|

#2

1st March 2016, 12:37 PM

| |||

| |||

| Re: PNB BPLR History

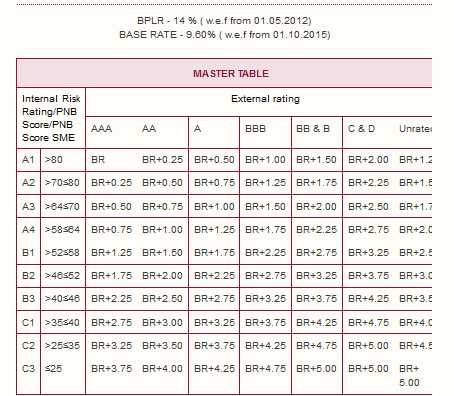

Punjab National Bank is an Indian multinational banking and financial services company founded in 1894. It is one of the Big Four banks of India, along with ICICI Bank, Bank of Baroda and State Bank of India. It has a banking subsidiary in the UK (PNB International Bank, with seven branches in the UK), as well as branches in Hong Kong, Kowloon, Dubai and Kabul. It has representative offices in Almaty (Kazakhstan), Dubai (United Arab Emirates), Shanghai (China), Oslo (Norway) and Sydney (Australia). PNB BPLR Rate BPLR: 14.00% w.e.f. 01.05.2012 Interest Rate on Advances Linked to BPLR and Base Rate 1. AGRICULTURE ADVANCES: (i) Regular Crop Loans/KCC up to Rs. 3 lacs: 7% (ii) Loans up to Rs. 20.00 lacs (including regular crop loans/KCC above Rs. 3 lacs): BR + 2% (iii) Loans above Rs. 20.00 lacs: As per Master Table above. 2. MSME ADVANCES: a) (i)Advances up to Rs. 50000/-: BR+1.25% (ii)Advances above Rs. 50000/- & up to Rs 20 lacs: BR+2.25% (iii)Advances above Rs. 20 lacs: As per Master Table above b) i)-Minimum ROI for MSME advances BR i.e presently 9.60 % ii)-Maximum ROI for MSME advances BR+2.50% treating the investment grade as PNB B-3 as per internal rating iii) Mean ROI for MSME advances BR+2.13% c) The total yearly interest cost on fixed amount of credit of Rs.100000/- based on Minimum/Maximum/ Mean ROI on MSME advances will be as under till any change in our ROI structure or Base Rate. i) At Minimum ROI @ 9.60% =Rs.10034/- ii) At Maximum ROI @ 13.85% =Rs.14764/- iii) At Mean ROI @ 11.73% =Rs.12382/- Interest Rate on Advances Linked to BPLR and Base Rate  |