|

#3

21st June 2018, 12:07 PM

| |||

| |||

| Re: Hedge fund MBA salary

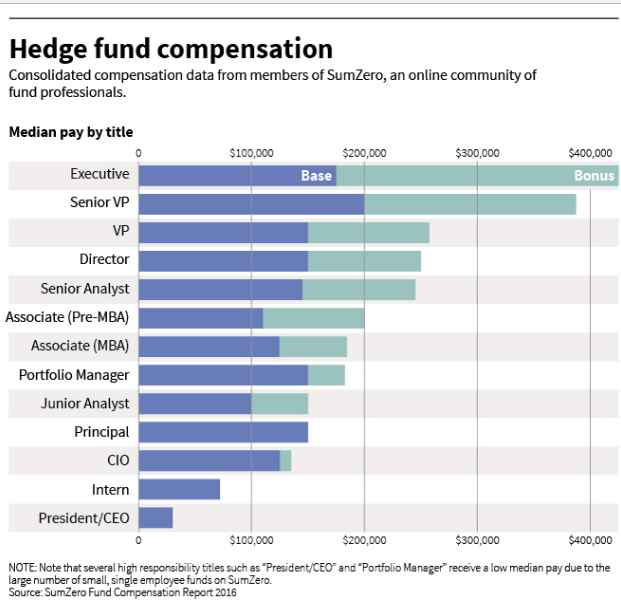

Hedge fund analysts make between $175,000 and $200,000 all in per year when they first switch over to hedge funds or mutual funds, Their median starting salaries were $122,500, higher than any other finance job category other than private equity and venture capital where the firms paid median bases of $150,000 to start. MBAs landing the largest comp packages were the 9% of the class that went into investment management and hedge funds jobs. Those grads landed total median comp packages of $199,630, including base salaries of $150,000, sign-on bonuses of $35,000, and other guaranteed first-year compensation of $125,000. Hedge fund offer salary to MBA candidates:  Pre-MBA associates took home an average of $200,000, including a $90,000 bonus. Fund Compensation Report is based on a survey of more than 1,800 associate positions. Associates with an MBA, meanwhile, took home an average of about $184,000, including a bonus of $60,000. The private equity work centers on deal transactions, which is as follows: Source deals through public auctions and private relationships. Conduct initial company due diligence Forecast financial projections, develop upside / downside scenarios, and calculate rates of return. Draft investment committee presentation and get follow-up items Perform due diligence on follow-up items, potentially with a third-party consultant. Meet with investment bankers and private lenders to receive debt financing. Review and comment on legal documents. Close the deal and coordinate funds flow with banks, company and lawyers. Interview new management and board of directors (if the existing management is to be replaced) Help the CEO, CFO, Treasurer on company strategies, operations, and quarterly financial reports. Prepare the company for sale when company financial goals are achieved (the typical private equity investment holding period is 3-5 years). |