|

#2

20th August 2014, 02:54 PM

| |||

| |||

| Re: IPCC admission dates

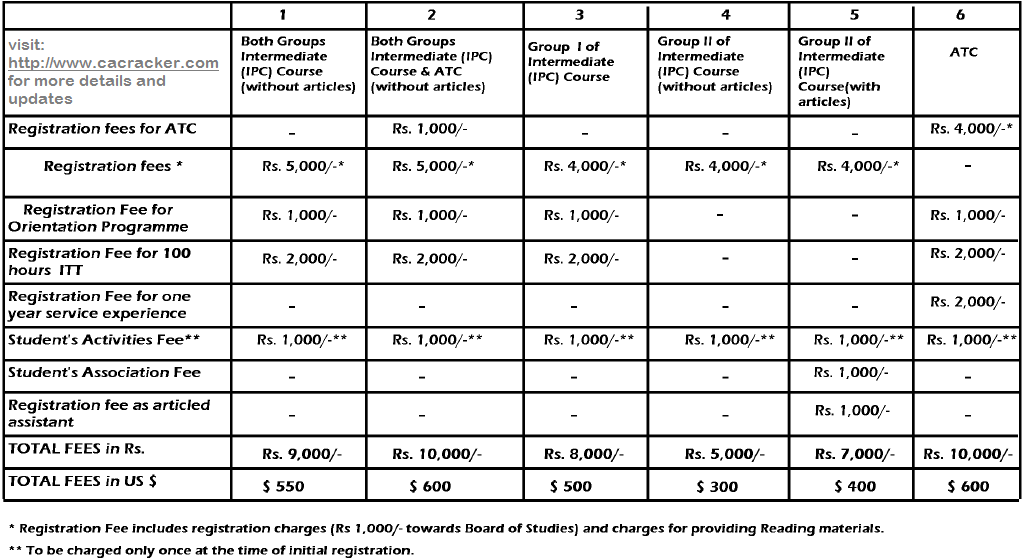

Intermediate (Integrated Professional Competence) Course is the next level after having cleared the CPT Exams of ICAI CA course. Here are the details of it: Important dates: Attempt Due Last Date for IPCC Registration May Attempt 1st September of the previous year November Attempt 1st March of the same year Eligibility: The applicants should have more than 55% marks in graduation; they have been exempted from appearing for CPT and can directly appear for Intermediate Exams by registering for the same. Admission fees:  Required documents at the time of admissions: Demand Draft/Pay Order towards IPCC Registration Fees Attested Copies of 12th Class Pass Certificate Graduation/Post Graduation marks statement for Direct Entry to Intermediate (IPC) Course Attested Copy of CPT Pass Marks Statement Subjects in IPCC Group I: IPCC syllabus Subjects to study in CA IPCC In CA IPCC you will have to study 7 subjects in total parted in 2 groups which are given in the table below. Click on the IPCC subject’s link to jump directly to the subject of your choice. Subjects in IPCC Group I: Paper – 1 : Accounting (100 marks) Paper – 2 : Business Laws, Ethics and Communication (100 marks) Business Law (30 marks) Company Law (30 marks) Ethics (20 marks) Communication (20 marks) Paper – 3 : Cost Accounting and Financial Management (100 marks) Costing (50 marks) Financial Management (50 marks) Paper – 4 : Taxation Income Tax (50 marks) Service Tax (25 marks) Vat (25 marks) Subjects in IPCC Group II: Paper – 6 : Auditing and Assurance (100 marks) Paper – 7 : Information Technology and Strategic Management (IT & SM) Section A: Information Technology (50 marks) Section B: Strategic Management (50 marks) Below I have given subject wise IPCC syllabus for IPCC May 2014 exams and for Nov 2014 too. Changes in IPCC syllabus for May 2014 & Nov 2014 are also given below for the subjects of IT and Tax (Service tax & VAT.) Paper 1: Accounting 1 IPCC Syllabus 1. A General Knowledge of the framing of the accounting standards, national and international accounting authorities, adoption of international financial reporting standards 2. Accounting Standards AS 1 : Disclosure of Accounting Policies AS 2: Valuation of Inventories AS 3: Cash Flow Statements AS 6: Depreciation Accounting AS 7: Construction Contracts (Revised 2002) AS 9: Revenue Recognition AS 10: Accounting for Fixed Assets AS 13: Accounting for Investments AS 14: Accounting for Amalgamations 3. Company Accounts (a) Preparation of financial statements – Profit and Loss Account, Balance Sheet and Cash Flow Statement (b) Profit (Loss) prior to incorporation (c) Alteration of share capital, Conversion of fully paid shares into stock and stock into shares, Accounting for bonus issue (d) Simple problems on Accounting for business acquisition, Amalgamation and reconstruction (excluding problems of amalgamation on inter-company holding) 4. Average Due Date, Account Current, Self-Balancing Ledgers 5. Financial Statements of Not-for-Profit Organisations 6. Accounts from Incomplete Records 7. Accounting for Special Transactions (a) Hire purchase and installment sale transactions (b) Investment accounts (c) Insurance claims for loss of stock and loss of profit. 8. … [missing in ICAI IPCC syllabus.. lol] 9. Issues in Partnership Accounts Final accounts of partnership firms – Admission, retirement and death of a partner including treatment of goodwill; 10. Accounting in Computerised Environment An overview of computerized accounting system – Salient features and significance, Concept of grouping of accounts, Codification of accounts, Maintaining the hierarchy of ledger, Accounting packages and consideration for their selection, Generating Accounting Reports. Note : If either old Accounting Standards (ASs), Announcements and Limited Revisions to ASs are withdrawn or new ASs, Announcements and Limited Revisions to ASs are issued by the Institute of Chartered Accountants of India in place of existing ASs, Announcements and Limited Revisions to ASs, the syllabus will accordingly include/exclude such new developments in place of the existing ones with effect from the date to be notified by the Institute. Paper 2: IPCC Law Syllaubs Below I have given IPCC syllabus for Law, Ethics & Communication subject which is paper 2 for IPCC exams for May-Nov 2014. Company law is going to change in upcoming attempts for IPCC syllabus as new company’s bill has been passed already. Business Laws (30 marks) Acts to study in Business laws for CA IPCC are given below. 1. The Indian Contract Act, 1872 2. The Negotiable Instruments Act, 1881 3. The Payment of Bonus Act, 1965 4. The Employees’ Provident Fund and Miscellaneous Provisions Act, 1952 5. The Payment of Gratuity Act, 1972. Company Law (30 marks) The Companies Act, 1956 – Sections 1 to 197 (a) Preliminary (b) Board of Company Law Administration – National Company Law Tribunal; Appellate Tribunal (c) Incorporation of company and matters incidental thereto (d) Prospectus and allotment, and other matters relating to use of shares or debentures (e) Share capital and debentures (f) Registration of charges (g) Management and administration – general provisions – registered office and name, restrictions on commencement of business, registers of members and debentures holders, foreign registers of members or debenture holders, annual returns, general provisions regarding registers and returns, meetings and proceedings. (h) Company Law in a computerized environment – e-filing. Note: If new legislations are enacted in place of the existing legislations, the syllabus would include the corresponding provisions of such new legislations with effect from a date notified by the Institute. Part II: Ethics (20 marks) Chapter to study in IPCC Ethics are mentioned below. 1. Introduction to Business Ethics 2. Environment Issues 3. Ethics in Workplace 4. Ethics in Marketing and Consumer Protection 5. Ethics in Accounting and Finance Part III: Communication (20 marks) Chapters to study in IPCC communication subjects are mentioned below. 1. Elements of Communication 2. Communication in Business Environment 3. Basic Understanding of Legal Deeds and Documents Paper 3: Costing & FM IPCC Syllabus Chapters to study in IPCC Costing & FM subject in IPCC Syllabus are mentioned in below . This subject is always tricky looking to most of the students. But as a part of IPCC syllabus, you must take it seriously. Part I: Cost Accounting (50 marks) Chapters for Cost Accounting for IPCC syllabus includes following chapters. 1. Introduction to Cost Accounting 2. Cost Ascertainment (a) Material Cost (b) Employee Cost (c) Direct Expenses (d) Overheads 3. Cost Book-keeping 4. Costing Systems (a) Job Costing (b) Batch Costing (c) Contract Costing (d) Process Costing (e) Operating Costing System 5. Marginal Costing 6. Standard Costing 7. Budgets and Budgetary Control Part II: Financial Management (50 marks) Financial management part has following chapters as a imp part of IPCC syllabus. Generally this section of IPCC syllabus will require much, more concentration and practice to get confidence and attempt all the questions in paper. 1. Scope and Objectives of Financial Management 2. Time Value of Money 3. Financial Analysis and Planning (a) Ratio analysis for performance evaluation and financial health (b) Application of ratio analysis in decision making (c) Analysis of cash flow statement. 4. Financing Decisions (a) Cost of Capital – weighted average cost of capital and marginal cost of capital (b) Capital Structure decisions - capital structure patterns, designing optimum (c) Business risk and financial risk - operating and financial leverage, trading on equity. 5. Types of Financing 6. Investment Decisions 7. Management of working capital (a) Working capital policies (b) Funds flow analysis (c) Inventory management (d) Receivables management (e) Payables management (f) Management of cash and marketable securities (g) Financing of working capital. Paper 4: IPCC Taxation Syllabus Chapters to study in IPCC Taxation subjects in IPCC Syllabus are as mentioned below. Part I: Income-tax (50 marks) 1. Important definitions in the Income-tax Act, 1961 2. Basis of charge; rates of taxes applicable for different types of assessees 3. Concepts of previous year and assessment year 4. Residential status and scope of total income; Income deemed to be received / deemed to accrue or arise in India 5. Incomes which do not form part of total income 6. Heads of income and the provisions governing computation of income under different heads 7. Income of other persons included in assessee’s total income 8. Aggregation of income; set-off or carry forward and set-off of losses 9. Deductions from gross total income 10. Computation of total income and tax payable; rebates and reliefs 11. Provisions concerning advance tax and tax deducted at source 12. Provisions for filing of return of income. Part II: Service tax (25 marks) and VAT (25 marks) [Applicable up to May, 2014 Examination] Service tax (25 marks) 1. Service tax – concepts and general principles 2. Charge of service tax and taxable services 3. Valuation of taxable services 4. Payment of service tax and filing of returns VAT (25 marks) 5. VAT – concepts and general principles 6. Calculation of VAT Liability including input Tax Credits 7. Small Dealers and Composition Scheme 8. VAT Procedures. Note: If new legislations are enacted in place of the existing legislations the syllabus will accordingly include the corresponding provisions of such new legislations in the place of the existing legislations with effect from the date to be notified by the Institute. Students shall not be examined with reference to any particular State VAT Law. Revised Part II: Indirect Taxes (50 marks) Syllabus – Applicable from November 2014 Examination onwards 1. Introduction to excise duty, customs duty, central sales tax and VAT – Constitutional aspects, Basic concepts relating to levy, taxable event and related provisions 2. Significant provisions of service tax (i) Constitutional Aspects (ii) Basic Concepts and General Principles (iii) Charge of service tax including negative list of services (iv) Point of taxation of services (v) Exemptions and Abatements (vi) Valuation of taxable services (vii) Invoicing for taxable services (viii) Payment of service tax (ix) Registration (x) Furnishing of returns (xi) CENVAT Credit [Rule 1 -9 of CENVAT Credit Rules, 2004] Note: If new legislations are enacted in place of the existing legislations the syllabus will accordingly include the corresponding provisions of such new legislations in place of the existing legislations with effect from the date to be notified by the Institute. Students shall not be examined with reference to any particular State VAT Law. Paper 5: IPCC Syllabus for Advanced Accounting IPCC accounts syllabus for paper 5 includes following chapters. IPCC syllabus for advanced accounting (paper 5) is much advance than that of IPCC syllabus for accounting (paper 1). 1. Conceptual Framework for Preparation and Presentation of Financial Statements 2. Accounting Standards: AS 4 : Contingencies and Events occurring after the Balance Sheet Date AS 5 : Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies AS 11: The Effects of Changes in Foreign Exchange Rates (Revised 2003) AS 12: Accounting for Government Grants AS 16: Borrowing Costs AS 19: Leases AS 20: Earnings Per Share AS 26: Intangible Assets AS 29: Provisions, Contingent Liabilities and Contingent Assets. 3. Advanced Issues in Partnership Accounts 4. Company Accounts (a) Accounting for employee stock option plan, Buy back of securities, Equity shares with differential rights, Underwriting of shares and debentures, Redemption of debentures (b) Advanced problems for business acquisition, Amalgamation and reconstruction (excluding problems of amalgamation of inter-company holding) (c) Accounting involved in liquidation of companies, Statement of Affairs (including deficiency/surplus accounts) and Iiquidator’s statement of account of the winding up. (d) Financial Statements of Banking, Insurance and Electricity Companies 5. Accounting for Special Transactions Departmental and branch accounts including foreign branches Note : Note: If either old Accounting Standards (ASs), Announcements and Limited Revisions to ASs are withdrawn or new ASs, Announcements and Limited Revisions to ASs are issued by the Institute of Chartered Accountants of India in place of existing ASs, Announcements and Limited Revisions to ASs, the syllabus will accordingly include/exclude such new developments in place of the existing ones with effect from the date to be notified by the Institute. Paper 6: IPCC Audit Syllabus Following numbered chapters are in the syllabus of IPCC Auditing subject. 1. Auditing Concepts - 2. Auditing and Assurance Standards – Overview, Standard-setting process, Role of International Auditing and Assurance Standards Board and Auditing and Assurance Standards Board in India. 3. Auditing engagement - Audit planning, Audit programme, Control of quality of audit work- Delegation and supervision of audit work. 4. Documentation - Audit working papers, Audit files: Permanent and current audit files, Ownership and custody of working papers. 5. Audit evidence – Audit procedures for obtaining evidence, Sources of evidence, Reliability of audit evidence, Methods of obtaining audit evidence, Physical verification, Documentation, Direct confirmation, Re-computation, Analytical review techniques, Representation by management. 6. Internal Control - Elements of internal control, Review and documentation, Evaluation of internal control system, Internal control questionnaire, Internal control check list, Tests of control, Application of concept of materiality and audit risk, Concept of internal audit. 7. Internal Control and Computerized Environment, Approaches to Auditing in Computerised Environment. 8. Audit Sampling – Types of sampling, Test checking, Techniques of test checks. 9. Analytical review procedures. 10. Audit of payments - General considerations, Wages, Capital expenditure, Other payments and expenses, Petty cash payments, Bank payments, Bank reconciliation. 11. Audit of receipts – General considerations, Cash sales, Receipts from debtors, Other Receipts. 12. Audit of Purchases – Vouching cash and credit purchases, Forward purchases, Purchase returns, Allowance received from suppliers. 13. Audit of Sales - Vouching of cash and credit sales, Goods on consignment, Sale on approval basis, Sale under hire-purchase agreement, Returnable containers, Various types of allowances given to customers, Sale returns. 14. Audit of suppliers’ ledger and the debtors’ ledger – Self-balancing and the sectional balancing system, Total or control accounts, Confirmatory statements from credit customers and suppliers, Provision for bad and doubtful debts, Writing off of bad debts. 15. Audit of impersonal ledger – Capital expenditure, deferred revenue expenditure and revenue expenditure, Outstanding expenses and income, Repairs and renewals, Distinction between reserves and provisions, Implications of change in the basis of accounting. 16. Audit of assets and liabilities. 17. Company Audit – Audit of Shares, Qualifications and Disqualifications of Auditors, Appointment of auditors, Removal of auditors, Powers and duties of auditors, Branch audit, Joint audit, Special audit, Reporting requirements under the Companies Act, 1956. 18. Audit Report - Qualifications, Disclaimers, Adverse opinion, Disclosures, Reports and certificates. 19. Special points in audit of different types of undertakings, i.e., Educational institutions, Hotels, Clubs, Hospitals, Hire-purchase and leasing companies (excluding banks, electricity companies, cooperative societies, and insurance companies). 20. Features and basic principles of government audit, Local bodies and not-for-profit organizations, Comptroller and Auditor General and its constitutional role. Note: Candidates are expected to have working knowledge of relevant Auditing and Assurance Standards issued by the ICAI with reference to above-mentioned topics. Paper 7: IT & SM Syllabus for IPCC Chapter in IT & SM subjects for IPCC syllabus are displayed below. IPCC syllabus for May 2014 inclusions are also given below. IPCC syllabus changes for IT from IPCC Nov 2014 exam which is also given below Section A: Information Technology (50 Marks) [Applicable up to May, 2014 Examination] 1. Introduction to Computers (a) (Computer hardware: Classification of computers - personal computer, workstation, servers and super computers, Computer components – CPU, input output devices, storage devices) * (b) (BUS, I/O CO processors, ports (serial, parallel, USB ports), expansion slots, add on cards, on board chips, LAN cards, multimedia cards, cache memory, buffers, controllers and drivers) * * The Council has decided to exclude these topics effective from November, 2012 examination onwards. (c) Computer software Systems software - operating system, translators (compilers, interpreters and assemblers), system utilities General purpose software/ utilities - word processor, spread sheet, DBMS, scheduler / planner, internet browser and e-mail clients Application software – financial accounting, payroll, inventory. Specialised systems – Enterprise Resource Planning (ERP), artificial intelligence, expert systems, decision support systems – an overview 2. Data Storage, Retrievals and Data Base Management Systems (a) Data and information concepts: bits, bytes, KB, MB, GB, TB (b) Data organization and access (c) DBMS models and classification: (d) Backup and recovery - backup policy, backup schedules, offsite backups, recycling of backups, frequent checking of recovery of backup (e) Usage of system software like program library management systems and tape and disk management systems – features, functionalities, advantages (f) Data mining and data warehousing – an overview 3. Computer Networks & Network Security (a) Networking concepts – need and scope, benefits (b) Local Area Networks – components of a LAN, advantages of LAN (c) Client server technology (d) Data centres: features and functions, primary delivery centre and disaster recovery site (e) Network security need; threats and vulnerabilities; security levels; techniques 4. Internet and other technologies (a) Internet and world-wide web, intranets, extranets, applications of internet, internet protocols (b) E-commerce – nature, types (B2B, B2C, C2C), supply chain management, CRM, Electronic (Data Interchange (EDI))*, Electronic Fund Transfers (EFT), payment portal, e- commerce security; (c) Mobile commerce, bluetooth and Wi-Fi 5. Flowcharts, Decision Tables. 1. Business Process Management & IT Introduction to various Business processes – Accounting, Finances, Sale, Purchase etc., Business Process Automation – Benefits & Risks, Approach to mapping systems : Entity Diagrams, Data Flow Diagrams, Systems Flow diagrams, Decision trees/tables, Accounting systems vs. Value chain automation, Information as a business asset, Impact of IT on business processes, Business Risks of failure of IT, Business Process Re-engineering 2. Information Systems and IT Fundamentals Understand importance of IT in business and relevance to Audit with case studies, Understand working of computers and networks in business process automation from business information perspective, Concepts of Computing (Definition provided by ACM/IEEE and overview of related terminologies), Overview of IS Layers – Applications, DBMS, systems software, hardware, networks & links and people, Overview of Information Systems life cycle and key phases, Computing Technologies & Hardware – Servers, end points, popular computing architectures, emerging computing architectures & delivery models – example: SaaS, Cloud Computing, Mobile computing, etc., Example: Overview of latest devices/technologies – i5, Bluetooth, Tablet, Wi-Fi, Android, Touchpad, iPad, iPod, Laptop, Notebook, Smartphone, Ultra- Mobile PC etc.) 3. Telecommunication and Networks >Fundamentals of telecommunication, Components and functions of Telecommunication >Systems, Data networks – types of architecture, LAN, WAN, Wireless, private and public networks etc., Overview of computing architectures – centralised, de-centralised, mainframe, client-server, thin-thick client etc., Network Fundamentals – Components, Standards and protocols, Network risks & controls – VPN, Encryption, Secure protocols, >Network administration and management – concepts and issues, How information systems are facilitated through telecommunications, How Internet works, Internet architecture, key concepts, risks and controls, e-Commerce and M-commerce technologies 4. Business Information Systems Information Systems and their role in businesses, IT as a business enabler & driver – ERP, Core Banking System, CRM, SCM, HRMS, Payment Mechanisms, The relationship between organisations, information systems and business processes, Accounting Information Systems and linkages to Operational systems, Business Reporting, MIS & IT, Organisation Roles & responsibilities and table or authorities, importance of access controls, privilege controls, Specialised systems – MIS, DSS, Business Intelligence, Expert Systems, Artificial Intelligence, Knowledge Management systems etc. 5. Business process automation through Application software Business Applications – overview and types, Business Process Automation, relevant controls and information systems, Information Processing & Delivery channels and their role in Information Systems, Key types of Application Controls and their need, Emerging concepts – Virtualisation, Grid Computing, Cloud delivery model. Section B: Strategic Management (50 marks) CA IPCC syllabus for SM subject includes following chapters. 1. Business Environment General environment – demographic, socio-cultural, macro-economic, legal/political, technological, and global; competitive environment. 2. Business Policy and Strategic Management Meaning and nature; strategic management imperative; vision, mission and objectives; strategic levels in organisations. 3. Strategic Analyses Situational analysis – SWOT analysis, TOWS matrix, portfolio analysis – BCG matrix. 4. Strategic Planning Meaning, stages, alternatives, strategy formulation. 5. Formulation of Functional Strategy Marketing strategy, financial strategy, production strategy, logistics strategy, human resource strategy. 6. Strategy Implementation and Control Organisational structures; establishing strategic business units; establishing profit centers by business, product or service, market segment or customer; leadership and behavioural challenges. 7. Reaching Strategic Edge Business process re-engineering, benchmarking, total quality management, six sigma, contemporary strategic issues. |