|

#2

5th November 2015, 09:48 AM

| |||

| |||

| Re: MBA ICFAI Papers

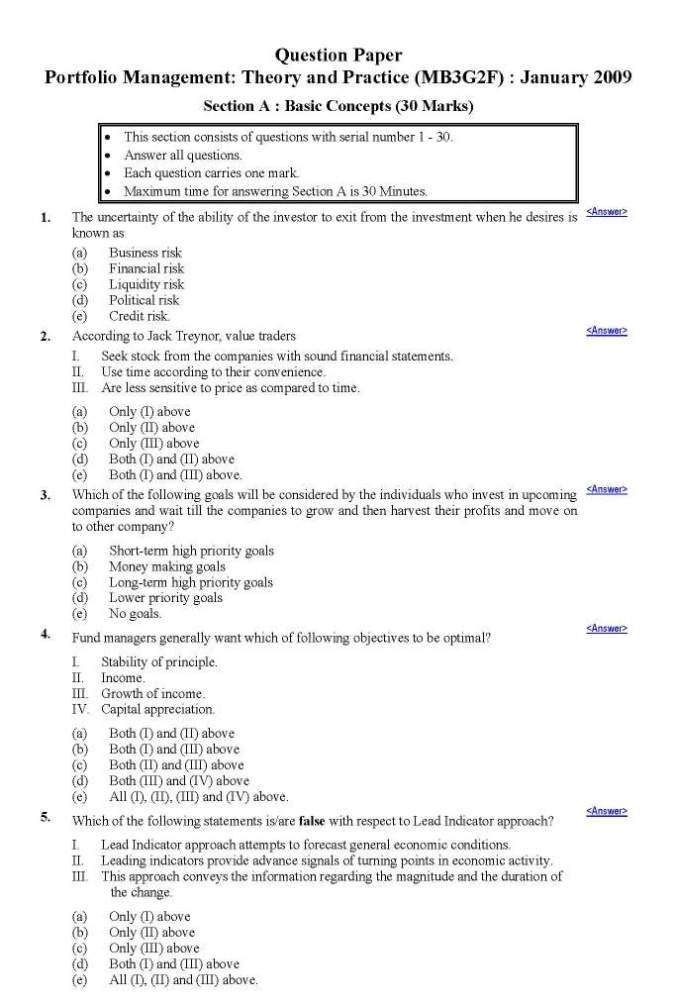

As per your demand I will help you here to get the exam paper of MBA program offer by the ICFAI University so that you can clear the exam easily and score well. Here is the exam paper of ICFAI University 1. The uncertainty of the ability of the investor to exit from the investment when he desires is known as (a) Business risk (b) Financial risk (c) Liquidity risk (d) Political risk (e) Credit risk. <Answer> 2. According to Jack Treynor, value traders I. Seek stock from the companies with sound financial statements. II. Use time according to their convenience. III. Are less sensitive to price as compared to time. (a) Only (I) above (b) Only (II) above (c) Only (III) above (d) Both (I) and (II) above (e) Both (I) and (III) above. <Answer> 3. Which of the following goals will be considered by the individuals who invest in upcoming companies and wait till the companies to grow and then harvest their profits and move on to other company? (a) Short-term high priority goals (b) Money making goals (c) Long-term high priority goals (d) Lower priority goals (e) No goals. <Answer> 4. Fund managers generally want which of following objectives to be optimal? I. Stability of principle. II. Income. III. Growth of income. IV. Capital appreciation. (a) Both (I) and (II) above (b) Both (I) and (III) above (c) Both (II) and (III) above (d) Both (III) and (IV) above (e) All (I), (II), (III) and (IV) above. <Answer> 5. Which of the following statements is/are false with respect to Lead Indicator approach? I. Lead Indicator approach attempts to forecast general economic conditions. II. Leading indicators provide advance signals of turning points in economic activity. III. This approach conveys the information regarding the magnitude and the duration of the change. (a) Only (I) above (b) Only (II) above (c) Only (III) above (d) Both (I) and (III) above (e) All (I), (II) and (III) above. 6. Which of the following approaches/methods ignores the financials and focuses on the psychology of individual? (a) 100 minus your age method (b) Risk tolerance method (c) 100 common stocks for long run (d) Cash flow needs method (e) Financial objective method. <Answer> 7. Which of the following statements is/are true with respect Capital Market Line (CML)? I. It is the line passing from risk-free rate through market portfolio. II. The slope of CML is called market price of risk. III. CML fails to express equilibrium pricing relationship between expected return and standard deviation for all efficient portfolios lying along the line. (a) Only (I) above (b) Only (II) above (c) Only (III) above (d) Both (I) and (II) above (e) Both (I) and (III) above. <Answer> 8. Which of the statements is/are false regarding Arbitrage Pricing Theory (APT)? I. APT assumes that return on any asset can be expressed as a linear function of a set of market factors or indexes. II. The arbitrage price line indicates relation between unsystematic risk and the expected return of an asset. III. While deriving the APT model, APT assumes that the error term can be reduced to zero through appropriate diversification. (a) Only (I) above (b) Only (II) above (c) Only (III) above (d) Both (I) and (II) above (e) Both (I) and (III) above. <Answer> 9. Which of the following statements is/are true with respect to the fair value of an index futures contract, if all the other things remain constant? I. An increase in the risk free rate increases the fair value of the futures contract. II. A decrease in the risk free rate increases the fair value of the futures contract. III. A reduction in the dividend yield reduces the fair value of futures contract. (a) Only (I) above (b) Only (II) above (c) Only (III) above (d) Both (I) and (III) above (e) Both (II) and (III) above. <Answer> 10. If the risk free rate of return (Rf) is 7%, expected return on the market [E(Rm)] is 15%, and the return on stock X is 16%, the beta for the stock X using CAPM is (a) 0.85 (b) 1.00 (c) 1.14 (d) 1.26 (e) 1.33. ICFAI University MBA paper      |