|

#2

8th March 2016, 08:37 AM

| |||

| |||

| Re: Indian Equity

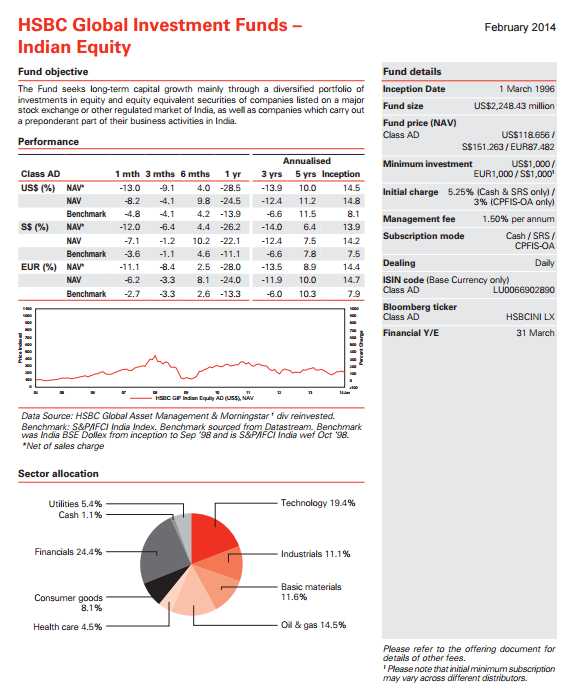

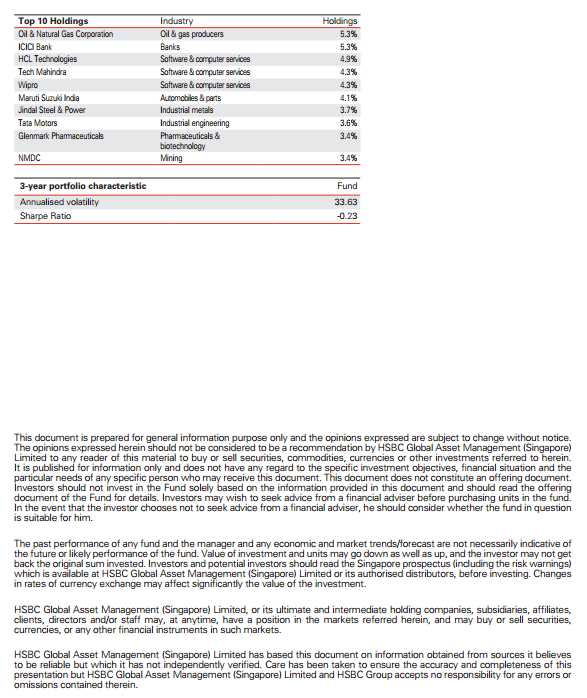

As per your demand here I am providing you details of the HSBC Global Investment Funds – Indian Equity Fund objective The Fund seeks long-term capital growth mainly through a diversified portfolio of investments in equity and equity equivalent securities of companies listed on a major stock exchange or other regulated market of India, as well as companies which carry out a preponderant part of their business activities in India Fund details Inception Date 1 March 1996 Fund size US$2,248.43 million Fund price (NAV) Class AD US$118.656 / S$151.263 / EUR87.482 Minimum investment US$1,000 / EUR1,000 / S$1,0001 Initial charge 5.25% (Cash & SRS only) / 3% (CPFIS-OA only) Management fee 1.50% per annum Subscription mode Cash / SRS / CPFIS-OA Dealing Daily ISIN code (Base Currency only) Class AD LU0066902890 Bloomberg ticker Class AD HSBCINI LX Financial Y/E 31 March Top 10 Holdings Industry Holdings Oil & Natural Gas Corporation Oil & gas producers 5.3% ICICI Bank Banks 5.3% HCL Technologies Software & computer services 4.9% Tech Mahindra Software & computer services 4.3% Wipro Software & computer services 4.3% Maruti Suzuki India Automobiles & parts 4.1% Jindal Steel & Power Industrial metals 3.7% Tata Motors Industrial engineering 3.6% Glenmark Pharmaceuticals Pharmaceuticals & biotechnology 3.4% NMDC Mining 3.4% 3-year portfolio characteristic Fund Annualised volatility 33.63 Sharpe Ratio -0.23 HSBC Global Investment Funds – Indian Equity   Last edited by Kiran Chandar; 8th March 2016 at 08:56 AM. |