|

#2

3rd March 2016, 03:18 PM

| |||

| |||

| Re: How Income Tax is Deducted

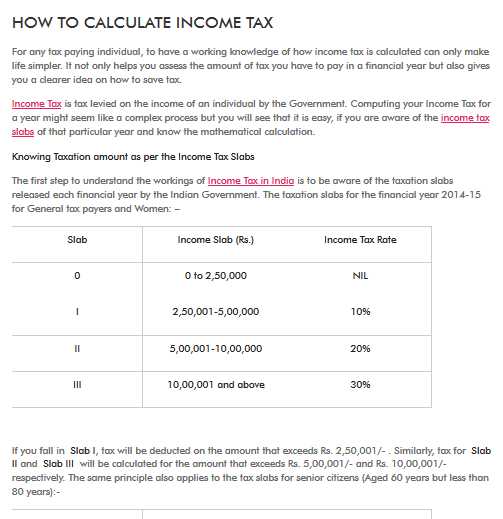

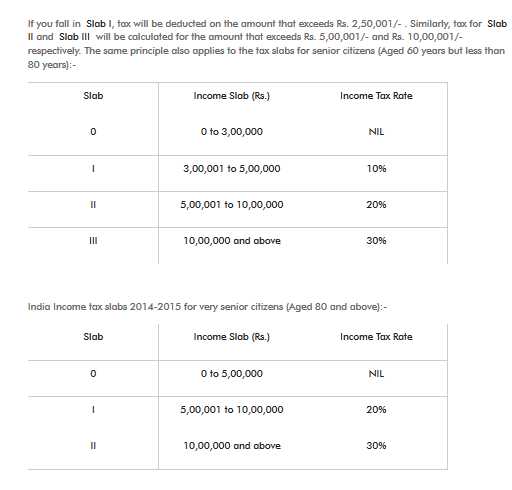

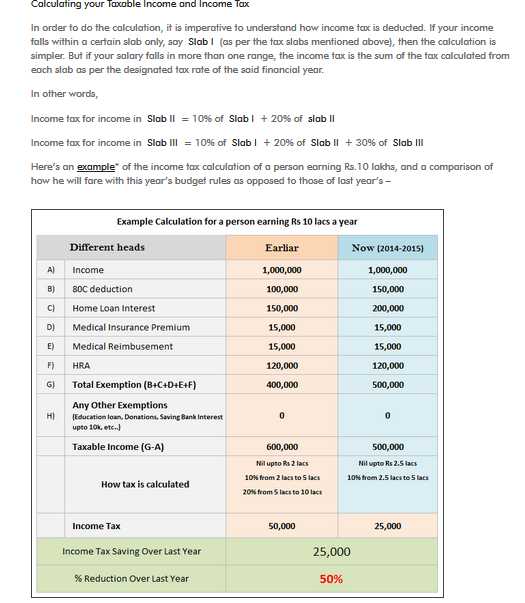

Any income received by an employee is taxed under the head Income from Salaries in India. It is only taxable when an employer-employee relationship exists. The first thing one need to know is the salary slab they fall under. Slab Income Slab (Rs.) Income Tax Rate 0 0 to 2,50,000 NIL I 2,50,001-5,00,000 10% II 5,00,001-10,00,000 20% III 10,00,001 and above 30% If one fall in Slab I, tax is deducted on the amount that exceeds Rs. 2,50,001/- . Similarly, tax for Slab II and Slab III is calculated for the amount that exceeds Rs. 5,00,001/- and Rs. 10,00,001/- respectively. The same principle also applies to the tax slabs for senior citizens (Aged 60 years but less than 80 years):- Slab Income Slab (Rs.) Income Tax Rate 0 0 to 3,00,000 NIL I 3,00,001 to 5,00,000 10% II 5,00,001 to 10,00,000 20% III 10,00,000 and above 30% India Income tax slabs 2014-2015 for very senior citizens (Aged 80 and above):- Slab Income Slab (Rs.) Income Tax Rate 0 0 to 5,00,000 NIL I 5,00,001 to 10,00,000 20% II 10,00,000 and above 30% Deductions on Income from Salary The deductions on Income from Salary fall under the Section 16 of the Income Tax Act. The deductions are: Entertainment Allowance under Section 16(ii): Deduction is allowed by way of entertainment allowance given by an employer. This deduction is available only for the Government employees. The deduction is either the 1/5th of salary without including the benefits or perquisites or other allowances or Rs.5,000, whichever is lesser. The non-government employees can avail this deduction. Tax on Employment under Section 16(iii): The Professional Tax is allowed as a deduction while computing income from salaries. How to Calculate Income Tax    |