|

#2

13th August 2015, 03:05 PM

| |||

| |||

| Re: Syndicate Bank recruitment interview

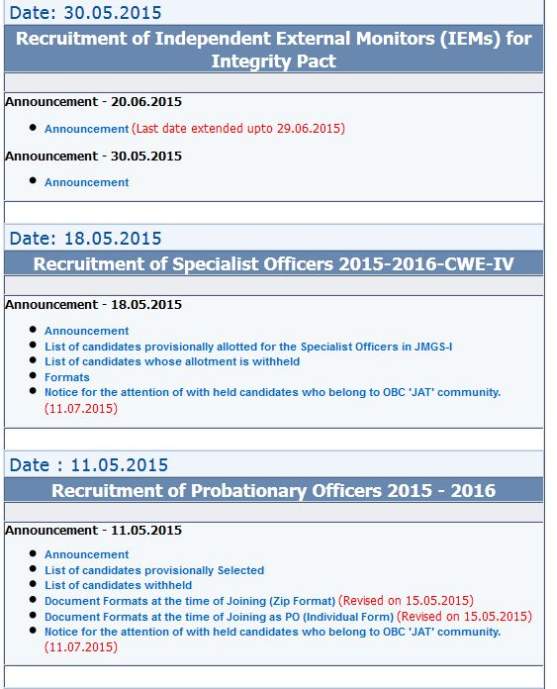

As you want to get the details of candidates who are provisionally selected in interview in Syndicate Bank recruitment of Probationary Officers in 2015 so here is the information of the same for you: Here for your reference I am giving you the process of getting the candidates who are provisionally selected in interview in Syndicate Bank recruitment of Probationary Officers in 2015: (1). Firstly go to the official website of Syndicate Bank which looks like this image:  (2). Now on this page at the bottom you will find some tabs and from those tabs choose the tab of “Recruitment” (3). Now you will be directed to the next page which looks like this image:  Now on this page you will have to choose the tab of “Recruitment of Probationary Officers 2015 - 2016 List of candidates provisionally Selected” and a PDF file will come which here I am uploading it for you and it is free to download: Syndicate Bank PO interview questions: 1)Where was the Head Quarters of Syndicate Bank located ? A) SyndicateBank Head Office Post Box No.1,MANIPAL 576 104 (Udupi Dist),Karnataka, INDIA 2)Who is the Chairman of Syndicate Bank ? A) Shri Basant Seth, Chairman & Managing Director of Syndicate Bank 3) When did the bank came into existence ? A) Syndicate Bank was established in 1925 in Udupi.karnataka 4) What was the Syndicate bank initial name? A)On 10.11.1925, the business of the Bank commenced in Udupi with the name “Canara Industrial and Banking Syndicate Ltd.,”a joint Stock Company with just one employee.Name of the Bank changed from “Canara Industrial &Banking syndicate Ltd.” to “Syndicate Bank Limited”. Head Office was shifted to Manipal on 19.4.1964. 5) When was nationalised Syndicate bank? A) Bank was nationalised on 19th July 1969 6) Syndicate bank line ? A) “Your faithful and friendly financial partner” 7) could you tell about Network of Syndicate bank? A) the total network of branches to over 2300. 8)Why do you choose po job as your career ? A)You just say, “Job Security and Job in Syndicate bank is a privilege and it is a service to nation” 9)What do you think of the responsibilities / duties of a PO job in the banking sector ? 10)How do you prove yourself as a successful employee ? 11)Tell us about yourself ? A)Introduce yourself , your education, your current job,etc in a short and sweet manner. 12)Tell us about your schooling background ? 13)Tell us about your academic career ? 14)What are your hobbies ? 15)What are the primary functions of a commercial bank ? A)The primary functions of a commercial bank include: a) accepting deposits; and b) granting loans and advances 16)What are the salient features of Indian Banking Sector ? 17)Can you explain the reforms that taken place in the Indian banking industry ? A) The Narasimham Committee laid the foundation for the reformation of the Indian banking sector. Constituted in 1991, the Committee submitted two reports, in 1992 and 1998, which laid significant thrust on enhancing the efficiency and viability of the banking sector. 18)What are the functions of Reserve Bank of India ? A)Mainly the functions of RBI are classified as follows: Bank of Issue Banker to Government Bankers’ Bank and Lender of the Last Resort Controller of Credit Custodian of Foreign Reserves Supervisory functions Promotional functions 19)Tell some of the Qualitative methods used by RBI for credit control in the country ? 20)Tell some of the Quantitative methods used by RBI for credit control in the country ? 21)What is Bank rate ? A) A Bank rate is the interest rate that is charged by a country’s central or federal bank on loans and advances to control money supply in the economy and the banking sector. This is typically done on a quarterly basis to control inflation and stabilize the country’s exchange rates. A fluctuation in bank rates triggers a ripple-effect as it impacts every sphere of a country’s economy. For instance, the prices in stock markets tend to react to interest rate changes. A change in bank rates affects customers as it influences prime interest rates for personal loans. 22)What is Cash Reserve Ratio – CRR? A)The Cash Reserve Ratio (CRR) refers to the liquid cash that banks have to maintain with the Reserve Bank of India (RBI) as a certain percentage of their demand and time liabilities. For example if the CRR is 10% then a bank with net demand and time deposits of Rs 1,00,000 will have to deposit Rs 10,000 with the RBI as liquid cash. 23)What is Statutory Liquidity Ratio – SLR ? A)Statutory Liquidity Ratio refers to the amount that the commercial banks require to maintain in the form of cash, or gold or govt. approved securities before providing credit to the customers. Statutory Liquidity Ratio is determined and maintained by the Reserve Bank of India in order to control the expansion of bank credit. 24)What is Repo rate ? A)Whenever the banks have any shortage of funds they can borrow it from the central bank. Repo rate is the rate at which our banks borrow currency from the central bank. A reduction in the repo rate will help banks to get Money at a cheaper rate. When the repo rate increases borrowing from the central bank becomes more expensive.The Reverse repo rate is the rate at which the central bank borrows from the banks, while the Repo rate is the rate at which the banks borrow from the central bank. 25)Can you explain the terms National bank, Scheduled bank, Commercial bank, Cooperative bank, Private bank, Foreign bank ? 26)What Is Inflation? A)Inflation is increase in price of products & decrease in value of money. 27) Difference between Repo rate and Bank rate? A)The Main difference between Repo rate and Bank rate is that Repo rate is the discounting offered by the RBI on the monetary bill hold by the Banks 28))Important Terms? SLR – Statutory liquidity ratio CRR – Cash reserve ratio Repo rate – It is the rate at which RBI lends money to Banks. Reverse Repo Rate – It is the rate at which Banks park their funds with RBI Bank Rate – It is the rate at which RBI lends money to Banks. Call money rate – It is the rate of interest charged by the banks for temporary borrows among banks Ledger Contact Details: Syndicate Bank Naya Bazar नया बाजार Ajmer, Rajasthan 305001 India Map Location: [MAP]Syndicate Bank नया बाजार Ajmer Rajasthan[/MAP] |