|

#2

22nd September 2014, 02:48 PM

| |||

| |||

| Re: Institute Of Chartered Accountants of India Questions

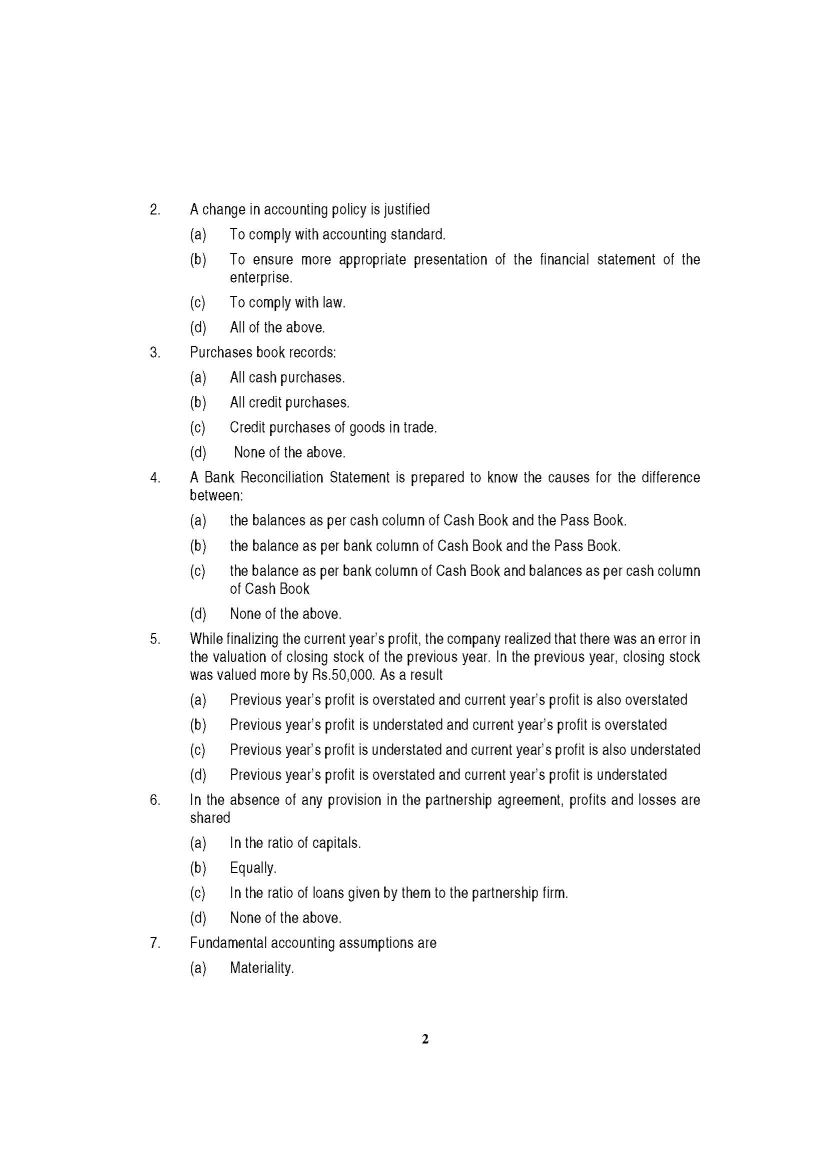

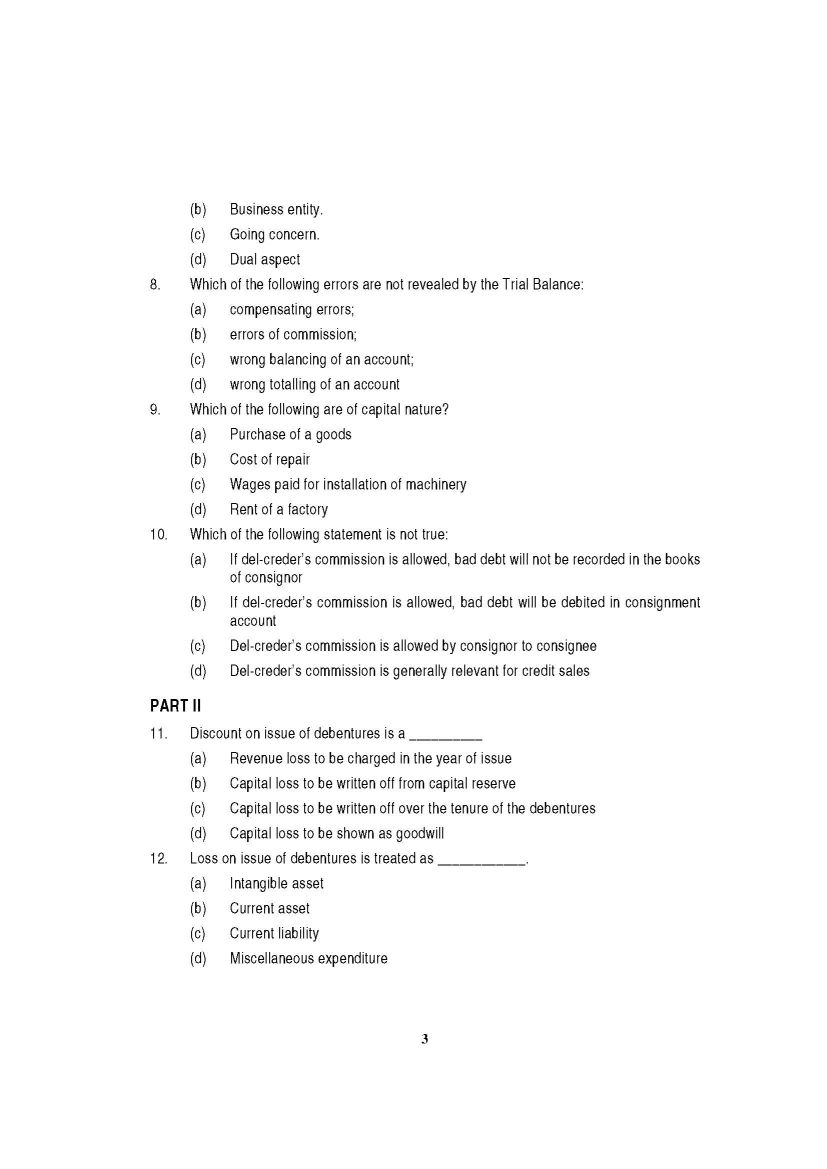

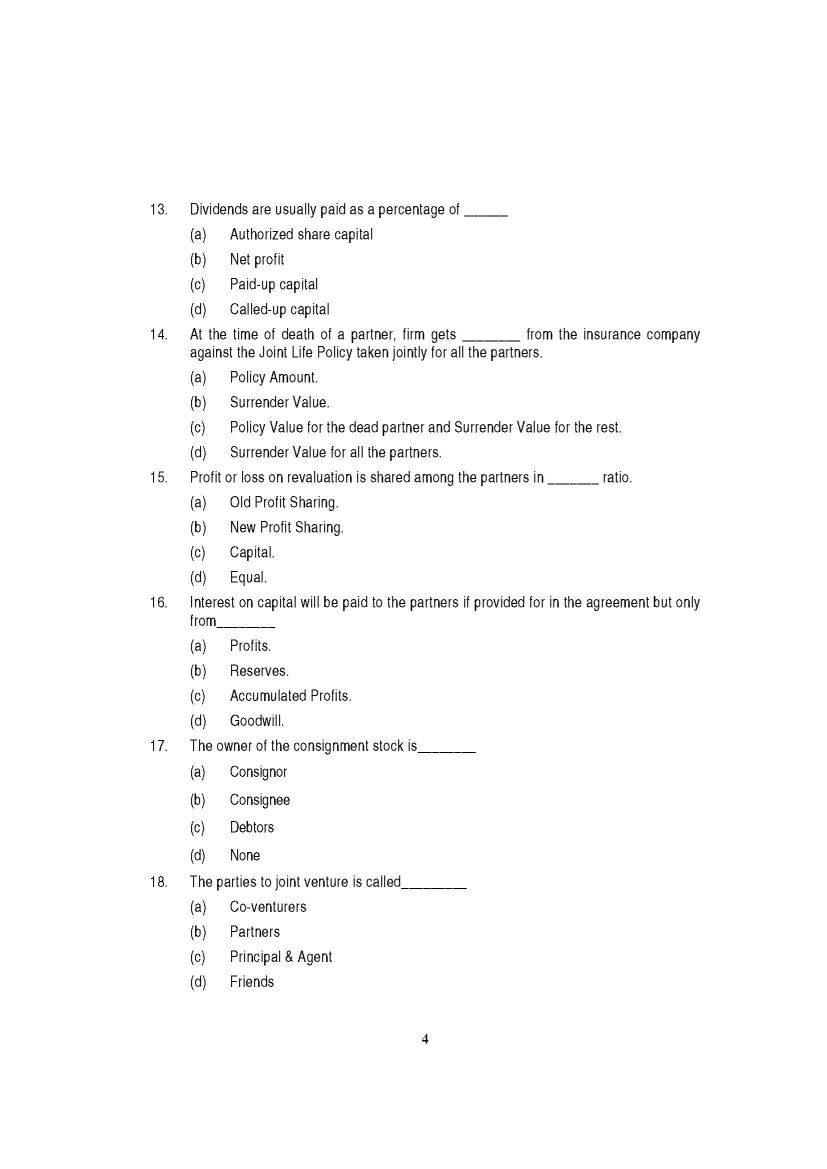

Here you are looking for Model Test Papers for CPT (Common Proficiency Test) as you are looking for here I am providing you. Model Test Papers for CPT (Common Proficiency Test) Model Test Paper – BOS/CPT/VOLUME - I CONTENTS S. No. Test Paper Denomination Page No 1. Model Test Paper – BOS/CPT-1/2006 1 – 41 2. Model Test Paper – BOS/CPT-2/2006 42 – 84 3. Model Test Paper – BOS/CPT-3/2006 85 – 126 4. Model Test Paper – BOS/CPT-4/2006 127 – 169 5. Model Test Paper – BOS/CPT-5/2006 170 – 211 6. Model Test Paper – BOS/CPT-6/2006 212 – 254 7. Model Test Paper – BOS/CPT-7/2006 255 – 297 8. Model Test Paper – BOS/CPT-8/2006 298 –341 9. Model Test Paper – BOS/CPT-9/2006 342 –383 10. Model Test Paper – BOS/CPT-10/2006 384 – 425 11 Answsers 426 – 442 SECTION – A : FUNDAMENTALS OF ACCOUNTING (60 MARKS) PART I 1. RPC Ltd. follows the written down value method of depreciating machinery year after year due to (a) Comparability. (b) Convenience. (c) Consistency. (d) All of the above. 2. A change in accounting policy is justified (a) To comply with accounting standard. (b) To ensure more appropriate presentation of the financial statement of the enterprise. (c) To comply with law. (d) All of the above. 3. Purchases book records: (a) All cash purchases. (b) All credit purchases. (c) Credit purchases of goods in trade. (d) None of the above. 4. A Bank Reconciliation Statement is prepared to know the causes for the difference between: (a) the balances as per cash column of Cash Book and the Pass Book. (b) the balance as per bank column of Cash Book and the Pass Book. (c) the balance as per bank column of Cash Book and balances as per cash column of Cash Book (d) None of the above. 5. While finalizing the current year’s profit, the company realized that there was an error in the valuation of closing stock of the previous year. In the previous year, closing stock was valued more by Rs.50,000. As a result (a) Previous year’s profit is overstated and current year’s profit is also overstated (b) Previous year’s profit is understated and current year’s profit is overstated (c) Previous year’s profit is understated and current year’s profit is also understated (d) Previous year’s profit is overstated and current year’s profit is understated 6. In the absence of any provision in the partnership agreement, profits and losses are shared (a) In the ratio of capitals. (b) Equally. (c) In the ratio of loans given by them to the partnership firm. (d) None of the above. 7. Fundamental accounting assumptions are (a) Materiality. (b) Business entity. (c) Going concern. (d) Dual aspect 8. Which of the following errors are not revealed by the Trial Balance: (a) compensating errors; (b) errors of commission; (c) wrong balancing of an account; (d) wrong totalling of an account 9. Which of the following are of capital nature? (a) Purchase of a goods (b) Cost of repair (c) Wages paid for installation of machinery (d) Rent of a factory 10. Which of the following statement is not true: (a) If del-creder’s commission is allowed, bad debt will not be recorded in the books of consignor (b) If del-creder’s commission is allowed, bad debt will be debited in consignment account (c) Del-creder’s commission is allowed by consignor to consignee (d) Del-creder’s commission is generally relevant for credit sales PART II 11. Discount on issue of debentures is a __________ (a) Revenue loss to be charged in the year of issue (b) Capital loss to be written off from capital reserve (c) Capital loss to be written off over the tenure of the debentures (d) Capital loss to be shown as goodwill 12. Loss on issue of debentures is treated as ____________. (a) Intangible asset (b) Current asset (c) Current liability (d) Miscellaneous expenditure 13. Dividends are usually paid as a percentage of ______ (a) Authorized share capital (b) Net profit (c) Paid-up capital (d) Called-up capital 14. At the time of death of a partner, firm gets ________ from the insurance company against the Joint Life Policy taken jointly for all the partners. (a) Policy Amount. (b) Surrender Value. (c) Policy Value for the dead partner and Surrender Value for the rest. (d) Surrender Value for all the partners. 15. Profit or loss on revaluation is shared among the partners in _______ ratio. (a) Old Profit Sharing. (b) New Profit Sharing. (c) Capital. (d) Equal. 16. Interest on capital will be paid to the partners if provided for in the agreement but only from________ (a) Profits. (b) Reserves. (c) Accumulated Profits. (d) Goodwill. 17. The owner of the consignment stock is________ (a) Consignor (b) Consignee (c) Debtors (d) None 18. The parties to joint venture is called_________ (a) Co-venturers (b) Partners (c) Principal & Agent (d) Friends 19. The purpose of accommodation bill is_______ (a) To finance actual purchase or sale of goods (b) To facilitate trade transmission (c) When both parties are in need of funds (d) None of the above 20. The number of production or similar units expected to be obtained from the use of an asset by an enterprise is called as _________ (a) Unit life (b) Useful life (c) Production life (d) Expected life Model Test Papers for CPT (Common Proficiency Test)     To get fill question paper with answer you can download this attachment it is free of cost |