|

#3

4th December 2015, 07:34 PM

| |||

| |||

| Re: South Indian Bank Agriculture Gold Loan

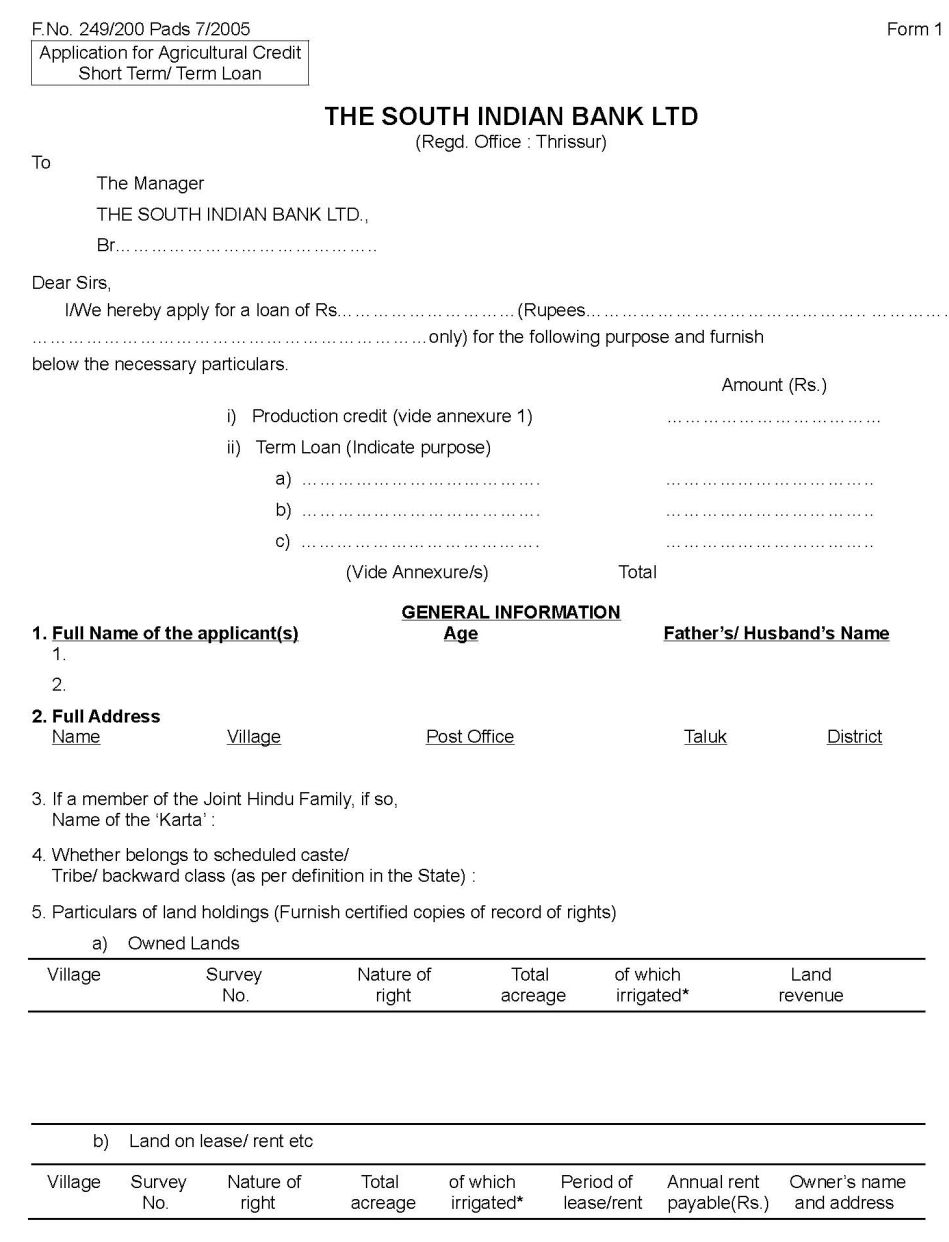

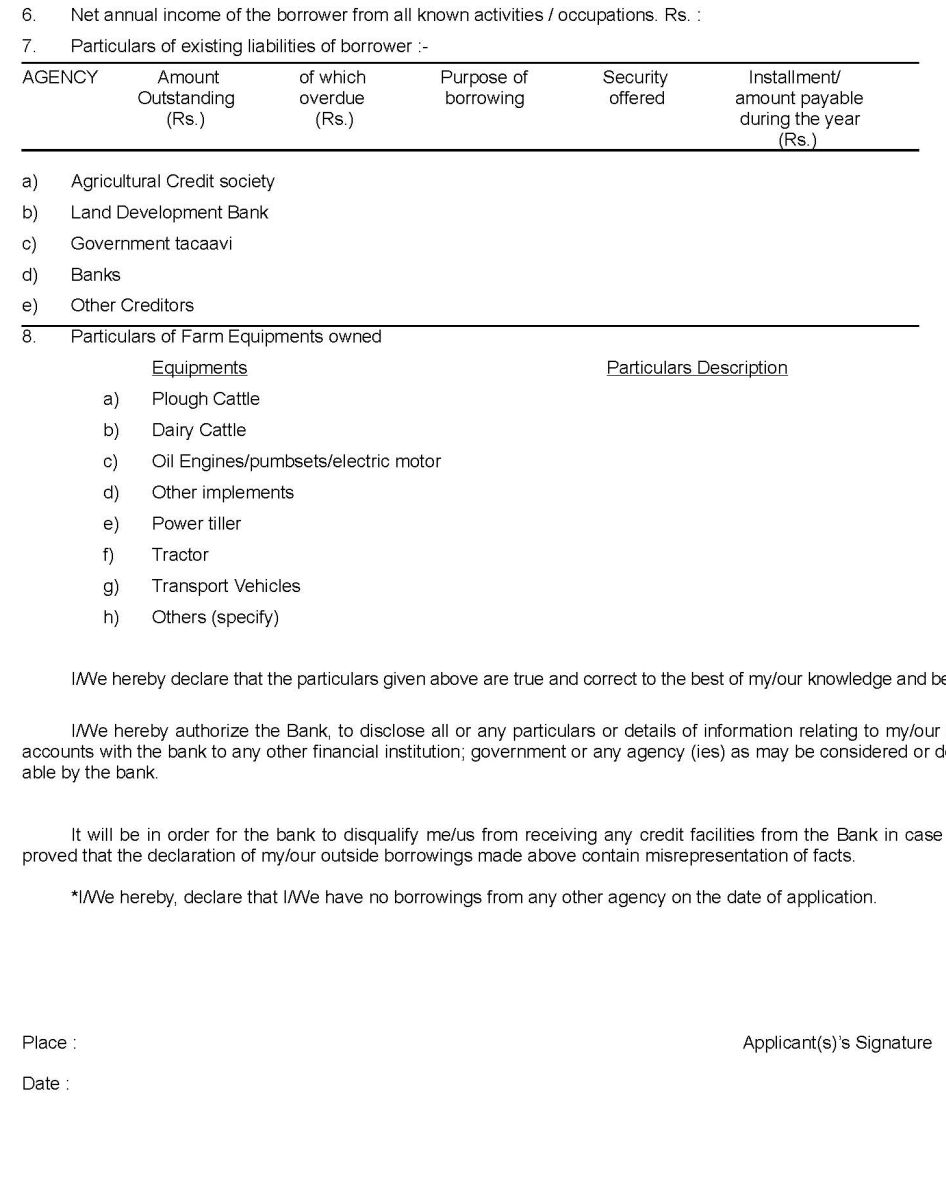

South Indian Bank Limited (SIB) is a private sector bank headquartered at Thrissur City in Kerala, India. Here as per your demand I am providing you application form of Agriculture Loan of South Indian Bank Application form of Agriculture Loan of South Indian Bank   In this form you have to fill the following details: 1. Full Name of the applicant 2. Full Address 3. If a member of the Joint Hindu Family, if so,Name ofthe ‘Karta’ 4. Caste 5. Particularsof land holdings 6.Net annual income oft he borrower from all known activities / occupations. Rs. 7.Particulars of existing liabilities of borrower 8.Particulars of Farm Equipments owned |