|

#2

2nd February 2018, 03:01 PM

| |||

| |||

| Re: State Bank Of India Rtgs

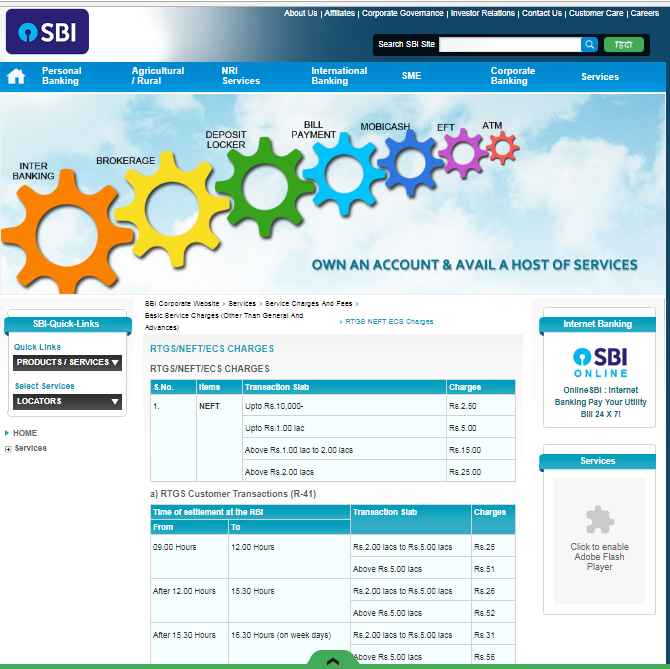

The state bank of India is Inter Transfer enables electronic transfer of funds from the account of the remitter in one Bank to the account of the beneficiary maintained with any other Bank branch. There are two systems of Inter Bank Transfer - RTGS and NEFT. Both these systems are maintained by Reserve Bank of India. RTGS is standing for Real Time Gross Settlement. This is a system where the processing of funds transfer instructions takes place at the time they are received (real time). Also the settlement of funds transfer instructions occurs individually on an instruction by instruction basis (gross settlement). RTGS is the fastest possible interbank money transfer facility available through secure banking channels in India. Minimum/maximum amount for RTGS transactions under Retail Internet Banking: Type Minimum Maximum RTGS Rs. 2 Lakhs Rs. 10 Lakhs Minimum/maximum amount for RTGS transactions under Corporate Internet Banking: Type Minimum Maximum RTGS Rs.2 Lakhs Rs.50 lakhs for Vyapaar and Rs.500 crores for Vistaar RTGS charges of SBI:  Contact to: STATE BANK OF INDIA Asst. General Manager Payment Systems Group 1st Floor, Plot No. 8,9 &10 State Bank of India Sector-11, CBD Belapur Navi Mumbai 400 614 |