For meeting personal / family finance requests including expenses towards purchase of household articles/ white goods / electronic / computer equipments, peripherals/ expenses for medical treatment / inland or foreign leisure travel / inland or foreign business travel / travel abroad on employment contract # etc.

The purpose of the loan should be indicated in the application form and proposal.

Individual Loans offered to:

Individuals lastingly employed in reputed companies / firms / organisations / Govt. service having outstanding period of service equal to the repayment period.

Practicing / employed Doctors - having specialized Medical Degree

Business men

Other categories having enough income /IT Return and who are competent of remitting EMIs.

NRIs

Maximum quantum of loan provided:

Maximum Rs. Three lakhs subject to the following:

Salaried persons: 15 times of the periodical net salary exclusive of the proposed loan deductions subject to a maximum of Rs.3.00 lacs.

Persons occupied in business/profession and filing IT Returns: Equal to the yearly income declared as per the most recent IT Return (without considering capital gains) subject to a maximum of Rs.3.00 lacs.

Persons travelling overseas on employment contract: 75% of total costs / 5 times of monthly salary whichever is lower as per agreement terms subject to a maximum loan of Rs. 3.00 lacs.

NRIs : 50% of the average yearly remittance to their NRI account /spouse’s home account (excluding bulk remittance) subject to a maximum loan of Rs. 3.00 lacs.

Persons who do not come under the tax bracket and gives a statement to that effect : Equal to the yearly income declared by the applicant supported by suitable documents to the satisfaction of the Branch Manager, subject to a maximum loan of Rs.3.00 lac

Mode of disbursement

By acclaim to the SB/CD account of the borrower and in the case of NRIs, by acclaim to NRO account only .

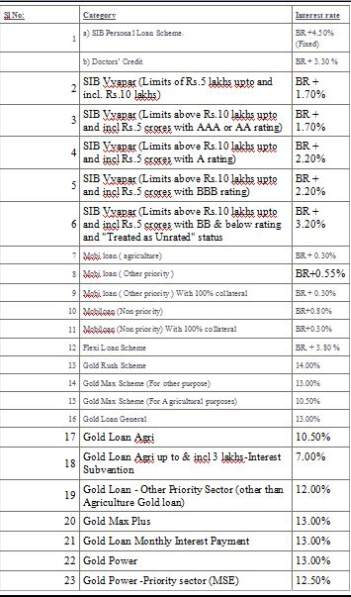

SIB Personal Loan Scheme rate of Interest is 15% (Fixed).

Address:

South Indian Bank Ltd.

Head Office

T.B Road, Mission Quarters, Thrissur 680 001,Kerala, India

Telephone Nos : +91-487-2420020, 2420058, 2420113

Email:

sibcorporate@sib.co.in