| 14th November 2014 07:52 AM | |

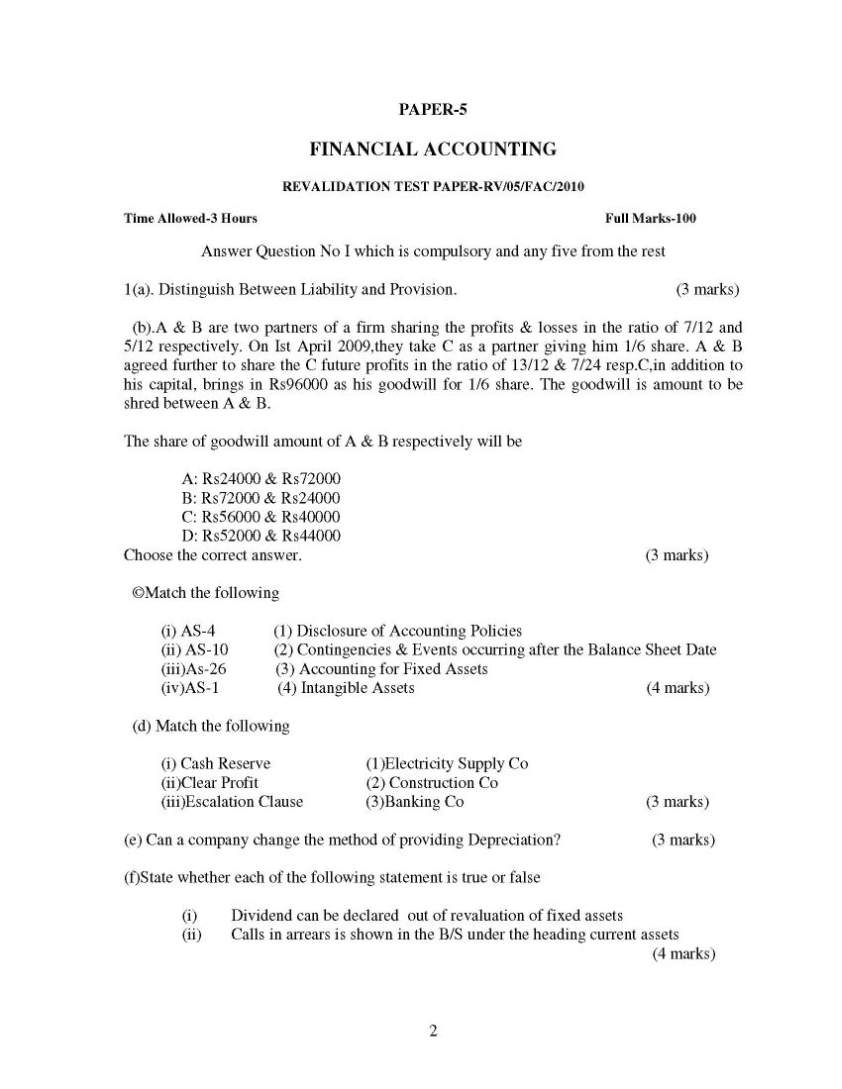

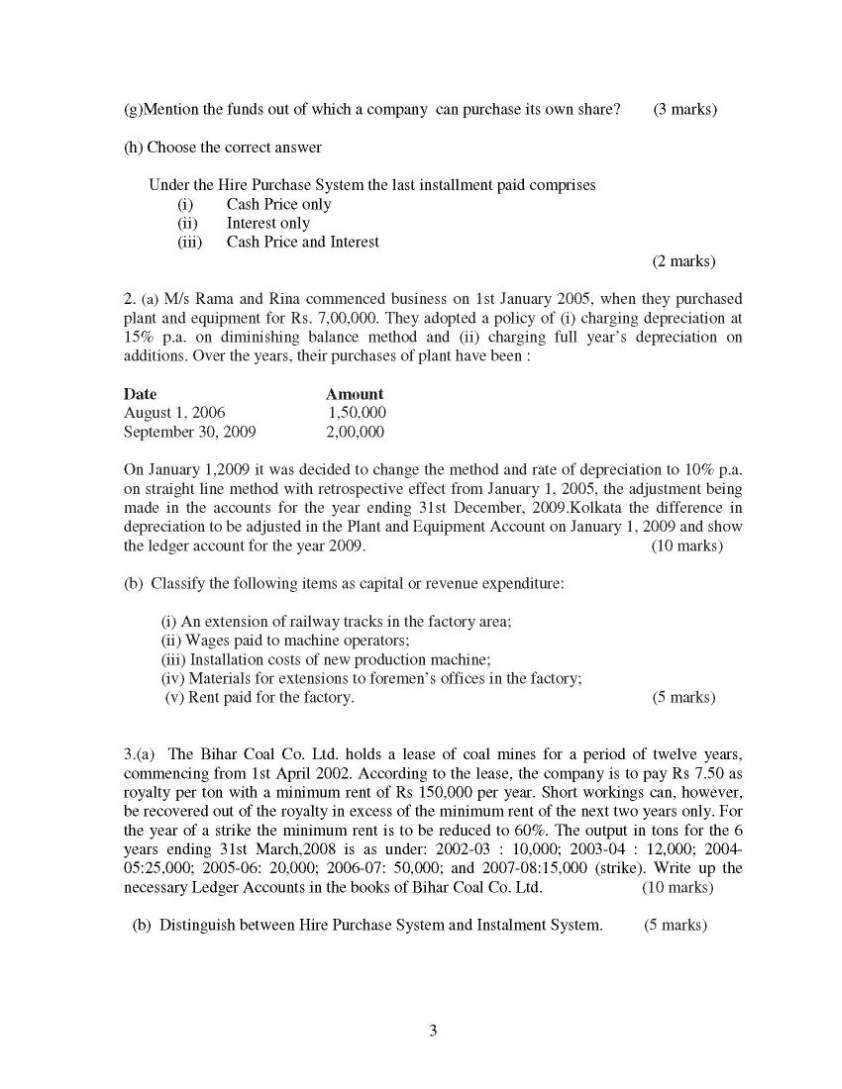

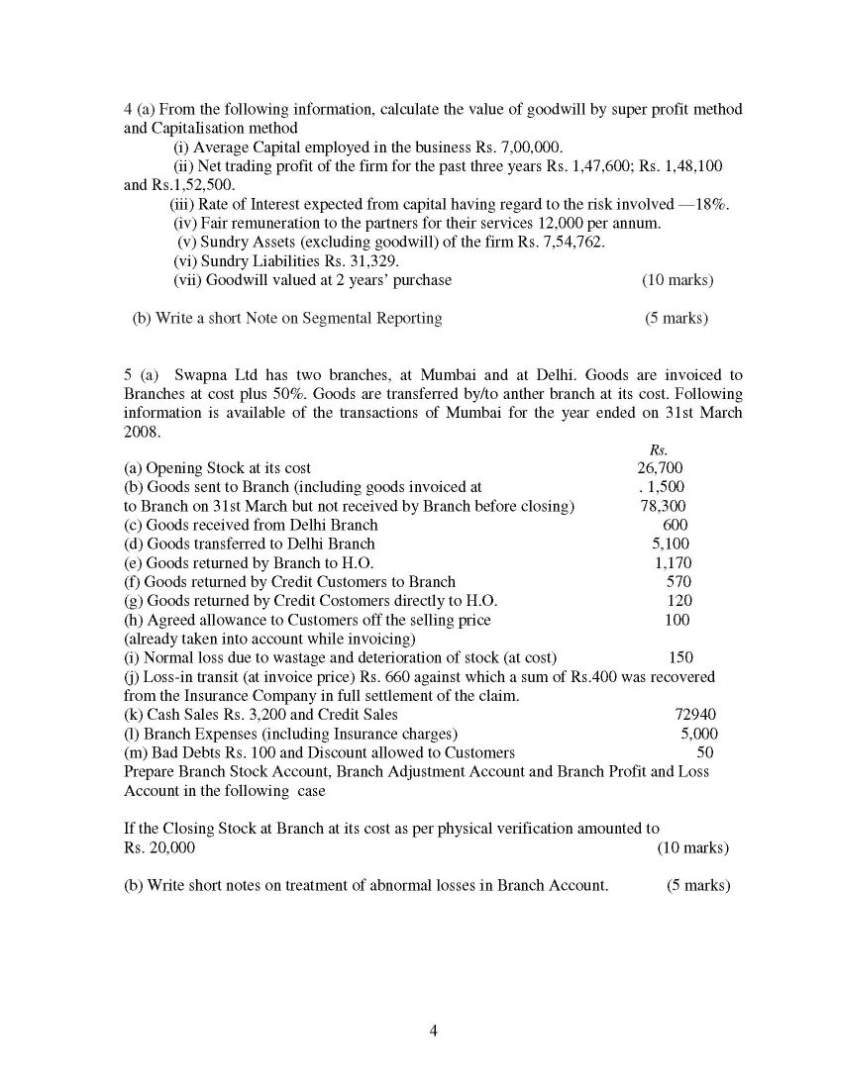

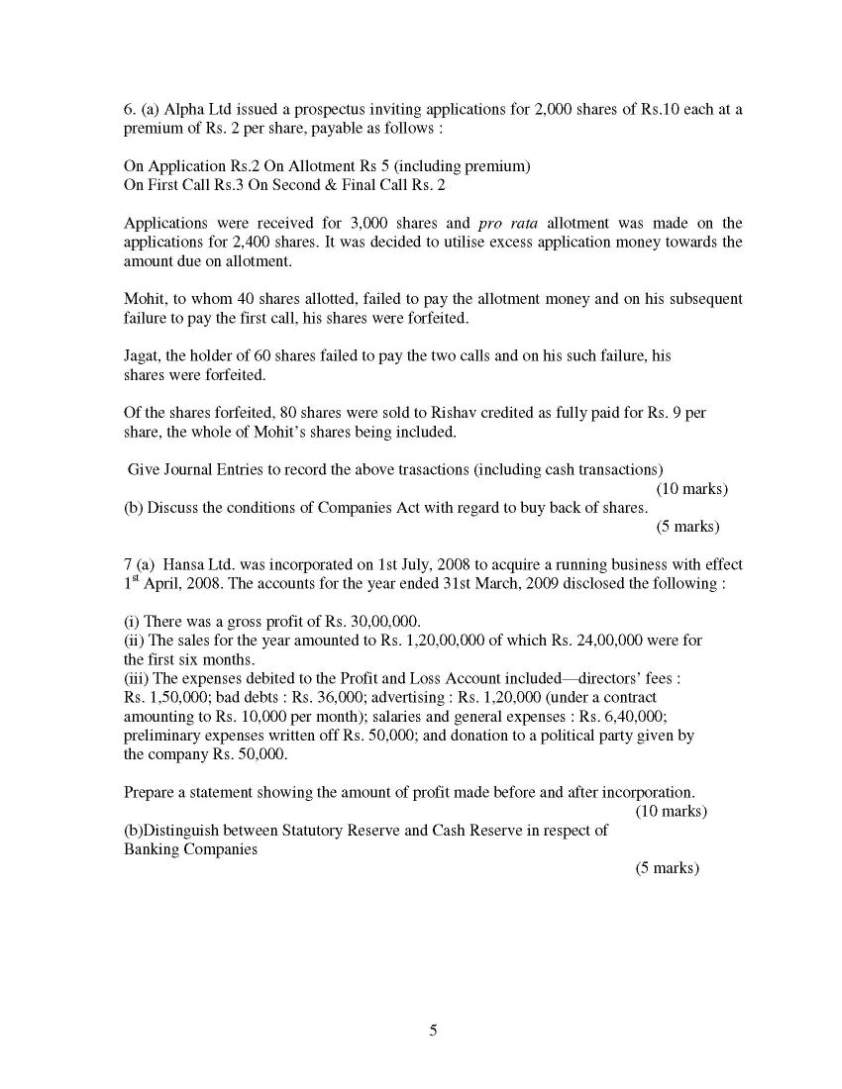

| Kiran Chandar | Re: ICWAI Inter solved question papers June? As you want to get the ICWAI Inter solved question papers of financial accounting of June so, here I am providing you the same. Here is an attachment for the solved question papers of the ICWAI Inter of financial accounting of June you can download that and some of the questions are given below. 1(a). Distinguish Between Liability and Provision. (3 marks) (b).A & B are two partners of a firm sharing the profits & losses in the ratio of 7/12 and 5/12 respectively. On Ist April 2009,they take C as a partner giving him 1/6 share. A & B agreed further to share the C future profits in the ratio of 13/12 & 7/24 resp.C,in addition to his capital, brings in Rs96000 as his goodwill for 1/6 share. The goodwill is amount to be shred between A & B. The share of goodwill amount of A & B respectively will be A: Rs24000 & Rs72000 B: Rs72000 & Rs24000 C: Rs56000 & Rs40000 D: Rs52000 & Rs44000 Choose the correct answer. (3 marks) ©Match the following (i) AS-4 (1) Disclosure of Accounting Policies (ii) AS-10 (2) Contingencies & Events occurring after the Balance Sheet Date (iii)As-26 (3) Accounting for Fixed Assets (iv)AS-1 (4) Intangible Assets (4 marks) (d) Match the following (i) Cash Reserve (1)Electricity Supply Co (ii)Clear Profit (2) Construction Co (iii)Escalation Clause (3)Banking Co (3 marks) (e) Can a company change the method of providing Depreciation? (3 marks) (f)State whether each of the following statement is true or false (i) Dividend can be declared out of revaluation of fixed assets (ii) Calls in arrears is shown in the B/S under the heading current assets (4 marks) 3 (g)Mention the funds out of which a company can purchase its own share? (3 marks) (h) Choose the correct answer Under the Hire Purchase System the last installment paid comprises (i) Cash Price only (ii) Interest only (iii) Cash Price and Interest (2 marks) 2. (a) M/s Rama and Rina commenced business on 1st January 2005, when they purchased plant and equipment for Rs. 7,00,000. They adopted a policy of (i) charging depreciation at 15% p.a. on diminishing balance method and (ii) charging full year’s depreciation on additions. Over the years, their purchases of plant have been : Date Amount August 1, 2006 1,50,000 September 30, 2009 2,00,000 On January 1,2009 it was decided to change the method and rate of depreciation to 10% p.a. on straight line method with retrospective effect from January 1, 2005, the adjustment being made in the accounts for the year ending 31st December, 2009.Kolkata the difference in depreciation to be adjusted in the Plant and Equipment Account on January 1, 2009 and show the ledger account for the year 2009. (10 marks) (b) Classify the following items as capital or revenue expenditure: (i) An extension of railway tracks in the factory area; (ii) Wages paid to machine operators; (iii) Installation costs of new production machine; (iv) Materials for extensions to foremen’s offices in the factory; (v) Rent paid for the factory. (5 marks) 3.(a) The Bihar Coal Co. Ltd. holds a lease of coal mines for a period of twelve years, commencing from 1st April 2002. According to the lease, the company is to pay Rs 7.50 as royalty per ton with a minimum rent of Rs 150,000 per year. Short workings can, however, be recovered out of the royalty in excess of the minimum rent of the next two years only. For the year of a strike the minimum rent is to be reduced to 60%. The output in tons for the 6 years ending 31st March,2008 is as under: 2002-03 : 10,000; 2003-04 : 12,000; 2004- 05:25,000; 2005-06: 20,000; 2006-07: 50,000; and 2007-08:15,000 (strike). Write up the necessary Ledger Accounts in the books of Bihar Coal Co. Ltd. (10 marks) (b) Distinguish between Hire Purchase System and Instalment System. (5 marks) 4 4 (a) From the following information, calculate the value of goodwill by super profit method and CapitaIisation method (i) Average Capital employed in the business Rs. 7,00,000. (ii) Net trading profit of the firm for the past three years Rs. 1,47,600; Rs. 1,48,100 and Rs.1,52,500. (iii) Rate of Interest expected from capital having regard to the risk involved —18%. (iv) Fair remuneration to the partners for their services 12,000 per annum. (v) Sundry Assets (excluding goodwill) of the firm Rs. 7,54,762. (vi) Sundry Liabilities Rs. 31,329. (vii) Goodwill valued at 2 years’ purchase (10 marks) (b) Write a short Note on Segmental Reporting (5 marks) 5 (a) Swapna Ltd has two branches, at Mumbai and at Delhi. Goods are invoiced to Branches at cost plus 50%. Goods are transferred by/to anther branch at its cost. Following information is available of the transactions of Mumbai for the year ended on 31st March 2008. Rs. (a) Opening Stock at its cost 26,700 (b) Goods sent to Branch (including goods invoiced at . 1,500 to Branch on 31st March but not received by Branch before closing) 78,300 (c) Goods received from Delhi Branch 600 (d) Goods transferred to Delhi Branch 5,100 (e) Goods returned by Branch to H.O. 1,170 (f) Goods returned by Credit Customers to Branch 570 (g) Goods returned by Credit Costomers directly to H.O. 120 (h) Agreed allowance to Customers off the selling price 100 (already taken into account while invoicing) (i) Normal loss due to wastage and deterioration of stock (at cost) 150 (j) Loss-in transit (at invoice price) Rs. 660 against which a sum of Rs.400 was recovered from the Insurance Company in full settlement of the claim. (k) Cash Sales Rs. 3,200 and Credit Sales 72940 (l) Branch Expenses (including Insurance charges) 5,000 (m) Bad Debts Rs. 100 and Discount allowed to Customers 50 Prepare Branch Stock Account, Branch Adjustment Account and Branch Profit and Loss Account in the following case If the Closing Stock at Branch at its cost as per physical verification amounted to Rs. 20,000 (10 marks) (b) Write short notes on treatment of abnormal losses in Branch Account. (5 marks)      For more questions here is an attachment you can download that. |

| 13th November 2014 12:24 PM | |

| Unregistered | ICWAI Inter solved question papers June? Will you please provide me the ICWAI Inter solved question papers of financial accounting of June? |