|

#2

4th December 2014, 09:11 AM

| |||

| |||

| Re: Self Employed Courses HMRC

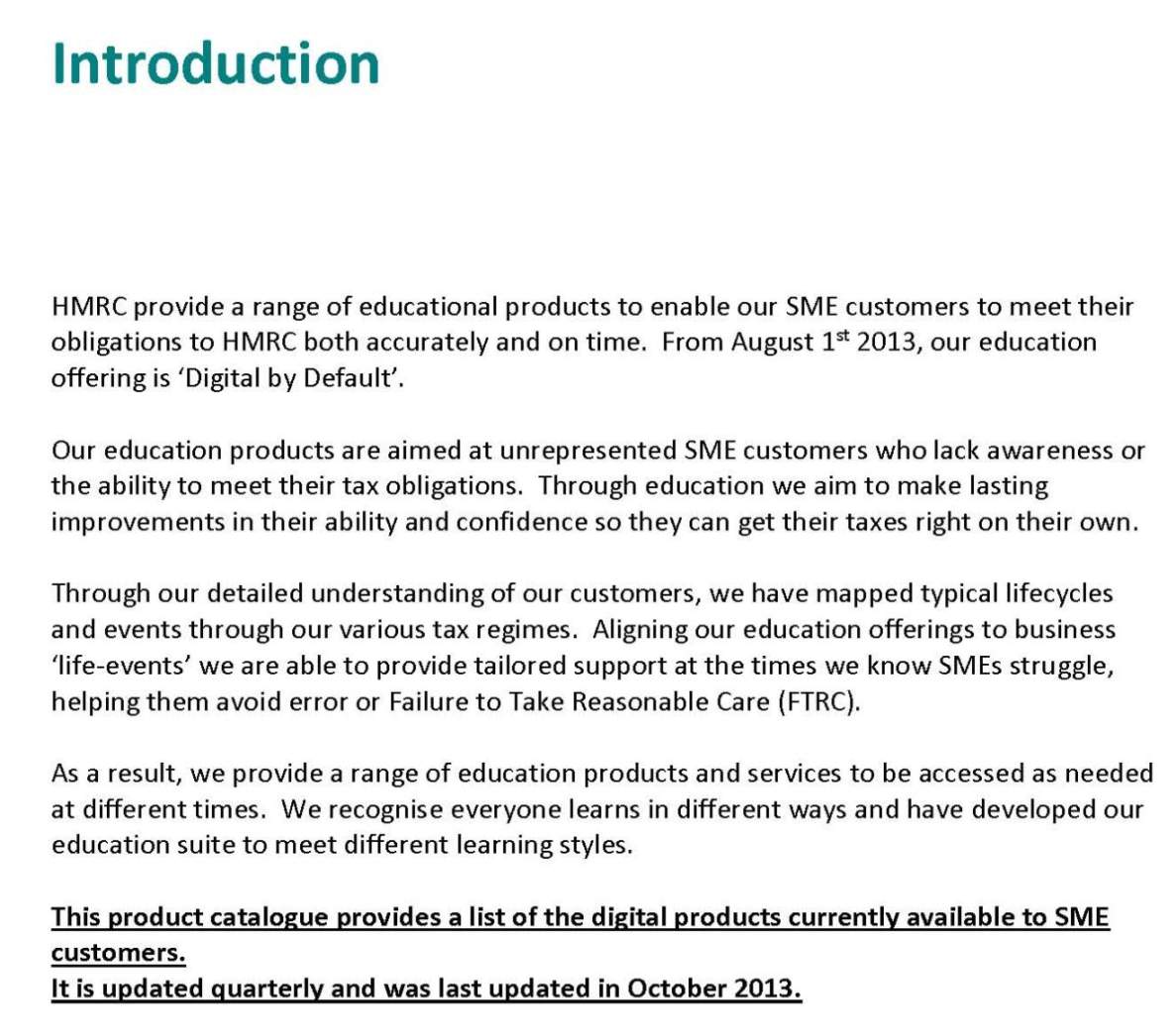

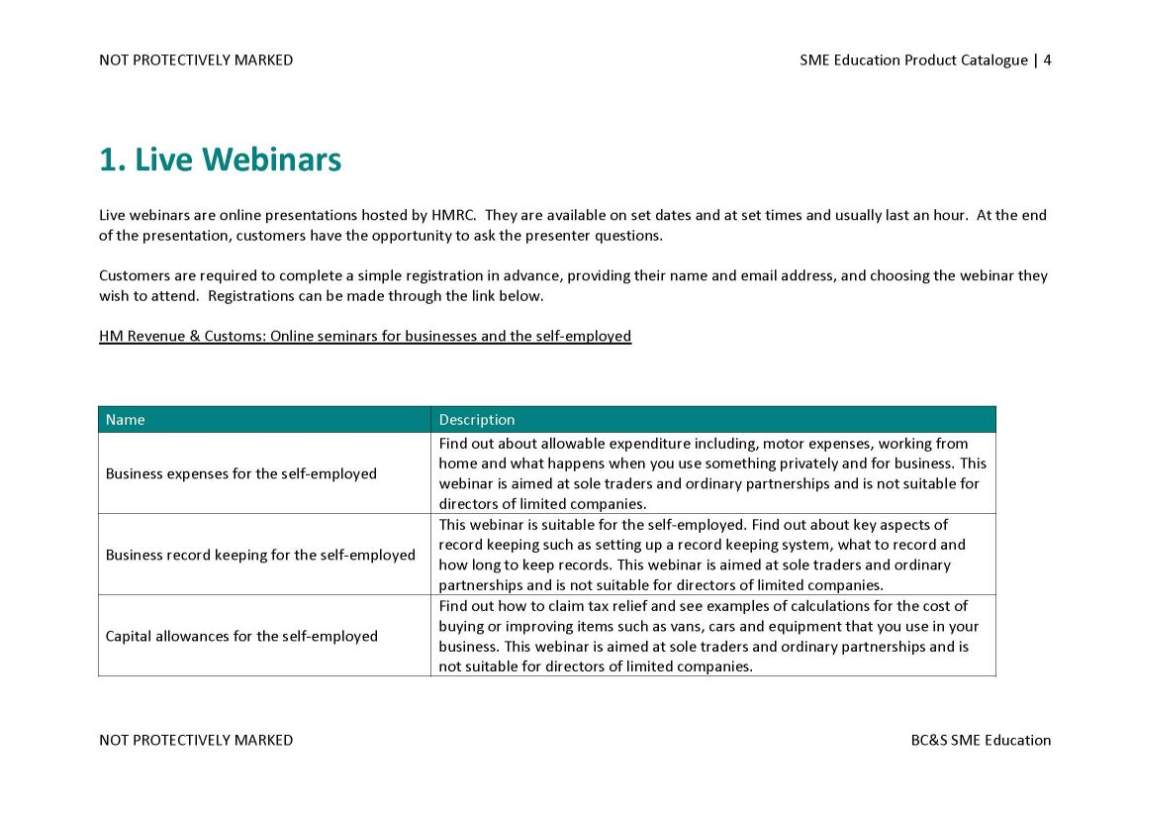

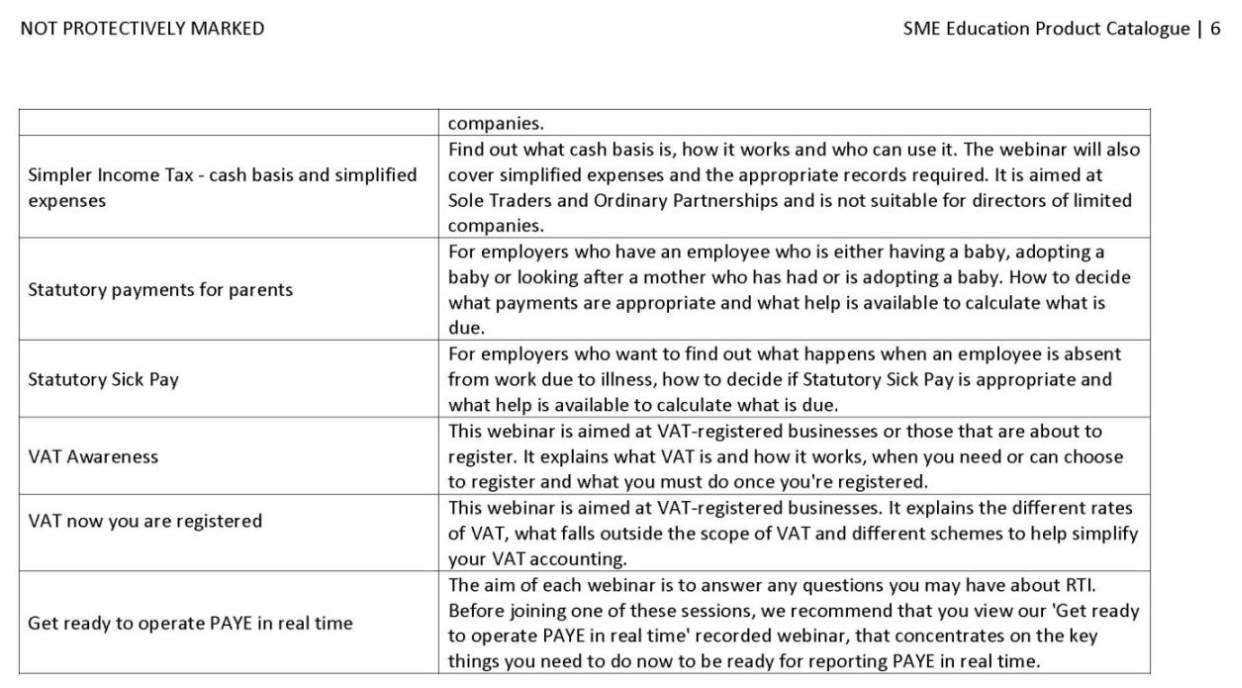

HM Revenue & Customs offers services to provide educations. Departments of HM Revenue & Customs Self Assessment PAYE for employers Tax credits National Insurance Income Tax VAT Paying HMRC Press and media See more services and information HMRC has wide range of webinars to help customers to understand a variety of tax systems and learn what obligations they need to meet. Webinars available on fixed time and date. So you need to register first. HMRC online Self Employed Programs Detail      Topics covered Construction Industry Scheme International trade HMRC digital services Employers Company directors Tax and change of career or retirement Self-employed HMRC and partners - working together to help you Property income VAT Tax agents and advisers For more detail, contact to; Address HM Revenue & Customs Euston Tower, 286 Euston Rd, London NW1 3UL, United Kingdom +44 845 300 0627 [MAP]https://maps.google.co.in/maps?q=HMRC,+London,+United+Kingdom&hl=en&sll=28.5 57986,77.090182&sspn=0.300346,0.653687&oq=HMRC,+U& hq=HMRC,&hnear=London,+United+Kingdom&t=m&z=11[/MAP] |