|

#2

16th June 2017, 02:30 PM

| |||

| |||

| Re: Standard Chartered Risk

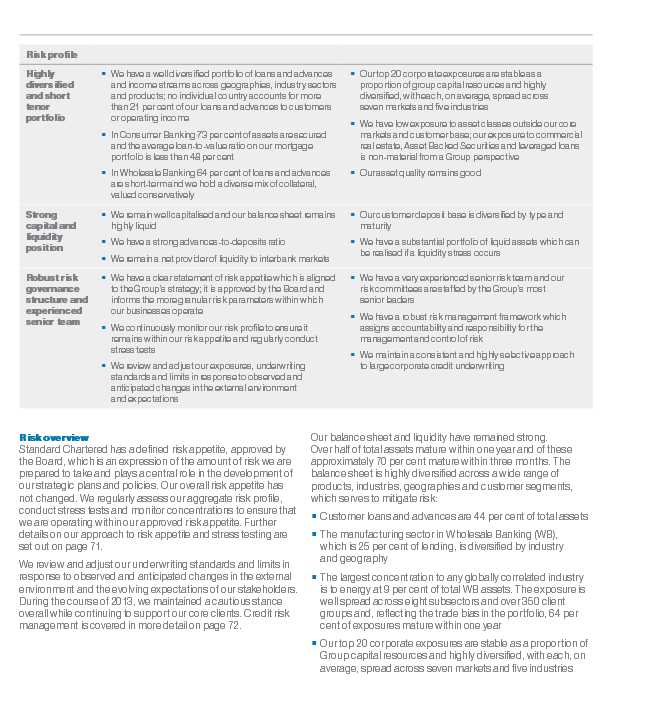

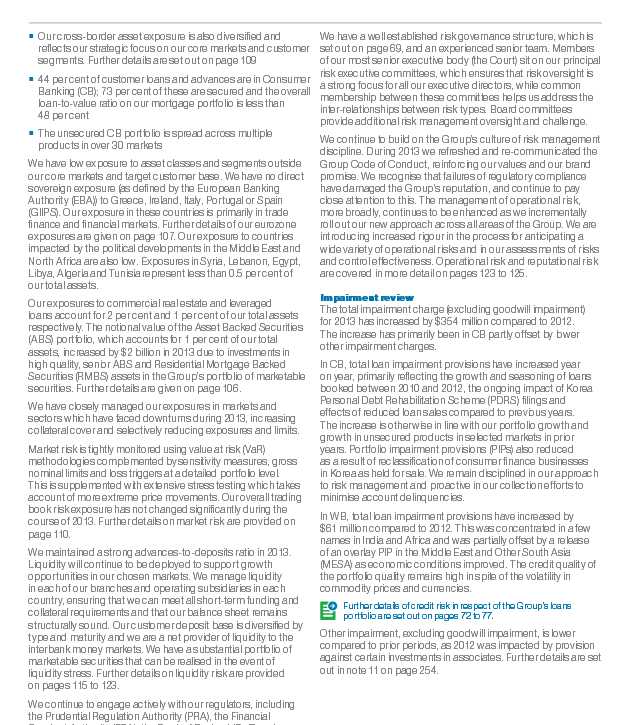

I am giving information related to Risk Review of Standard Chartered for your reference: Standard Chartered Risk Review Risk review Our risk profile is in line with our strategy Highly diversified and short tenor portfolio: We have a well diversified portfolio of loans and advances and income streams across geographies, industry sectors and products; no individual country accounts for more than 21 per cent of our loans and advances to customers or operating income In Consumer Banking 73 per cent of assets are secured and the average loan-to-value ratio on our mortgage portfolio is less than 48 per cent In Wholesale Banking 64 per cent of loans and advances are short-term and we hold a diverse mix of collateral, valued conservatively Our top 20 corporate exposures are stable as a proportion of group capital resources and highly diversified, with each, on average, spread across seven markets and five industries We have low exposure to asset classes outside our core markets and customer base; our exposure to commercial real estate, Asset Backed Securities and leveraged loans is non-material from a Group perspective Our asset quality remains good Strong capital and liquidity position We remain well capitalised and our balance sheet remains highly liquid We have a strong advances-to-deposits ratio We remain a net provider of liquidity to interbank markets Our customer deposit base is diversified by type and maturity We have a substantial portfolio of liquid assets which can be realised if a liquidity stress occurs Robust risk governance structure and experienced senior team We have a clear statement of risk appetite which is aligned to the Group’s strategy; it is approved by the Board and informs the more granular risk parameters within which our businesses operate We continuously monitor our risk profile to ensure it remains within our risk appetite and regularly conduct stress tests We review and adjust our exposures, underwriting standards and limits in response to observed and anticipated changes in the external environment and expectations We have a very experienced senior risk team and our risk committees are staffed by the Group’s most senior leaders We have a robust risk management framework which assigns accountability and responsibility for the management and control of risk We maintain a consistent and highly selective approach to large corporate credit underwriting Standard Chartered Risk Review   Last edited by pawan; 16th June 2017 at 02:51 PM. |