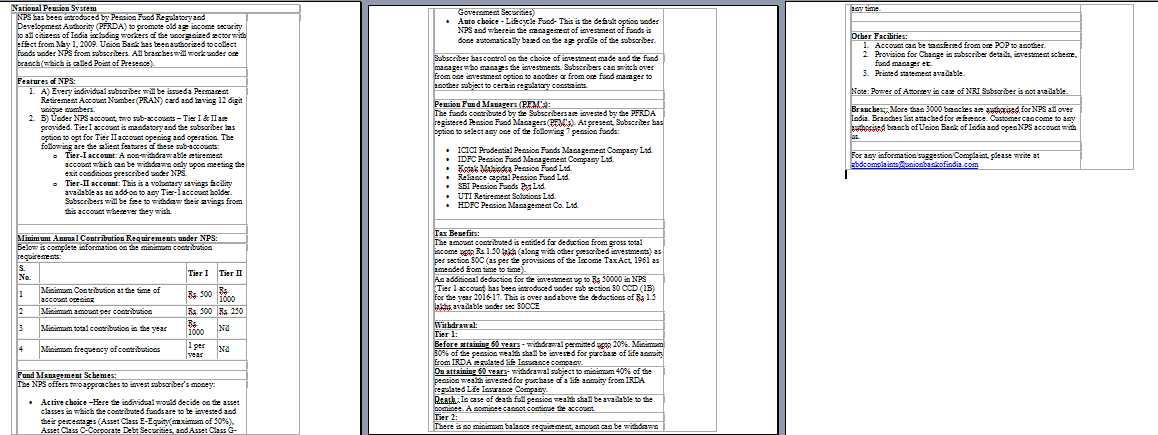

Don’t worry I will get details of Union Bank Of India, National Plan Schemes of Pension Fund Regulatory and Development Authority (PFRDA) so that you can go through it. The National Pension System was introduced by introduced by Pension Fund Regulatory and Development Authority (PFRDA) at Union Bank Of India to promote old age income security to all citizens of India. Minimum Annual Contribution Requirements under NPS: Below is complete information on the minimum contribution requirements: S. No. Tier I Tier II 1 Minimum Contribution at the time of account opening Rs. 500 Rs. 1000 2 Minimum amount per contribution Rs. 500 Rs. 250 3 Minimum total contribution in the year Rs. 1000 Nil 4 Minimum frequency of contributions 1 per year Nil Types of Schemes Fund Management Schemes Pension Fund Managers (PFM’s) Withdrawal: Tier 1: Before attaining 60 years - withdrawal permitted upto 20%. Minimum 80% of the pension wealth shall be invested for purchase of life annuity from IRDA regulated life Insurance company. On attaining 60 years- withdrawal subject to minimum 40% of the pension wealth invested for purchase of a life annuity from IRDA regulated Life Insurance Company. Death : In case of death full pension wealth shall be available to the nominee. A nominee cannot continue the account. Tier 2: There is no minimum balance requirement; amount can be withdrawn any time. National Plan Schemes  Address:- Union Bank Of India Union Bank Bhavan, 239, Vidhan Bhavan Marg, Nariman Point, Mumbai - 400 021, Maharashtra, India Phone:- 022-22892000 Last edited by pawan; 22nd August 2017 at 01:25 PM. |