|

#2

19th July 2016, 02:01 PM

| |||

| |||

| Re: Tamilnad Mercantile Bank Online Account Opening Form

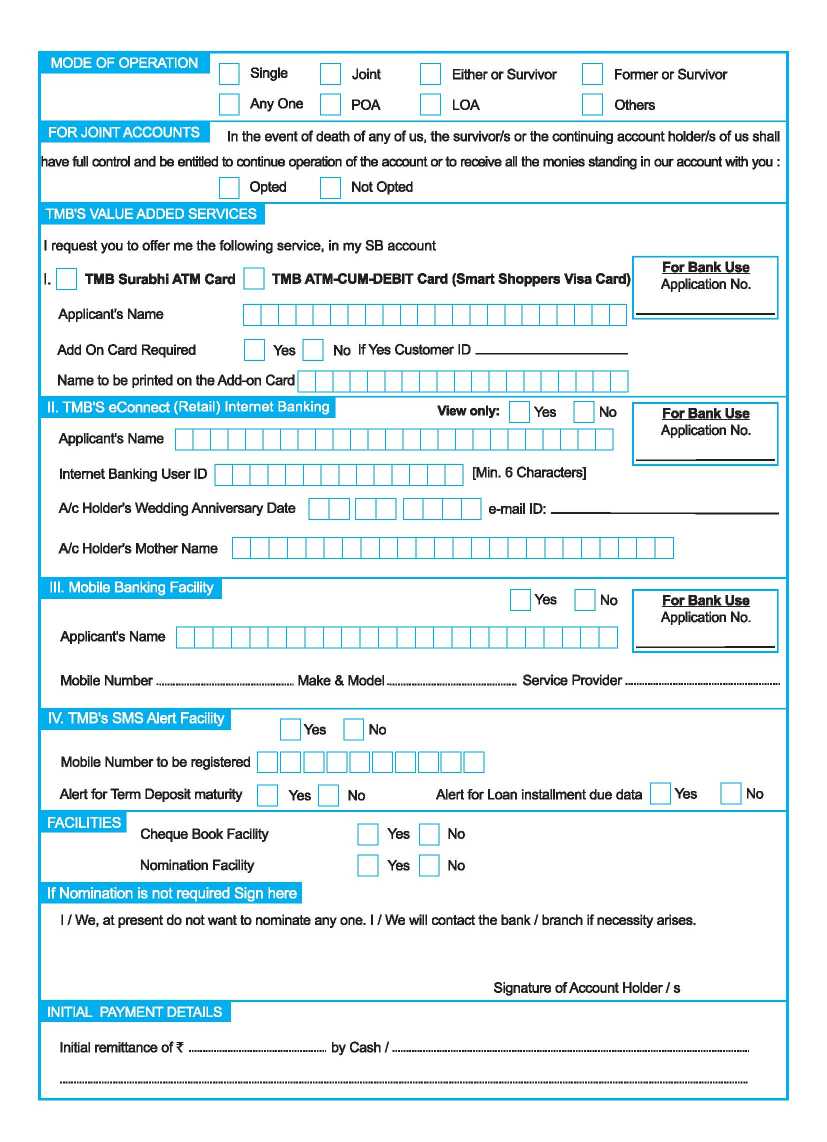

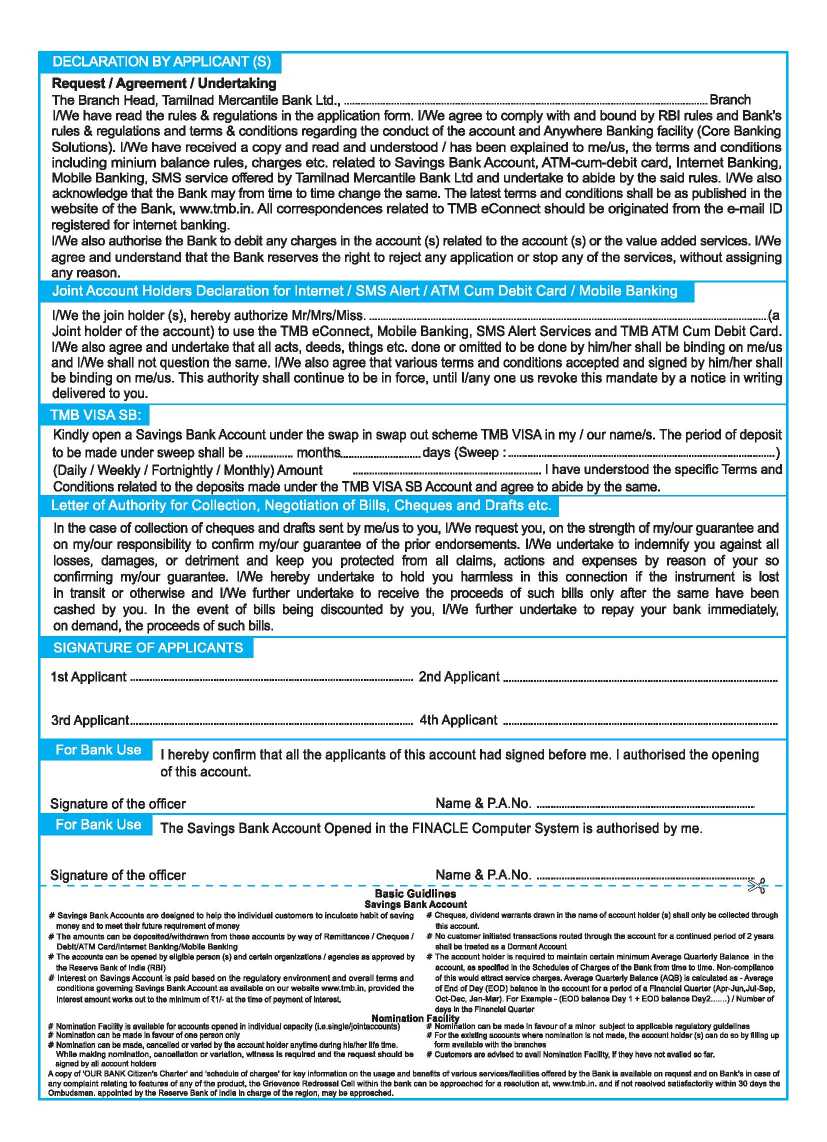

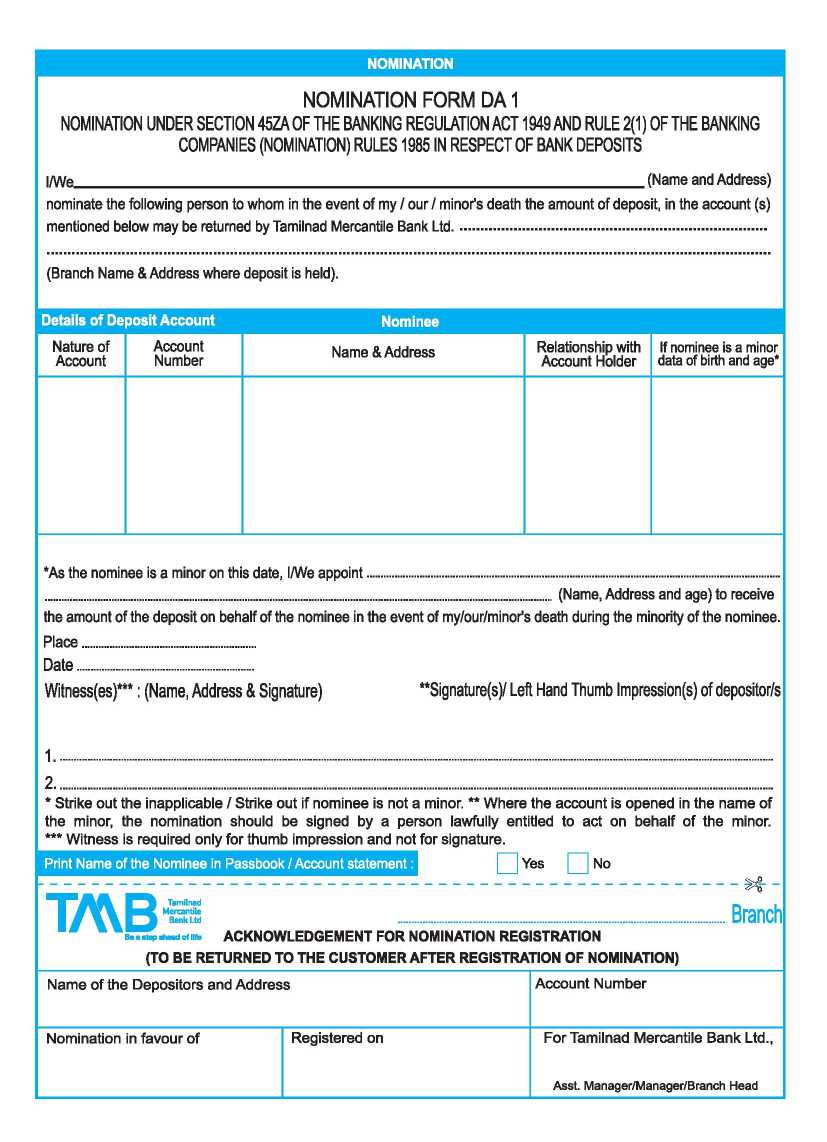

Friend I would like to tell you that If your Father want to Open Saving Account in Tamilnad Mercantile Bank , Can Not Get Online Application form . Tamilnad Mercantile Bank Application form for opening Saving Account     Eligibility: The following parties who are residents of India are eligible to open a Savings Account: Hindu Undivided Families Individuals above the age of 18 (single or joint account) Minors (jointly with a parent or guardian) Documents Required to Open Account : Identity Proof Address Proof Passport sized photographs Identity Proof Documents: Documents that qualify as identity proof are: Passport Valid driver’s license Permanent Account Number (PAN) card Voter ID card Government issued photo identity card NREGA Card Address Proof documents: Documents that qualify as address proof are: Passport Valid driver’s license Passbook (other bank) Electricity or phone bills Ration card Savings Account Minimum Balance Requirements Minimum Average Balance (MAB) With Cheque Book: Rural Rs. 250.00 / Others Rs. 500.00 Without Cheque Book: Rural Rs. 100.00 / Others Rs. 250.00 Charges per Month for non maintenance of MAB With Cheque Book: Rs. 5.00 (MAB > 187 & < 250), Rs. 15.00 (MAB > 124 & <= 187), Rs. 25.00 (MAB > 29 & <= 124), Rs. 0.00 (MAB <= 29). Without Cheque Book: Rs. 5.00 (MAB > 187 & < 250), Rs. 10.00 (MAB > 124 & <= 187), Rs. 15.00 (MAB > 29 & <= 124), Rs. 0.00 (MAB <= 29). Cheque Book Issue charges Rs. 2.00 per leaf. First 20 cheque leaves free. Folio charges for 6 Months Free Cash Remittance Limit - Parent / Satellite Branch Free up to Rs. 3,00,000.00 per day thereafter Rs. 1.50 per Rs. 1,000.00 for SB A/c with Monthly Average Balance (MAB) of previous month less than Rs. 10,000.00. Free for any amount with MAB of previous month Rs. 10,000.00 & above Cash withdrawl at Satellite Branch No Limit for Self Withdrawl by cheque only. Third Party Limit Rs. 10,000.00. Payment of Cheques in other centres in clearing / transfer No Limit Cheque Return / ECS Inward Debit Return Charges Rs. 1.50 per Rs. 1,000.00 with a minimum of Rs. 150.00. ECS Debit Mandate Cancellation Charges Rs. 100.00 per ECS Mandate Cancellation. Issue of Duplicate Statement Rs. 25.00 per Ledger Folio. Minimum Rs. 25.00 + postage if any. Issue of loose cheque leaves Rs. 25.00 per leaf. Issue of duplicate pass book Rs. 25.00 per passbook with an additional charge of Rs. 5.00 per ledger folio (40 entries) there of. Charges for statement through e-mail Free for any frequency. Certificate / Attestation Rs. 100.00 Outward Cheque Return Rs. 50.00 Stop Payment Charges Rs. 25.00, Max. Rs. 200.00 Standing Instruction Nil DD Cancellation DD Amount upto Rs. 250.00 - Rs. 10.00 + ST. DD Amount above Rs. 250.00 - Rs. 50.00 + ST. Bankers Report Rs. 100.00 Certificate of Balance for Previous Year Rs. 50.00 Old Record Retrieval Nil Duplicate Debit Card Rs. 100.00 Regeneration of Pin Mailer Rs. 50.00 Email Statement Charges Free |