|

#2

30th December 2016, 11:48 AM

| |||

| |||

| Re: IRDA Mutual Funds

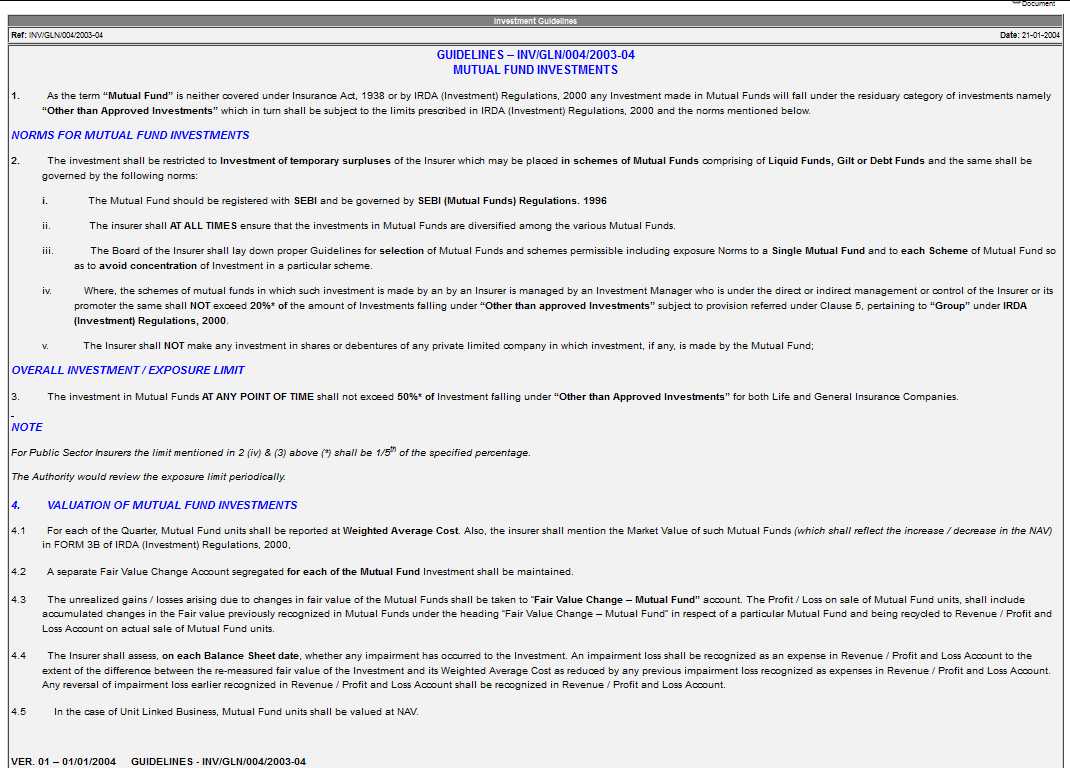

The Guidelines for Mutual Fund Investments as directed by Insurance Regulatory and Development Authority of India (IRDAI) are as follows: The investment shall be restricted to Investment of temporary surpluses of the Insurer which is placed in schemes of Mutual Funds comprising of Liquid Funds, Gilt or Debt Funds and the same shall be governed by the following norms: i. The Mutual Fund should be registered with SEBI and be governed by SEBI (Mutual Funds) Regulations. 1996 ii. The insurer shall at all times ensure that the investments in Mutual Funds are expanding among the various Mutual Funds. iii. The Board of the Insurer shall lay down proper Guidelines for selection of Mutual Funds and schemes permissible including exposure Norms to a Single Mutual Fund and to each Scheme of Mutual Fund so as to avoid concentration of Investment in a particular scheme. iv. Where, the schemes of mutual funds in which such investment is made by an Insurer is managed by an Investment Manager who is under the direct or indirect management or control of the Insurer or its promoter the same shall not exceed 20% of the amount of Investments falling under “Other than approved Investments” subject to provision referred under Clause 5, pertaining to “Group” under IRDA (Investment) Regulations, 2000. v. The Insurer shall not make any investment in shares or debentures of any private limited company in which investment, if any, is made by the Mutual Fund; IRDA Mutual Funds Investments Guidelines  |