|

#2

22nd July 2016, 09:31 AM

| |||

| |||

| Re: State Bank of Mysore Auto Sweep

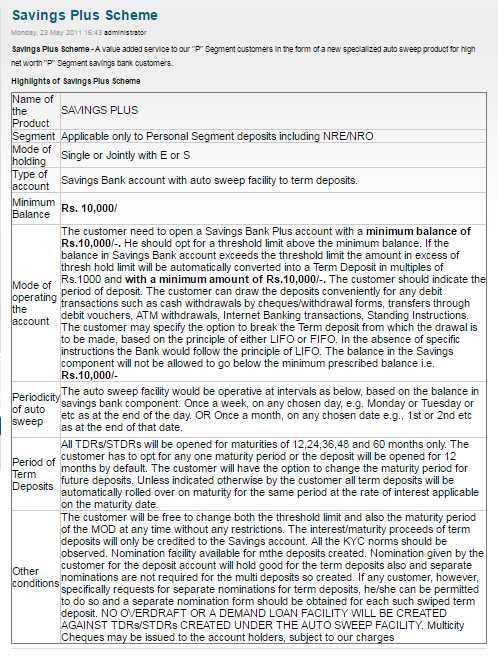

The vast majority of us like to keep up a decent measure of trade out the sparing record to look after liquidity. As unforeseen costs can hit any of us whenever. So to get high rate of enthusiasm at the expense of loss of liquidity is not a decent alternative. Gives discuss a bank office which a chance to can make you gain in the same class as settled store (8 to 12%) with liquidity of sparing financial balance. Yes, the office offered by banks which gives great comes back with liquidity is called as 'Auto Sweep' or 'Breadth In'. AUTO SWEEP Auto clear office offers join advantages of both sparing and altered store accounts. Where bank interlinks clients sparing record with altered store account and encourage programmed exchange of additional assets from sparing record to settled store record to make you acquire high rate of profits. This bank office takes an "edge" limit from its clients to give auto clear office. Edge cutoff is the measure of money you need to keep up in your sparing financial balance. Bank keeps a nearby track on your records to guarantee any sum above edge gets moved to settled store account. The best a portion of auto breadth lies with the way that you can pull back more than as far as possible i.e the measure of trade accessible out your sparing financial balance. How does the auto seep facility work? You choose the greatest sum that you need in your record. This is likewise called as far as possible. You choose the sum for which the FDs should be made. You choose the residency of these FDs After this, technology deals with everything! At whatever point the sum in your record turns out to be more than the aggregate of the most extreme sum you determined and the FD sum, a FD is made for the predefined sum and the predetermined residency. (This is called Sweep-in) At whatever point such a circumstance happens, another FD is made. This implies any sum that you consider as abundance procures the loan cost of a FD! A few banks likewise offer imaginative speculation streets – for instance, putting the sum in fluid or currency market (MM) common assets as opposed to putting resources into FDs. Auto Sweep Facility – SBM - Savings Plus Scheme  |