|

#2

28th November 2016, 04:05 PM

| |||

| |||

| Re: IRDA Data On Claim Settlement

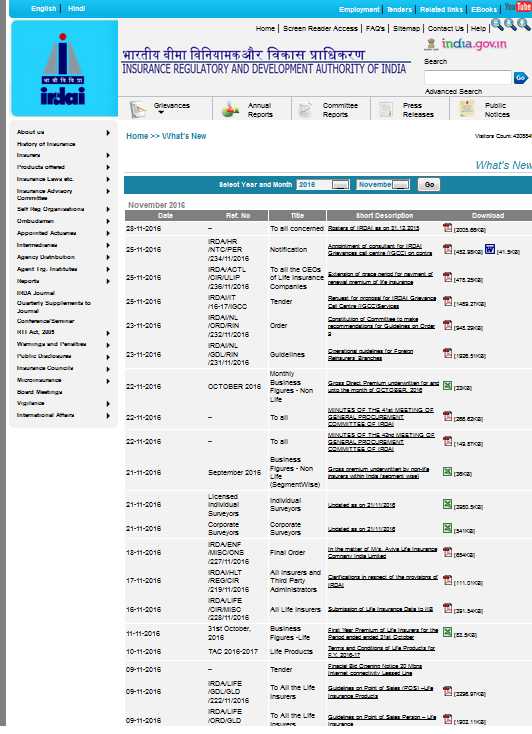

The IRDA Claim Settlement Ratio is provides detail before making the decision. At this point, IRDA must spite of the fact that overall CSR is NOT the best way to decide on your term insurance plan. Claim Settlement Ratio = Total Claims Approved (paid to nominees) divided by Total Claims Received by the Company. The Claim Settlement Ratio is the total number of death claims approved by an insurance company, divided by the total no. of death claims received by the insurance company. For example: If an insurance company received 1000 death claims between Apr 1, 2014 and Mar 31, 2015, out of which it Paid 973 claims to the nominees of those dead, Rejected 16 claims, and Is yet to take a decision on the remaining (1000-973-16=) 11 claims, Then The claim settlement ratio (or claims acceptance ratio or claims ratio) of the insurance company = 973/1000 = 97.3% The claim repudiation ratio (or claims rejection ratio) of the company = 16/1000 = 1.6% The claim pending ratio of the company = 11/1000 = 1.1% Statistics of IRDA data on claim settlement:  Get more other settlement of IRDA data:  Contact to: Insurance Regulatory and Development Authority of India 3rd Floor, Parisrama Bhavan, Basheer Bagh Hyderabad 500 004 Telangana State (India ) Ph: (040) 23381100 Fax: (040) 6682 3334 |