|

#2

21st August 2017, 11:48 AM

| |||

| |||

| Re: Internet Banking of State Bank of Hyderabad

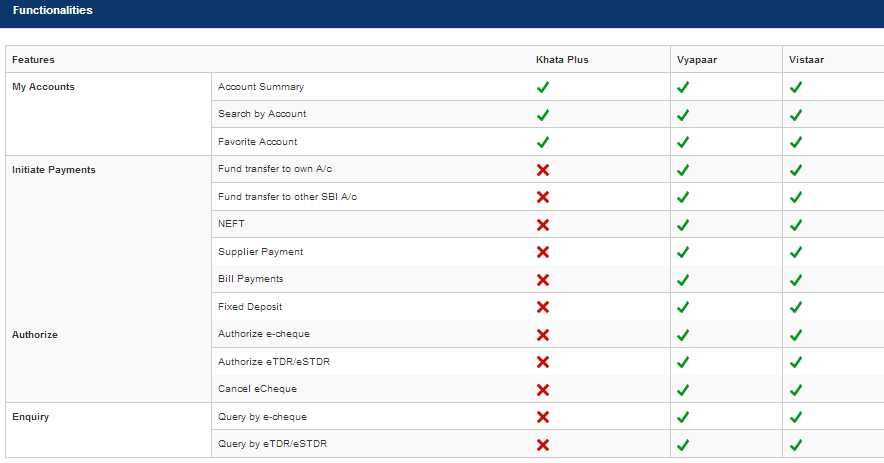

State Bank of Hyderabad has been merged with State Bank of India from 1st April 2017 along with other Associate Banks as well and now has become one entity i.e State Bank of India. State Bank of India will be India's biggest save money with a system of more than 15000 branches and 5 relate banks found even in the remotest parts of India. State Bank of India (SBI) offers an extensive variety of managing an account items and administrations to corporate and retail clients. OnlineSBI is the Internet keeping money entryway for State Bank of India. The entry gives anyplace, whenever, online access to represents State Bank's Retail and Corporate clients. The application is produced utilizing the most recent forefront innovation and devices. The framework bolsters bound together, secure access to managing an account administrations for accounts in more than 15,000 branches crosswise over India. Retail Internet Banking The Retail Internet Banking offers a plethora of products as well as services, to cater to all your banking demands online: -Transfer funds to own and third party accounts -A suite of completely online deposit products (Fixed, Recurring, Flexi, Tax Saving etc.) -Airline, Rail, Bus and hotel ticket booking -Online Shopping and instant recharge features. -IMPS Funds Transfer -Western Union Service -Credit beneficiary accounts using RTGS/NEFT feature -Generate account statements -Setup Standing Instructions and Scheduling payments -Configure profile settings -E- Tax for online tax payment -E - Pay for automatic bill payments -Avail DEMAT and IPO services -Pay bill of Visa Credit Card issued by any Bank. -Other Value added Services Corporate Internet Banking The Corporate Internet Banking (CINB) facility of SBI enables the corporate customer to carry out banking activities anywhere as well as anytime aided with the power and convenience of the internet. -Convenience banking - Operate your account from the comfort of home or office. -Maker - Checker model to ensure security and integrity in the transactions. -Anytime Banking- Enquire/transact on your account on a 24 x 7 basis. -Save time and costs- No need to go to the bank branch for routine transactions. -Promote Green Banking - No hassle of paper work -Pay your Bills, taxes and statutory dues online- Beat the queues. -File upload facility: Facilitates bulk payment of salary, tax, pre-paid card top up, utility bills, remittances etc. -Transfer money to other bank and SBI accounts. -Supplier Payment - Make online, instantaneous payments to registered suppliers. -Merchant Payments by using Merchant pre-approved limit to different merchants like telecom, electricity, municipal corporations etc., -ASBA: Apply to IPOs online. -MIS / Reverse file: - Convenience of easy reconciliation. -State Bank collect - For collecting and remitting various fees, collections, etc. Key Features of Corporate Internet Banking  Who can profit Corporate Internet Banking? With the end goal of Internet Banking, all non-singular clients, viz., private venture endeavors, firms, puts stock in, establishments, Government associations or extensive combinations are dealt with as Corporates. So regardless of whether you are sole proprietor or accomplice of a little firm or dealing with the records of an expansive corporate or Government office with complex money related prerequisites, SBI has the correct answer for you under Corporate Internet Banking.  |