|

#2

15th January 2018, 11:30 AM

| |||

| |||

| Re: KYC Document IDBI Bank

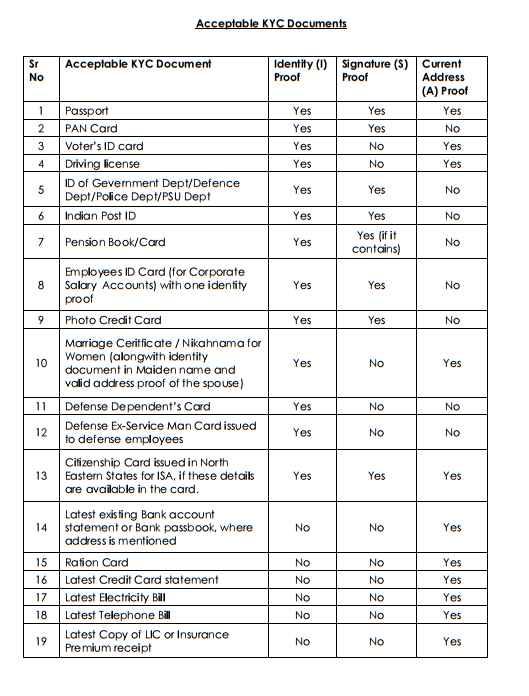

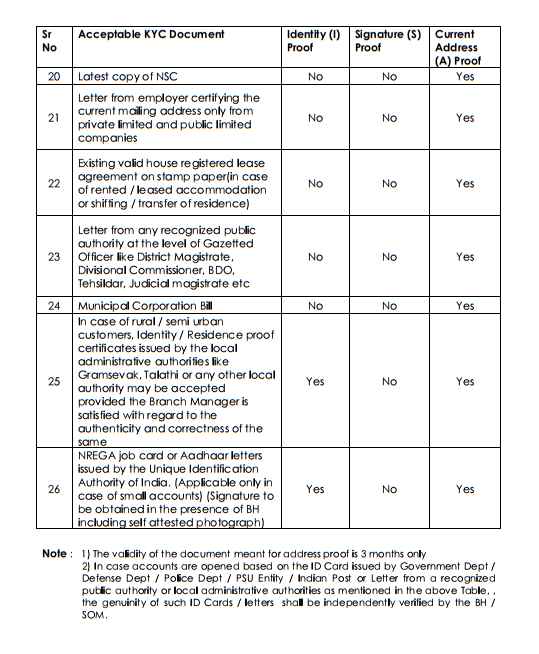

In terms of provisions of Prevention of Money Laundering Act, 2002(PMLA) and Reserve Bank of India (RBI) guidelines, IDBI bank had sent personal letters to those customers who need updation of KYC details, requesting to submit the updated KYC details along with required documents. Know Your Customer KYC Documents Passport PAN card Driving License (laminated/non laminated) Election ID / Voters ID card Employee ID card (only for corporate Salary account) with one more valid identity proof ID Card of Government Dept/Defence dept/Police Dept/PSU entity/ Indian Post Photo ID debit/credit card Letter from a recognized public authority at the level of a Gazetted Officer like District Magistrate, Divisional Commissioner, BDO, Tehsildar, Judicial Magistrate etc. Pension Book/Card Marriage Certificate / Nikahnama for Women (along with identity document of Maiden name and valid address proof of the spouse) Defence Dependents Card Defence Ex-Service Man Card issued to defence employees Citizenship Card issued in North Eastern States for ISA. Employers letter certifying current mailing address only from private limited and public limited companies. Latest electricity or telephone bill (landline/postpaid mobile) Latest copy of Life Insurance policy or premium receipt Latest house lease agreement duly stamped and registered Bank account /credit card statement or passbook (first page) Municipal Corporation Bill Ration Card In case of rural / semi urban customers, Identity / Residence proof certificates issued by the local administrative authorities like Gramsevak, Talathi or any other local authority may be accepted provided the Branch Manager is satisfied with regard to the authenticity and correctness of the same. NREGA job card (Applicable only in case of small accounts) (Signature to be obtained in the presence of BH including self attested photograph) Aadhaar letters issued by the Unique Identification Authority of India.   Contact- Registered Office: IDBI Bank Ltd. IDBI Tower, WTC Complex, Cuffe Parade, Colaba, Mumbai 400005. Customers can contact our 24 X 7 Phone Banking numbers from any Landline / Mobile number, our Toll free numbers are as follows: 1800-200-1947 1800-22-1070 |