|

#2

17th August 2015, 08:45 AM

| |||

| |||

| Re: Systematic Investment Plan Citibank

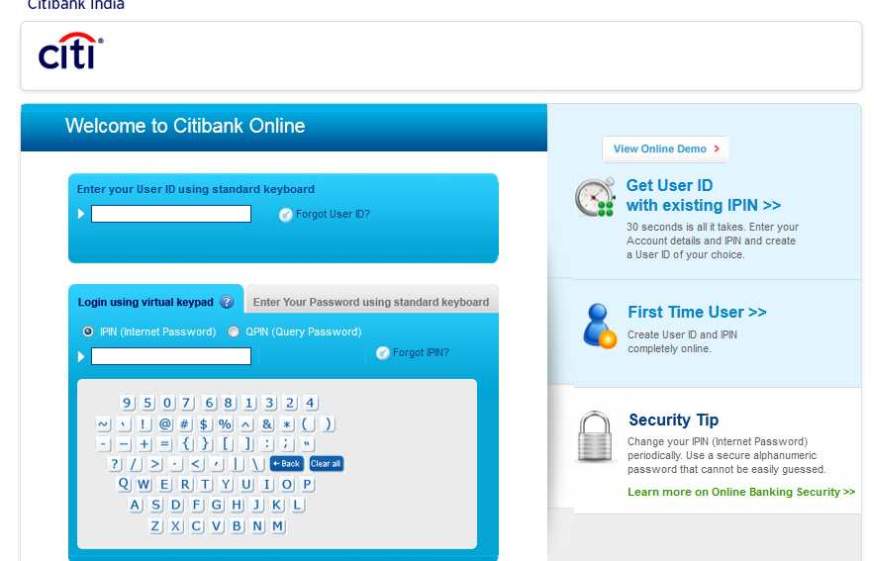

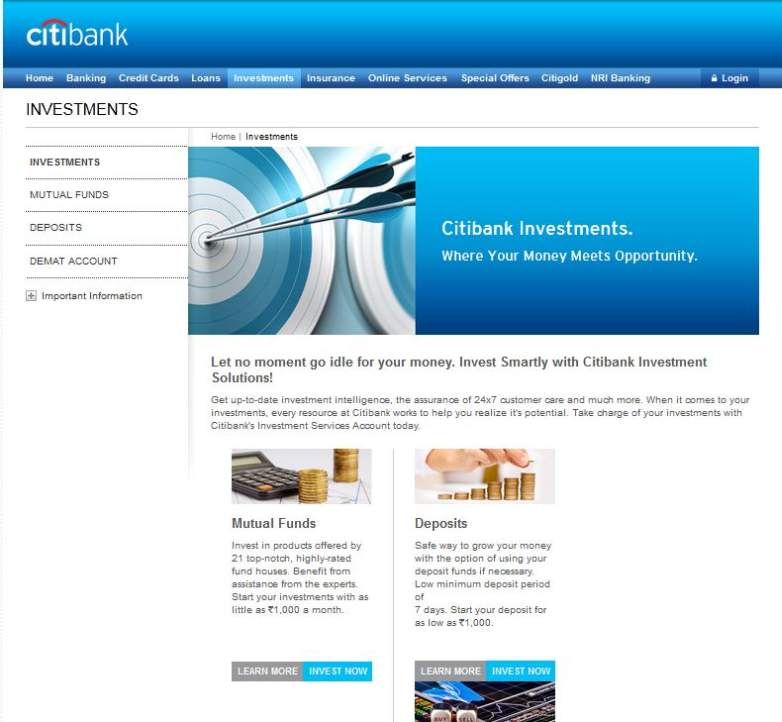

Citibank is the consumer division of financial services multinational Citigroup. Citibank was founded in 1812 as the City Bank of New York, later First National City Bank of New York. Here I are the steps ,by following them you cam easily check the investment plans of Citibank: Go to the official website of the Citibank  Than click on the investment section which you will find on its homepage In investment section click on the investment again  This page will open giving you all the info about the investments of Citibank Here I am telling you about the benefits you get under the mutual funds investment plans Professional Management Benefit from expert management of your money by qualified professionals. Enjoy the advantage of having the funds you invest in continuously monitored. They remain under non-stop performance and performance analysis by seasoned research teams. This regular and continuous process adds value to your investment—the reason why your investments fare better when managed by an investment professional. Intelligent Investing Lower your risk of loss by having your investment spread across various industries and geographic regions. This investment concept is called diversification. It is an extremely rare possibility for all your investments to decline at the same time and in the same proportion. Flexibility Mutual Funds offer a variety of schemes that will suit your needs over a lifetime. When you enter a new stage in your life, all you need to do is rearrange your portfolio to suit your altered lifestyle. Affordability You can start investing with as little as Rs1,000*. You can invest that amount in our Systematic Investment Plan (SIP) on a regular basis. Liquidity With open-end funds, you can redeem all or part of your investment any time you wish and receive the current value of your investment. In addition, the process is standardised, making it quick and efficient so that you can get your cash in hand as soon as possible. Transparency The performance of a Mutual Fund is reviewed by various publications and rating agencies, making it easy for investors to compare one fund to another. As a unit holder, you are provided with regular updates, for example daily NAVs, as well as information on the fund's holdings and the fund manager's strategy. Regulations All Mutual Funds are required to register with Securities Exchange Board of India (SEBI). They are obliged to follow strict regulations designed to protect investors. All operations are also regularly monitored by the SEBI. |