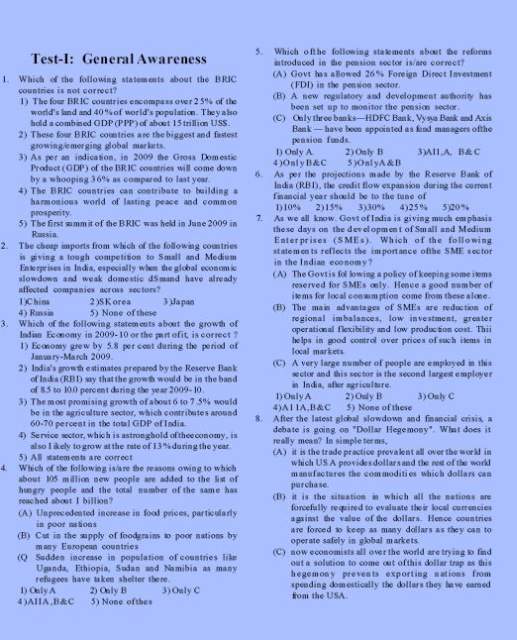

| Re: RBI Grade B Exam Question Paper

Here is the list of few questions of RBI Grade B Exam Entrance Exam Question Paper for your idea.

1. Which of the following statements about the BRIC

countries is not correct?

1) The four BRIC countries encompass over 25% of the

world's land and 40% of world's population. They also

hold a combined GDP (PPP) of about 15 trillion US$.

2) These four BRIC countries are the biggest and fastest

growing/emerging global markets.

3) As per an indication, in 2009 the Gross Domestic

Product (GDP) of the BRIC countries will come down

by a whooping 36% as compared to last year.

4) The BRIC countries can contribute to building a

harmonious world of lasting peace and common

prosperity.

5) The first summit of the BRIC was held in June 2009 in

Russia.

2. The cheap imports from which of the following countries

is giving a tough competition to Small and Medium

Enterprises in India, especially when the global economic

slowdown and weak domestic dSmand have already

affected companies across sectors?

I)China 2)SKorea 3)Japan

4) Russia 5) None of these

3. Which of the following statements about the growth of

Indian Economy in 2009-10 or the part of it, is correct ?

1) Economy grew by 5.8 per cent during the period of

January-March 2009.

2) India's growth estimates prepared by the Reserve Bank

of India (RBI) say that the growth would be in the band

of 8.5 to 10.0 percent during the year 2009-10.

3) The most promising growth of about 6 to 7.5% would

be in the agriculture sector, which contributes around

60-70 percent in the total GDP of India.

4) Service sector, which is astronghold oftheeconomy, is

also I ikely to grow at the rate of 13% during the year.

5) All statements are correct

4. Which of the following is/are the reasons owing to which

about 105 million new people are added to the list of

hungry people and the total number of the same has

reached about I billion?

(A) Unprecedented increase in food prices, particularly

in poor nations

(B) Cut in the supply of foodgrains to poor nations by

many European countries

(Q Sudden increase in population of countries like

Uganda, Ethiopia, Sudan and Namibia as many

refugees have taken shelter there.

1) Only A 2) Only B 3) Only C

4)AIIA,B&C 5) None of thes

5. Which ofthe following statements about the reforms

introduced in the pension sector is/are correct?

(A) Govt has allowed 26% Foreign Direct Investment

(FDI) in the pension sector.

(B) A new regulatory and development authority has

been set up to monitor the pension sector.

(C) Only three banks—HDFC Bank, Vysya Bank and Axis

Bank — have been appointed as fund managers ofthe

pension funds.

1) Only A. 2) Only B 3)AI1,A, B&C

4)OnlyB&C 5)OnlyA&B

6. As per the projections made by the Reserve Bank of

India (RBI), the credit flow expansion during the current

financial year should be to the tune of

1)10% 2)15% 3)30% 4)25% 5)20%

7. As we all know. Govt of India is giving much emphasis

these days on the development of Small and Medium

E n t e r p r i s e s (SMEs). Which of the following

statements reflects the importance ofthe SME sector

in the Indian economy?

(A) The Govt is fol lowing a policy of keeping some items

reserved for SMEs only. Hence a good number of

items for local consumption come from these alone.

(B) The main advantages of SMEs are reduction of

regional imbalances, low investment, greater

operational flexibility and low production cost. Thii

helps in good control over prices of such items in

local markets.

(C) A very large number of people are employed in this

sector and this sector is the second largest employer

in India, after agriculture.

1) Only A 2) Only B 3) Only C

4)A11A,B&C 5) None of these

8. After the latest global slowdown and financial crisis, a

debate is going on "Dollar Hegemony". What does it

really mean? In simple terms,

(A) it is the trade practice prevalent all over the world in

which US A provides dollars and the rest of the world

manufactures the commodities which dollars can

purchase.

(B) it is the situation in which all the nations are

forcefully required to evaluate their local currencies

against the value of the dollars. Hence countries

are forced to keep as many dollars as they can to

operate safely in global markets.

(C) now economists all over the world are trying to find

out a solution to come out of this dollar trap as this

hegemony prevents exporting nations from

spending domestically the dollars they have earned

from the USA.

1) Only A 2) Only B 3) Only C

4)OnlyA&C 5)A11A,B&C

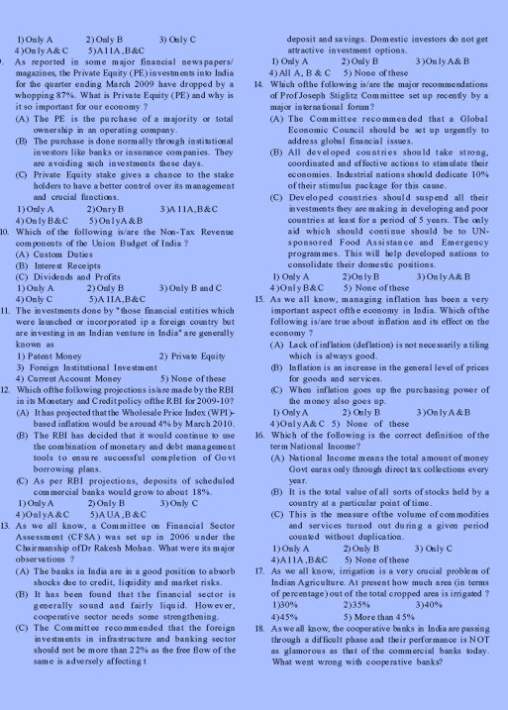

9. As reported in some major financial newspapers/

magazines, the Private Equity (PE) investments into India

for the quarter ending March 2009 have dropped by a

whopping 87%. What is Private Equity (PE) and why is

it so important for our economy ?

(A) The PE is the purchase of a majority or total

ownership in an operating company.

(B) The purchase is done normally through institutional

investors like banks or insurance companies. They

are avoiding such investments these days.

(C) Private Equity stake gives a chance to the stake

holders to have a better control over its management

and crucial functions.

1) Only A 2)OnryB 3)A11A,B&C

4)OnlyB&C 5)OnlyA&B

10. Which of the following is/are the Non-Tax Revenue

components of the Union Budget of India ?

(A) Custom Duties

(B) Interest Receipts

(C) Dividends and Profits

1) Only A 2) Only B 3) Only B and C

4) Only C 5)A1IA,B&C

11. The investments done by "those financial entities which

were launched or incorporated ip a foreign country but

are investing in an Indian venture in India" are generally

known as

1) Patent Money 2) Private Equity

3) Foreign Institutional Investment

4) Current Account Money 5) None of these

12. Which ofthe following projections is/are made by the RBI

in its Monetary and Credit policy ofthe RBI for 2009-10?

(A) It has projected that the Wholesale Price Index (WPI)-

based inflation would be around 4% by March 2010.

(B) The RBI has decided that it would continue to use

the combination of monetary and debt management

tools to ensure successful completion of Govt

borrowing plans.

(C) As per RBI projections, deposits of scheduled

commercial banks would grow to about 18%.

1) Only A 2) Only B 3) Only C

4)OnlyA&C 5)AUA,B&C

13. As we all know, a Committee on Financial Sector

Assessment (CFSA) was set up in 2006 under the

Chairmanship of Dr Rakesh Mohan. What were its major

observations ?

(A) The banks in India are in a good position to absorb

shocks due to credit, liquidity and market risks.

(B) It has been found that the financial sector is

generally sound and fairly liquid. However,

cooperative sector needs some strengthening.

(C) The Committee recommended that the foreign

investments in infrastructure and banking sector

should not be more than 22% as the free flow of the

same is adversely affecting t

deposit and savings. Domestic investors do not get

attractive investment options.

1) Only A 2) Only B 3)OnlyA&B

4) All A, B & C 5) None of these

14. Which ofthe following is/are the major recommendations

of Prof Joseph Stiglitz Committee set up recently by a

major international forum?

(A) The Committee recommended that a Global

Economic Council should be set up urgently to

address global financial issues.

(B) All developed countries should take strong,

coordinated and effective actions to stimulate their

economies. Industrial nations should dedicate 10%

of their stimulus package for this cause.

(C) Developed countries should suspend all their

investments they are making in developing and poor

countries at least for a period of 5 years. The only

aid which should continue should be to UNsponsored

Food Assistance and Emergency

programmes. This will help developed nations to

consolidate their domestic positions.

1) Only A 2)OnlyB 3)OnlyA&B

4)OnlyB&C 5) None of these

15. As we all know, managing inflation has been a very

important aspect ofthe economy in India. Which ofthe

following is/are true about inflation and its effect on the

economy ?

(A) Lack of inflation (deflation) is not necessarily a tiling

which is always good.

(B) Inflation is an increase in the general level of prices

for goods and services.

(C) When inflation goes up the purchasing power of

the money also goes up.

1) Only A 2) Only B 3)OnlyA&B

4)OnlyA&C 5) None of these

16. Which of the following is the correct definition of the

term National Income?

(A) National Income means the total amount of money

Govt earns only through direct tax collections every

year.

(B) It is the total value of all sorts of stocks held by a

country at a particular point of time.

(C) This is the measure of the volume of commodities

and services turned out during a given period

counted without duplication.

1) Only A 2) Only B 3) Only C

4)A11A,B&C 5) None of these

17. As we all know, irrigation is a very crucial problem of

Indian Agriculture. At present how much area (in terms

of percentage) out of the total cropped area is irrigated ?

1)30% 2)35% 3)40%

4)45% 5) More than 4 5%

18. As we all know, the cooperative banks in India are passing

through a difficult phase and their performance is NOT

as glamorous as that of the commercial banks today.

What went wrong with cooperative banks?

(A) The cooperative banks disbursed credit on the

loans on demand mostly without proper guarantees

and documents. Hence repayments were always

at the mercy of the borrowers and up to some extent

on good crops.

(B) The cooperative banks are mostly under the

supervisory control of the Panchayats, which are

not professionally qualified to control such

institutions.

(C) Cooperative Banks do not get any relief package

from the Govt. Hence they have to manage their

affairs on their own resources only.

l)OnlyB 2) Only A 3) Only C

4)A11A,B&C 5) None of these

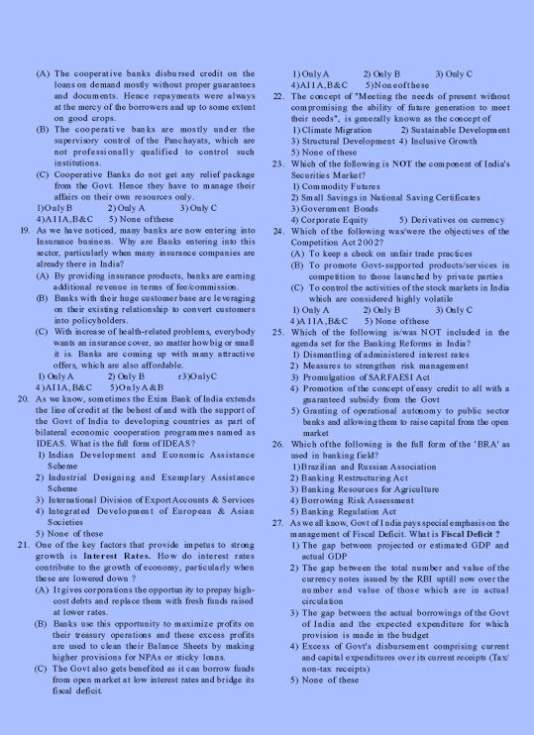

19. As we have noticed, many banks are now entering into

Insurance business. Why are Banks entering into this

sector, particularly when many insurance companies are

already there in India?

(A) By providing insurance products, banks are earning

additional revenue in terms of fee/commission.

(B) Banks with their huge customer base are leveraging

on their existing relationship to convert customers

into policyholders.

(C) With increase of health-related problems, everybody

wants an insurance cover, no matter how big or small

it is. Banks are coming up with many attractive

offers, which are also affordable.

1) Only A 2) Only B r3)OnlyC

4)AI1A,B&C 5)OnlyA&B

20. As we know, sometimes the Exim Bank of India extends

the line of credit at the behest of and with the support of

the Govt of India to developing countries as part of

bilateral economic cooperation programmes named as

IDEAS. What is the full form of IDEAS?

1) Indian Development and Economic Assistance

Scheme

2) Industrial Designing and Exemplary Assistance

Scheme

3) International Division of Export Accounts & Services

4) Integrated Development of European & Asian

Societies

5) None of these

21. One of the key factors that provide impetus to strong

growth is Interest Rates. How do interest rates

contribute to the growth of economy, particularly when

these are lowered down ?

(A) It gives corporations the opportun ity to prepay highcost

debts and replace them with fresh funds raised

at lower rates.

(B) Banks use this opportunity to maximize profits on

their treasury operations and these excess profits

are used to clean their Balance Sheets by making

higher provisions for NPAs or sticky loans.

(C) The Govt also gets benefited as it can borrow funds

from open market at low interest rates and bridge its

fiscal deficit.

1) Only A 2) Only B 3) Only C

4)AI1A,B&C 5)Noneofthese

22. The concept of "Meeting the needs of present without

compromising the ability of future generation to meet

their needs", is generally known as the concept of

1) Climate Migration 2) Sustainable Development

3) Structural Development 4) Inclusive Growth

5) None of these

23. Which of the following is NOT the component of India's

Securities Market?

1) Commodity Futures

2) Small Savings in National Saving Certificates

3) Government Bonds

4) Corporate Equity 5) Derivatives on currency

24. Which of the following was/were the objectives of the

Competition Act 2002?

(A) To keep a check on unfair trade practices

(B) To promote Govt-supported products/services in

competition to those launched by private parties

(C) To control the activities of the stock markets in India

which are considered highly volatile

1) Only A 2) Only B 3) Only C

4)A11A,B&C 5) None of these

25. Which of the following is/was NOT included in the

agenda set for the Banking Reforms in India?

1) Dismantling of administered interest rates

2) Measures to strengthen risk management

3) Promulgation of SARFAESI Act

4) Promotion of the concept of easy credit to all with a

guaranteed subsidy from the Govt

5) Granting of operational autonomy to public sector

banks and allowing them to raise capital from the open

market

26. Which of the following is the full form of the 'BRA' as

used in banking field?

1) Brazilian and Russian Association

2) Banking Restructuring Act

3) Banking Resources for Agriculture

4) Borrowing Risk Assessment

5) Banking Regulation Act

27. As we all know, Govt of I ndia pays special emphasis on the

management of Fiscal Deficit. What is Fiscal Deficit ?

1) The gap between projected or estimated GDP and

actual GDP

2) The gap between the total number and value of the

currency notes issued by the RBI uptill now over the

number and value of those which are in actual

circulation

3) The gap between the actual borrowings of the Govt

of India and the expected expenditure for which

provision is made in the budget

4) Excess of Govt's disbursement comprising current

and capital expenditures over its current receipts (Tax/

non-tax receipts)

5) None of these

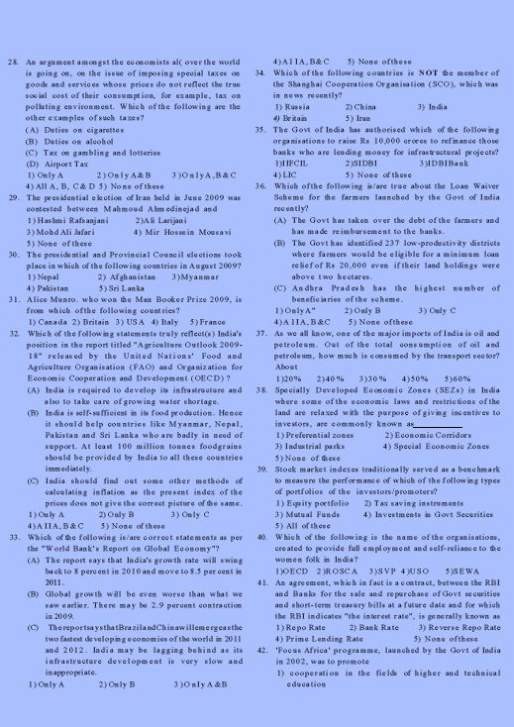

28. An argument amongst the economists al( over the world

is going on, on the issue of imposing special taxes on

goods and services whose prices do not reflect the true

social cost of their consumption, for example, tax on

polluting environment. Which of the following are the

other examples of such taxes?

(A) Duties on cigarettes

(B) Duties on alcohol

(C) Tax on gambling and lotteries

(D) Airport Tax

1) Only A 2)OnlyA&B 3)OnlyA,B&C

4) All A, B, C & D 5) None of these

29. The presidential election of Iran held in June 2009 was

contested between Mahmoud Ahmedinejad and

1) Hashmi Rafsanjani 2)Ali Larijani

3) Mohd Ali Jafari 4) Mir Hossein Mousavi

5) None of these

30. The presidential and Provincial Council elections took

place in which of the following countries in August 2009?

1) Nepal 2) Afghanistan 3)Myanmar

4) Pakistan 5) Sri Lanka

31. Alice Munro. who won the Man Booker Prize 2009, is

from which of the following countries?

1) Canada 2) Britain 3) USA 4) Italy 5) France

32. Which of the following statements t r u l y reflect(s) India's

position in the report titled "Agriculture Outlook 2009-

18" released by the United N a t i o n s ' Food and

Agriculture Organisation (FAO) and Organization for

Economic Cooperation and Development (OECD) ?

(A) India is required to develop its infrastructure and

also to take care of growing water shortage.

(B) India is self-sufficient in its food production. Hence

i t should help c o u n t r i e s like Myanmar, N e p a l ,

Pakistan and Sri Lanka who are badly in need of

support. At least 100 million tonnes foodgrains

should be provided by India to all these countries

immediately.

(C) India should find out some other methods of

calculating inflation as the present index of the

prices does not give the correct picture of the same.

1) Only A 2) Only B 3) Only C

4 ) A I I A , B & C 5) None of these

33. Which of the following is/are c o r r e c t statements as per

the "World Bank's Report on Global Economy"?

(A) The report says that India's growth rate will swing

back to 8 percent in 2010 and move to 8.5 per cent in

2011.

(B) Global growth will be even worse than what we

saw earlier. There may be 2.9 percent contraction

in 2009.

(C) ThereportsaysthatBrazilandChinawillemergeasthe

two fastest developing economies of the world in 2011

and 2 0 1 2 . India may be lagging behind as its

i n f r a s t r u c t u r e d e v e l o p m e n t is very slow and

inappropriate.

1) Only A 2) Only B 3)OnIyA&B

4 ) A 1 I A , B & C 5) None of these

34. Which of the following countries is NOT the member of

the Shanghai Cooperation Organisation (SCO), which was

in news recently?

1) Russia 2) China 3) India

4) Britain 5) Iran

35. The Govt of India has authorised which of the following

organisations to raise Rs 10,000 crores to refinance those

banks who are lending money for infrastructural projects?

1)IIFCIL 2)SIDBI 3)IDBIBank

4) LIC 5) None of these

36. Which of the following is/are t r u e about the Loan Waiver

Scheme for the farmers launched by the Govt of India

recently?

(A) The Govt has taken over the debt of the farmers and

has made reimbursement to the banks.

(B) The Govt has identified 237 low-productivity districts

where farmers would be eligible for a minimum loan

relief of Rs 20,000 even if their land holdings were

above two hectares.

(C) A n d h r a Pradesh has the highest number of

beneficiaries of the scheme.

1) Only A" 2) Only B 3) Only C

4 ) A 1 I A , B & C 5) None of these

37. As we all know, one of the major imports of India is oil and

petroleum. Out of the total consumption of oil and

petroleum, how much is consumed by the transport sector?

About

1)20% 2)40% 3)30% 4)50% 5)60%

38. Specially Developed Economic Zones (SEZs) in India

where some of the economic laws and restrictions of the

land are relaxed with the purpose of giving incentives to

investors, are commonly known as

1) Preferential zones 2) Economic Corridors

3) Industrial parks 4) Special Economic Zones

5) None of these

39. Stock market indexes traditionally served as a benchmark

to measure the performance of which of the following types

of portfolios of the investors/promoters?

1) Equity portfolio 2) Tax saving instruments

3) Mutual Funds 4) Investments in Govt Securities

5) All of these

40. Which of the following is the name of the organisations,

created to provide full employment and self-reliance to the

women folk in India?

l)OECD 2)ROSCA 3)SVP 4)USO 5)SEWA

41. An agreement, which in fact is a contract, between the RBI

and Banks for the sale and repurchase of Govt securities

and short-term treasury bills at a future date and for which

the RBI indicates "the interest rate", is generally known as

1) Repo Rate 2) Bank Rate 3) Reverse Repo Rate

4) Prime Lending Rate 5) None of these

42. 'Focus Africa' programme, launched by the Govt of India

in 2002, was to promote

1) cooperation in the fields of higher and technical

education

2) bilateral trade between the two countries

3) healthcare service in Africa, as Africa is badly affected

by HIV/AIDS

4) safety cover to the workers of Indian origin in African

countries as Indian workers are becoming victims of

racial discrimination there

5) None of these

43. Usain Bolt, who won the "Laureus World Sportsman of

the Year Award" for his record-breaking performance in

Beijing Olympics, is basically a/an

1) Golfer 2) Badminton player 3) Tennis player

4) Boxer 5) Athlete

44. Which of the following teams won the Roger Danet

Trophy (Junior Hockey^2009?

1) Italy 2) Germany 3) Netherlands

4) Pakistan 5) India

45. Habib Tanvir, who passed away recently, was a famous

I) politician 2) playwright 3) classical singer

4) sportsman 5) social worker

46. Rameshwar Thakur has taken over as the new Governor of

1) Uttar Pradesh 2) Madhya Pradesh 3) Andhra Pradesh

4)Goa 5) None of these

47. Which of the following States has launched an Insurance

scheme named as "Aam Aadami Insurance Scheme",

which will provide Rs 75,000 insurance cover to all the

beneficiaries?

1) Delhi 2) Himachal Pradesh 3)Kamataka

4) Maharashtra 5) Uttar Pradesh

48. The UN Security Council recently imposed sanctions on

which of the following nations for its recent missile tests

and an underground test of a nuclear device?

1) Pakistan 2) North Korea 3) Iran

4) Turkey 5) None of these

49. In which of the following countries, India recently started

its first Poverty Alleviation Project by sponsoring a

farmers' training and information centre?

1) Bangladesh 2) Nepal 3) Afghanistan

4) Iraq 5) China

50. Who amongst the following is the author of the book

The Grass is Singingl

1) Gunter Grass 2) John Maxwell Coetzee

3) Harold Pinter 4) Doris Lessing 5) Orhan Pamuk

For more questions , here is the attachment

Last edited by Kiran Chandar; 5th August 2014 at 10:51 AM.

|