|

#2

7th June 2015, 09:05 AM

| |||

| |||

| Re: State Bank of India TDS Form

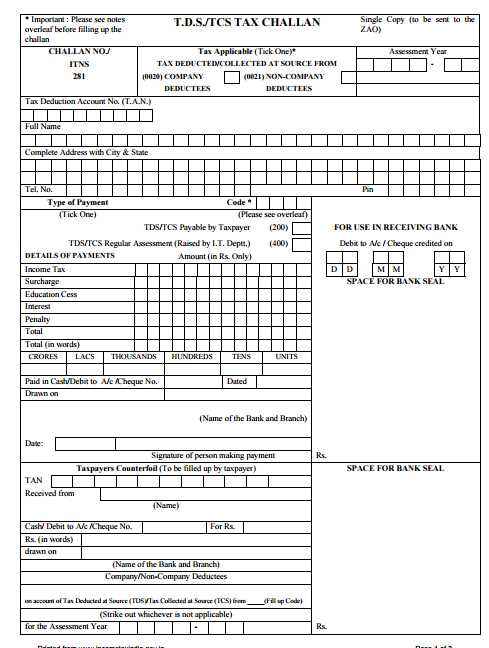

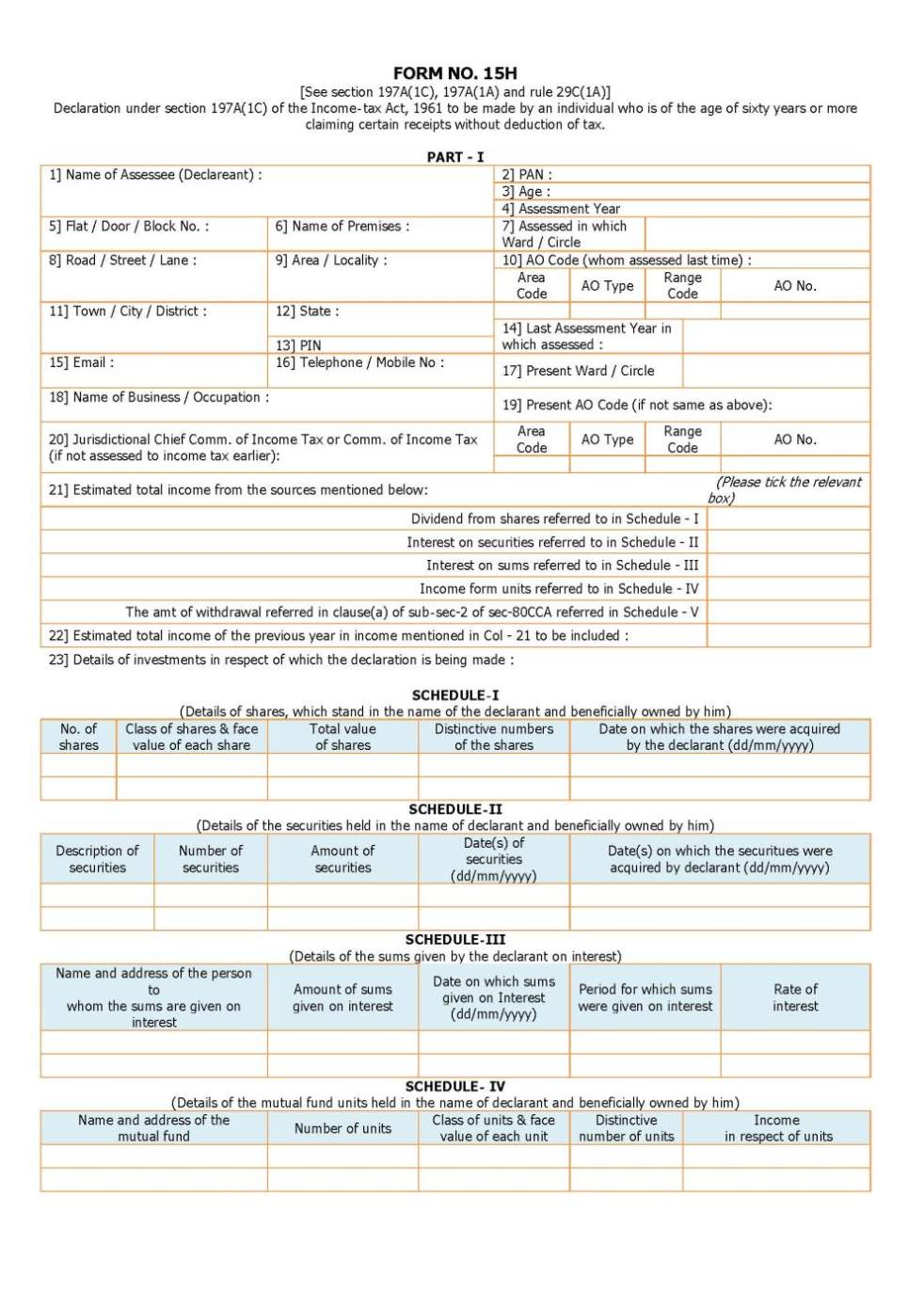

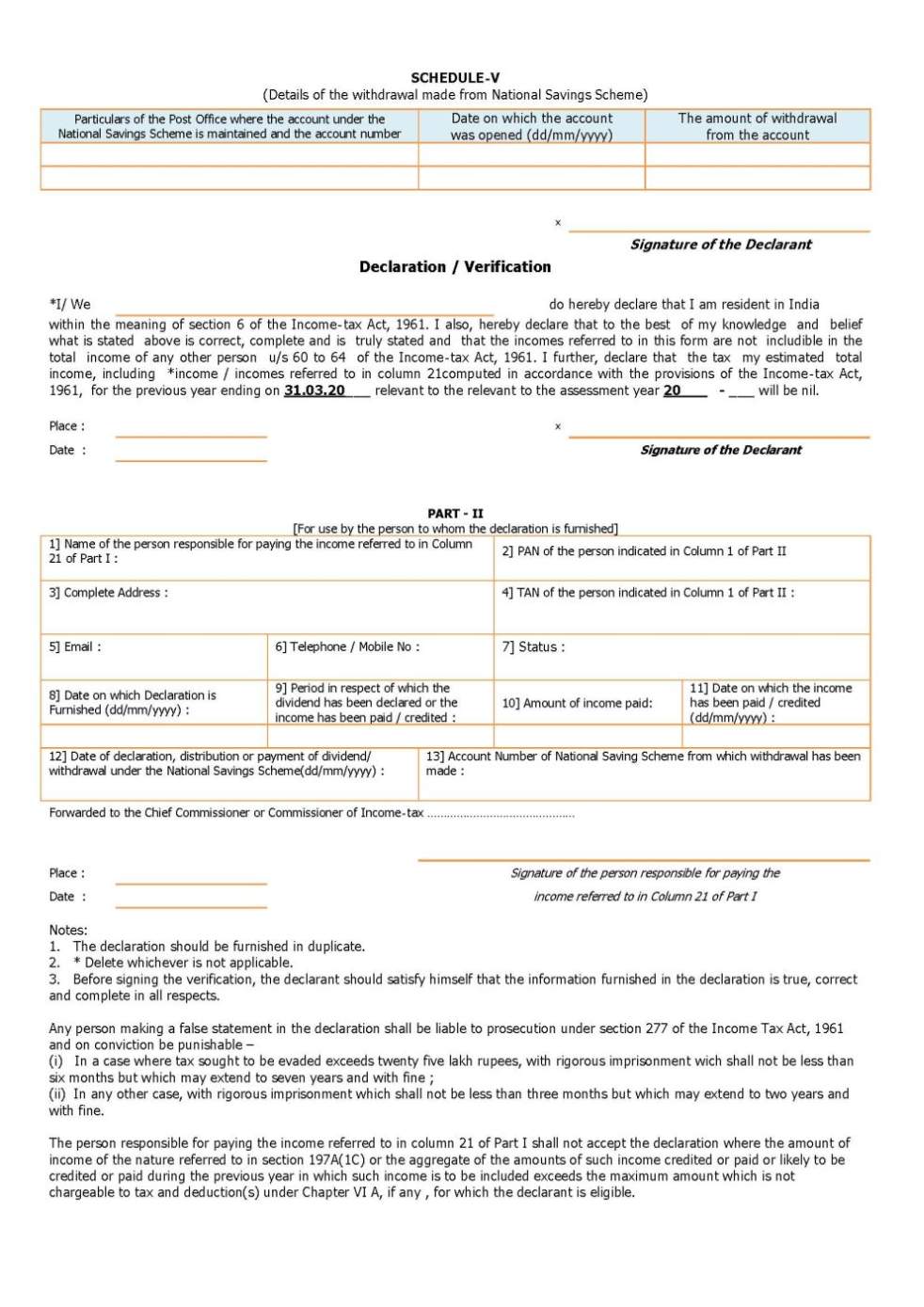

As you want I am here providing you TDS Form of the State Bank Of India. TDS Form- State Bank Of India   TDS is deducted when : interest amount due by customer exceeds Rs.10,000/- per annum Other form of SBI which we have : NRI Forms PPF/Loan A/C(s) Linking Form Linking of Aadhaar / UID Number with the Account Form Public Provident Fund Forms Senior Citizen Savings Scheme Forms Settlement of Deceased Assets Nomination Forms NPS Account Opening Account Opening forms Form 60 |