|

#2

13th September 2015, 09:07 AM

| |||

| |||

| Re: Pnb pf

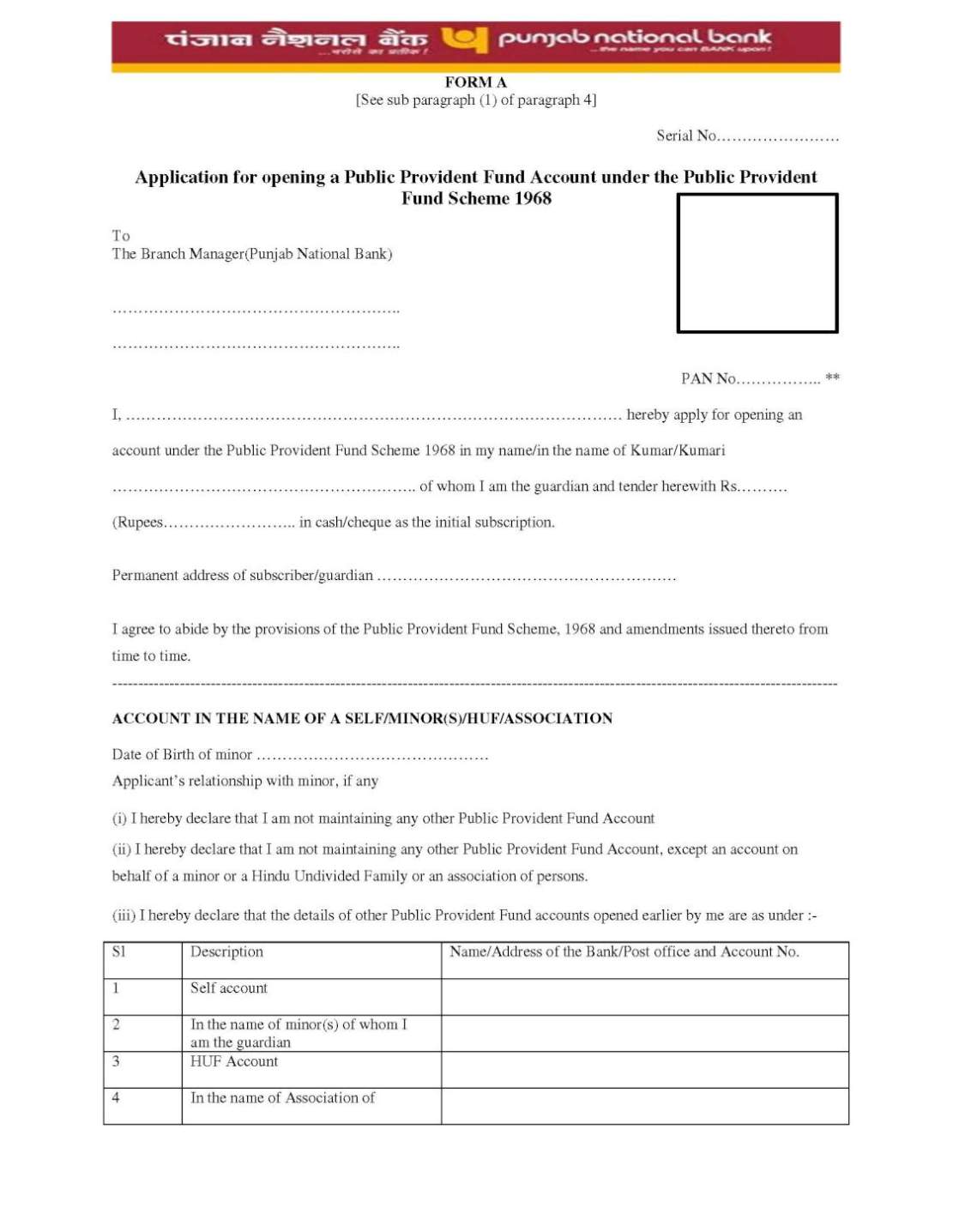

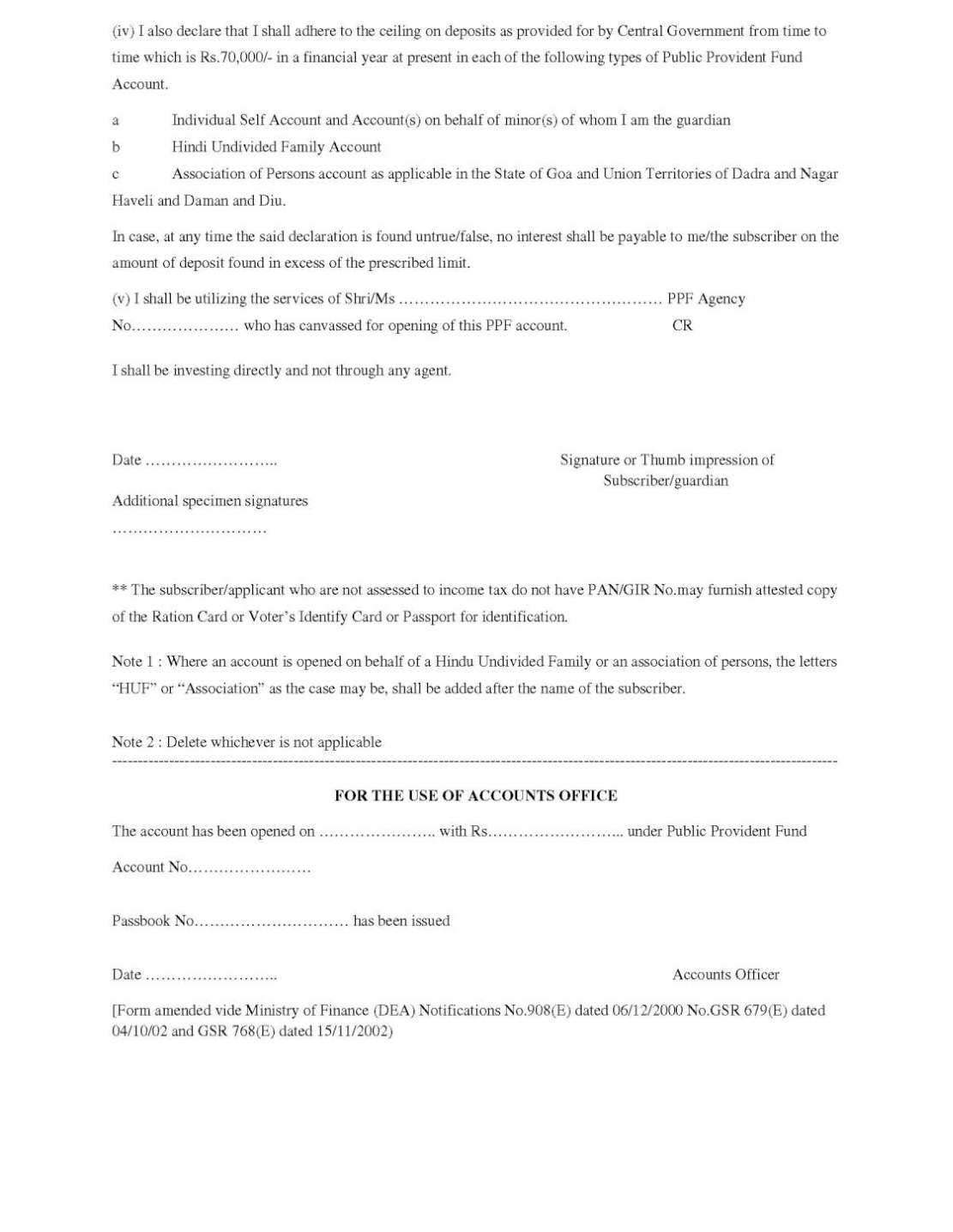

As you want to get the details of Punjab National Bank Public Provident Fund Account, here is the information of the same for you: Eligibility: a. Individual or individual as guardian of a minor can open the account. (can not be opened in Joint names). b. HUF are not eligible. c. Non Resident Indians are not eligible to open the account. d. Only one account can be opened by an individual in one name. Deposit: Minimum remittance of Rs.500/- and maximum of Rs.1,50,000/- in multiples of Rs.5/- can be made in lumpsum or in 12 installments per year. (The subscription limits stands enhanced to Rs. 1,50,000/ per year w.e.f. 23.08.2014) Duration: The account is of 15 years duration and the account can be continued for one or more blocks of 5 years without loss of interest on written request within 1 year from the date of maturity. Interest: Interest at the rate of 8.70% p.a. w.e.f 01.04.2013 is credited to the account on 31st March of every year on the minimum balance between 5th day and end of the month. The rate of interest is notified by Ministry of Finance every year. Loans and Withdrawals: The first loan can be taken in the third financial year from the financial year in which the account was opened up to 25% of the amount at the credit at the end of first financial year. Loan is repayable in 36 months. Withdrawal is allowed every year from the end of the 5th year. The amount is limited to 50% of the balance at credit, at the end of 4th year immediately preceding the year in which the amount is withdrawn Tax Benefits: The subscriptions to the account qualify for deduction under Section 80 C of IT Act. The interest credited to the account is totally exempt from Income Tax. The amount standing to the credit of the account is fully exempted from Wealth Tax. Steps: 2 easy steps how to open a PPF Account STEP-1: PPF account can be opened in only authorised bank branches. STEP-2: Submit Required Documents as below. Documents Required Account opening Form PPF Deposit Slip ID PROOF: a) PAN Card b) Driving License c) Voter ID Card d) Passport ADDRESS PROOF: a) Telephone Bill b) Electricity Bill c) Ration Card 2 (RECENT) PHOTOGRAPHS Pay-In Slip (available at all authorised bank branch) to transfer amount to your new opened PPF Account Application Form and Pay in Slip to open a Punjab National Bank Public Provident Fund Account:    Contact Details: Punjab National Bank S.K.Rao Shopping Complex, Sector-7 Hanuman Mandir Marg Naharpur Village, Rohini New Delhi, Delhi 110085 India [MAP]Punjab National Bank New Delhi[/MAP] |