|

#2

7th August 2014, 03:16 PM

| |||

| |||

| Re: Taxation in Executive Programme Last years question papers with solutions

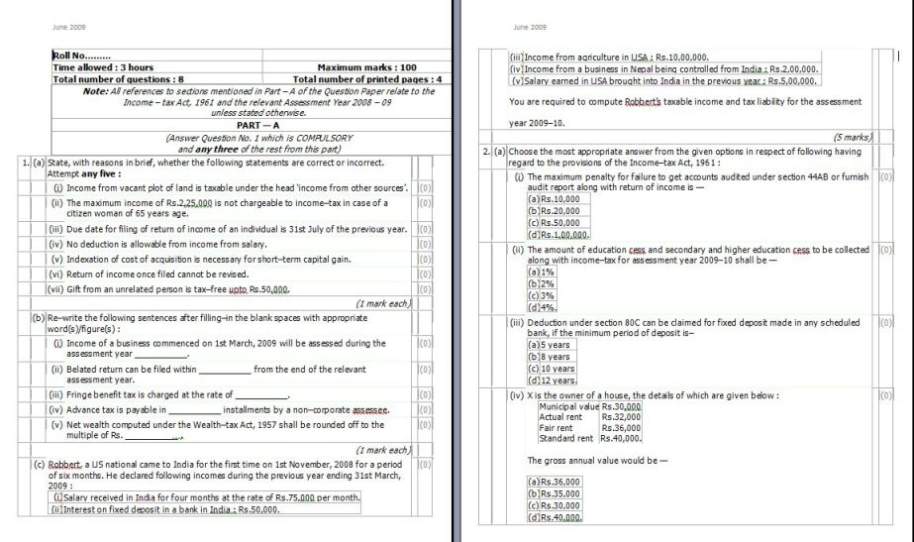

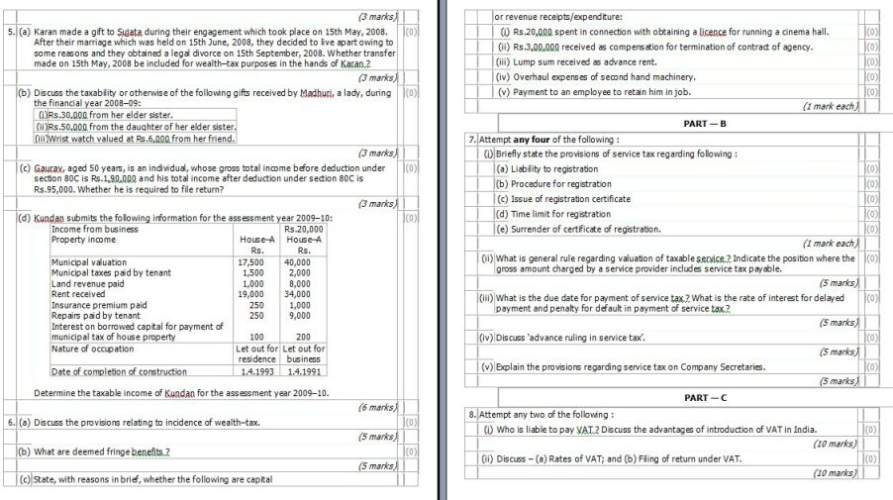

Here I am sharing the Taxation in Executive Programme Last years question papers with solutions: 4. (a) Who is liable to pay advance income–tax? On what dates the installments of advance tax are payable and what amount is to be paid under each installment? (0) (4 marks) (b) What are the provisions regarding deduction of tax at source from the following incomes : (i) Winnings from lottery (0) (ii) Payment to a resident contractor (0) (iii) Commission and brokerage (0) (iv) Payment of rent. (0) (2 marks each) (c) Discuss the items which are disallowed as deduction under section 40(b) while computing firm’s income from business and profession. (0) (3 marks) 5. (a) Karan made a gift to Sujata during their engagement which took place on 15th May, 2008. After their marriage which was held on 15th June, 2008, they decided to live apart owing to some reasons and they obtained a legal divorce on 15th September, 2008. Whether transfer made on 15th May, 2008 be included for wealth–tax purposes in the hands of Karan ? (0) (3 marks) (b) Discuss the taxability or otherwise of the following gifts received by Madhuri, a lady, during the financial year 2008–09: (i) Rs.30,000 from her elder sister. (ii) Rs.50,000 from the daughter of her elder sister. (iii) Wrist watch valued at Rs.6,000 from her friend. (0) (3 marks) (c) Gaurav, aged 50 years, is an individual, whose gross total income before deduction under section 80C is Rs.1,90,000 and his total income after deduction under section 80C is Rs.95,000. Whether he is required to file return? (0) (3 marks) (d) Kundan submits the following information for the assessment year 2009–10: Income from business Property income House–A Rs. Rs.20,000 House–A Rs. Municipal valuation Municipal taxes paid by tenant Land revenue paid Rent received Insurance premium paid Repairs paid by tenant Interest on borrowed capital for payment of municipal tax of house property 17,500 1,500 1,000 19,000 250 250 100 40,000 2,000 8,000 34,000 1,000 9,000 200 Nature of occupation Let out for residence Let out for business Date of completion of construction 1.4.1993 1.4.1991 Determine the taxable income of Kundan for the assessment year 2009–10. (0)    Rests of the questions are in the attachment, download it freely from here: |