|

#2

20th May 2015, 12:01 PM

| |||

| |||

| Re: State Bank of India Outward Remittance

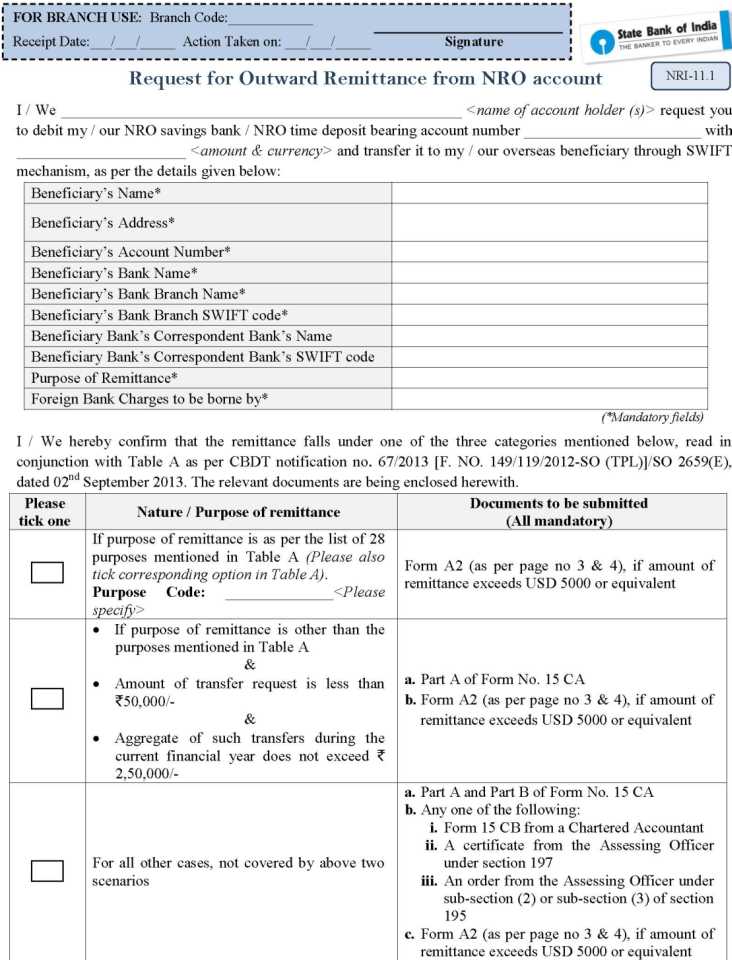

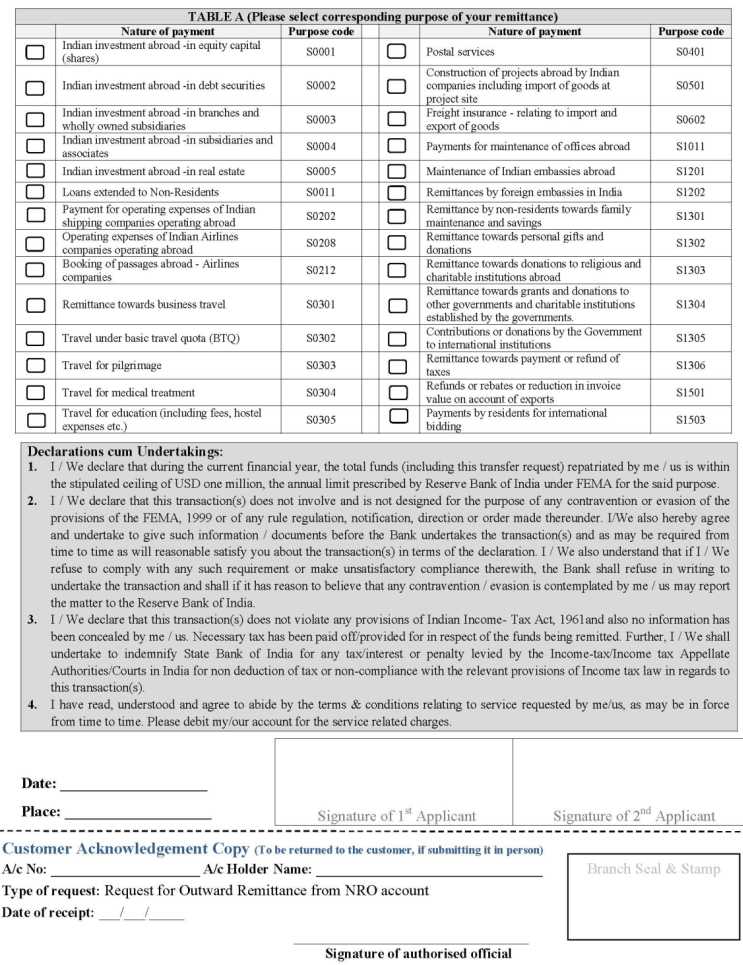

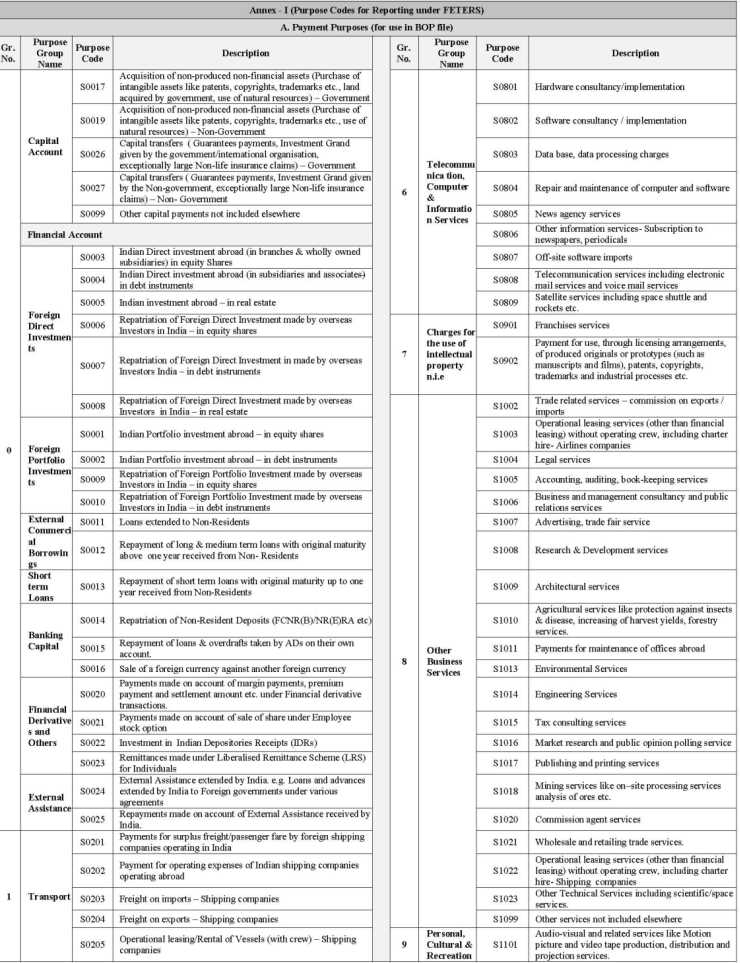

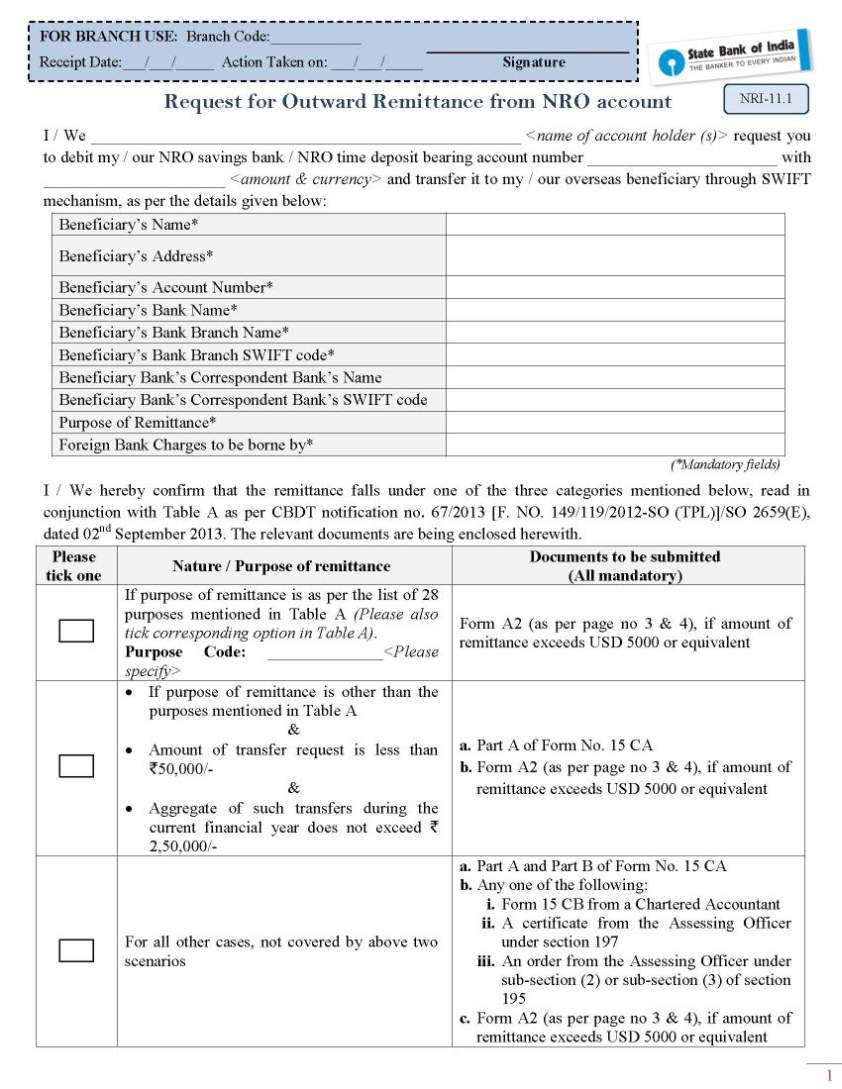

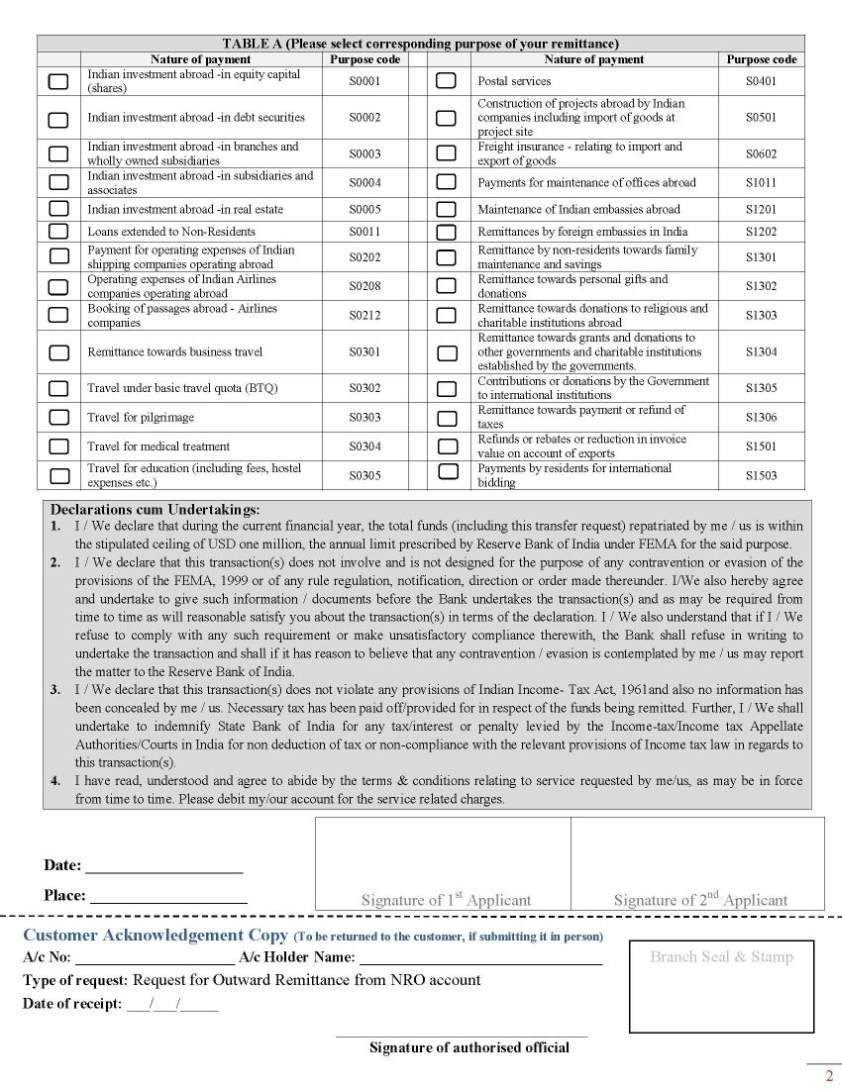

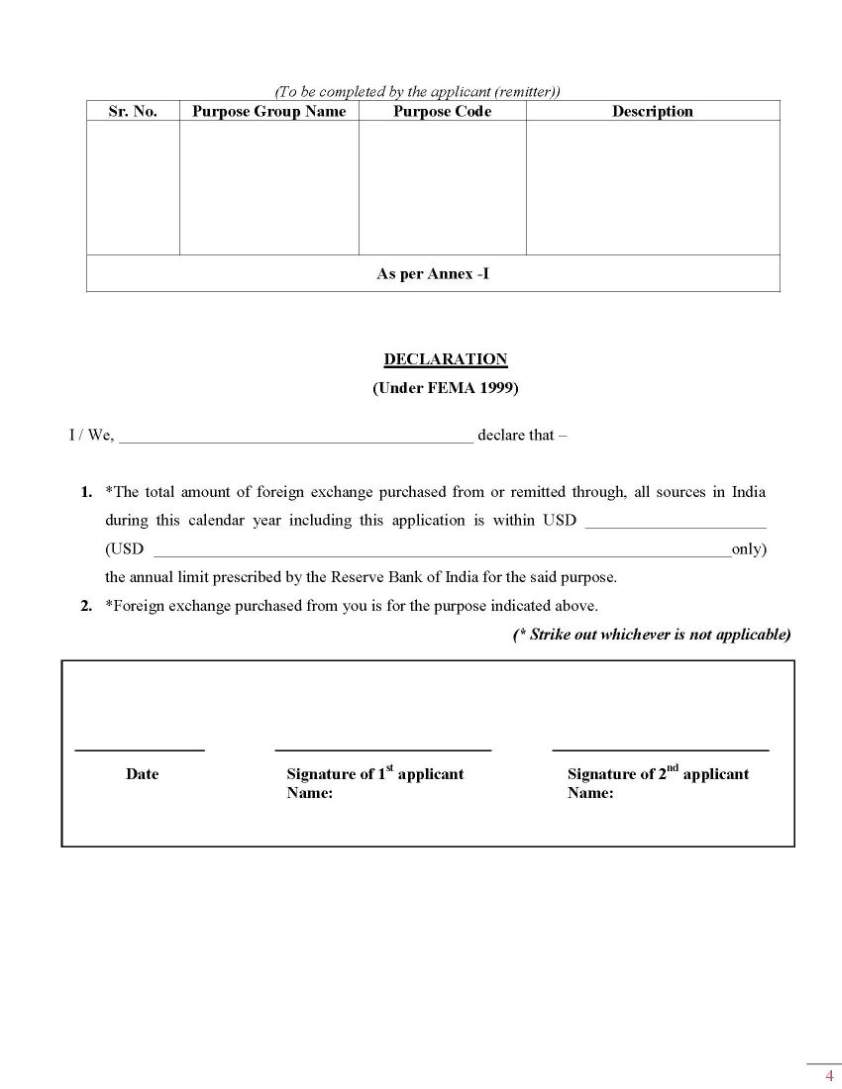

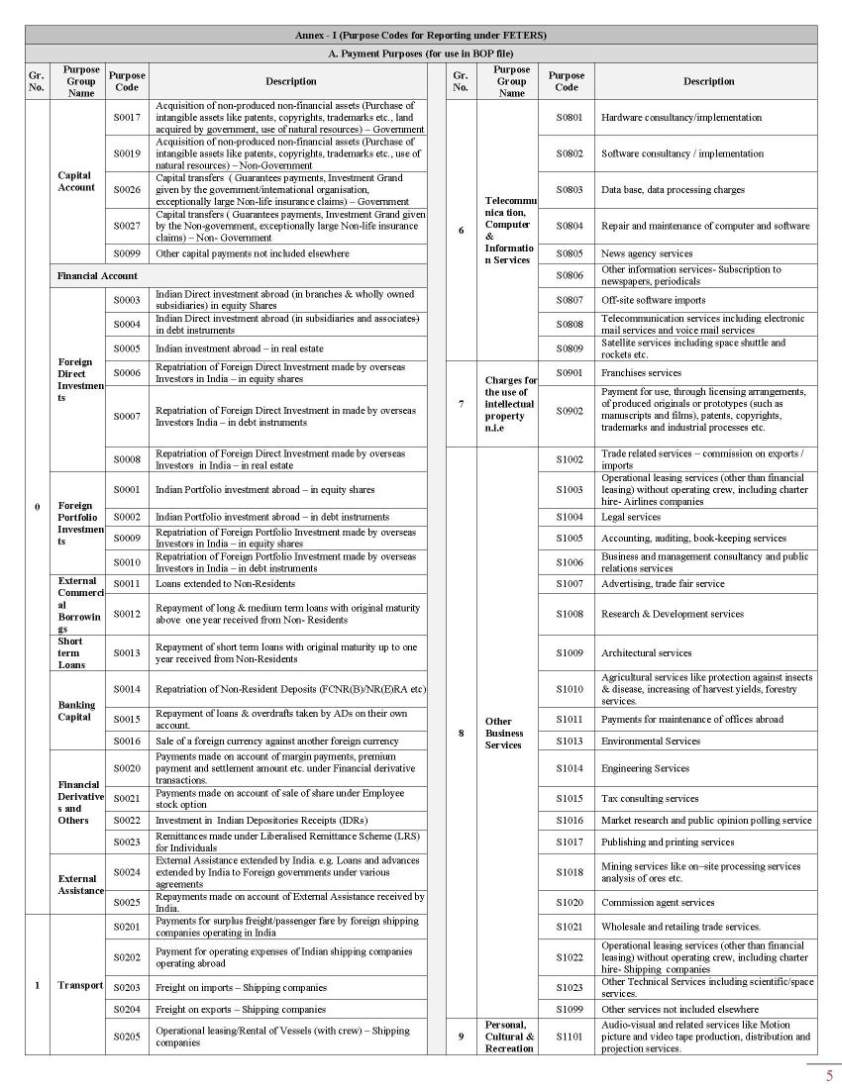

Hello buddy you are looking for the information about the State Bank of India, Kolkata. So I am providing you: State Bank of India is an Indian multinational, Public Sector banking and financial services company. It is a government-owned corporation with its headquarters in Mumbai, Maharashtra. State Bank of India is one of the Big Four banks of India, along with Bank of Baroda, Punjab National Bank and ICICI Bank. State Bank of India is a regional banking behemoth and has 20% market share in deposits and loans among Indian commercial banks. You are looking for the Outward Remittance form of NRO. So I am providing it to you: In this form you have to fill up the following formalities: • Beneficiary’s Name • Beneficiary’s Address • Beneficiary’s Account Number • Beneficiary’s Bank Name • Beneficiary’s Bank Branch Name • Beneficiary’s Bank Branch SWIFT code • Beneficiary Bank’s Correspondent Bank’s Name • Beneficiary Bank’s Correspondent Bank’s SWIFT code • Purpose of Remittance • Foreign Bank Charges to be borne by. Request for Outward Remittance from NRO account       Contact Information of State Bank of India, Kolkata: Stock price: SBIN (NSE) Rs. 287.00 0.00 (0.00%) Customer service: 1800 425 3800 Founded: June 2, 1806, Kolkata Subsidiaries: SBI Cards, State Bank of Hyderabad, State Bank of Mysore |