|

#2

21st November 2017, 03:34 PM

| |||

| |||

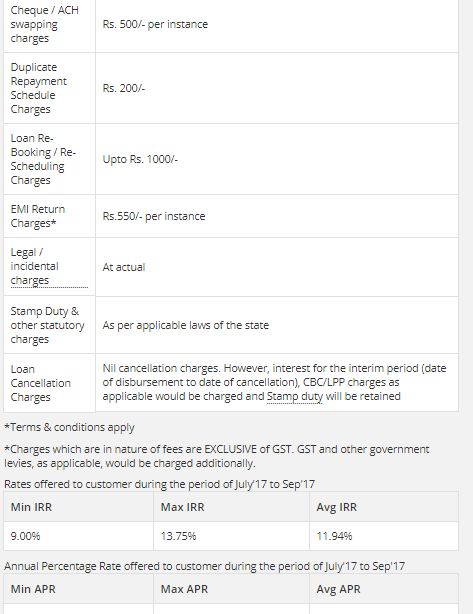

| Re: HDFC Bank Education Loan For IIM

Look for IIM through education loan from HDFC Bank Limited, here I will get details about that loan, so that you can have idea. Eligibility The following people are eligible to apply for an Education Loan for Indian Education: Resident Indians Individuals between the ages of 16 and 35 For Loan amount 4lac <=7.5lac: third party guarantee and parent(s) as joint borrower(s) For loan amount > 7.5lac: Tangible collateral security along with Parents to be joint borrower(s) Rates and Fees Loan Processing Charges Maximum up to 1% of the loan amount as applicable or Minimum Rs. 1000/- whichever is higher Pre-payment charges Upto 4% of the Outstanding Balance prepaid, if loan is foreclosed/ part perpaid during Moratorium (along with and in addition to due/accrued interest, if any, and other amounts due and/or payable by the Borrower to the Bank). No prepayment charges will be charged if loan is foreclosed / part prepaid any time after expiry of the Moratorium. No Due Certificate / No Objection Certificate (NOC) Nil Duplicate of No Dues Certificate/NOC Nil Rates and Charges   Features High Loan Amounts Quick and Easy Disbursals Subsequent Disbursement 100% Transparency Tax Rebates Wide Range of Collateral Options Easy Loan Repayment Stay Protected Address:- HDFC Bank Limited 1st Floor,C.S.No.6/242, Senapati Bapat Marg, Lower Parel, Mumbai - 400 013. |