|

#2

8th January 2016, 03:12 PM

| |||

| |||

| Re: Gross NPA of Syndicate Bank

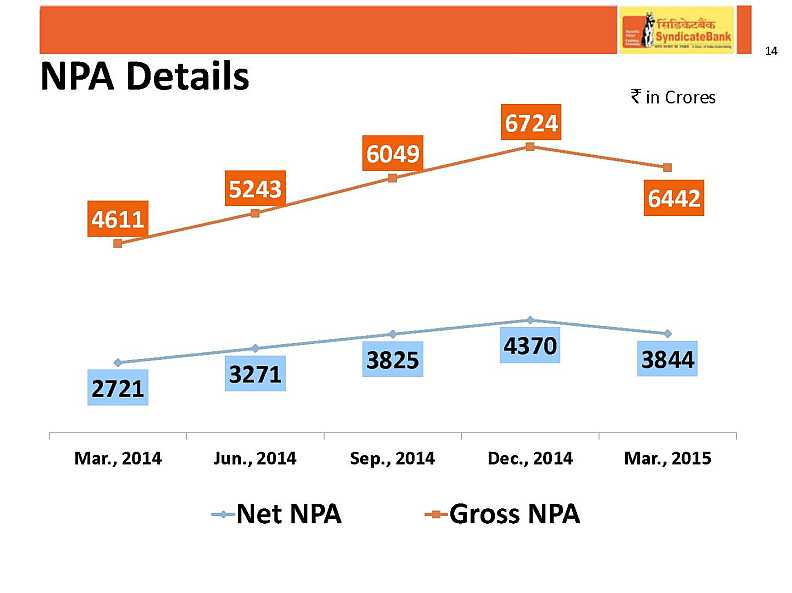

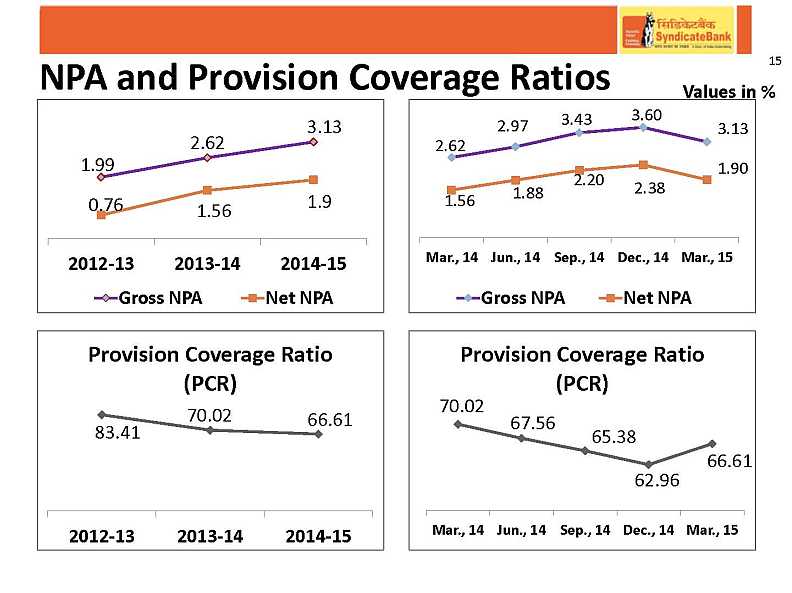

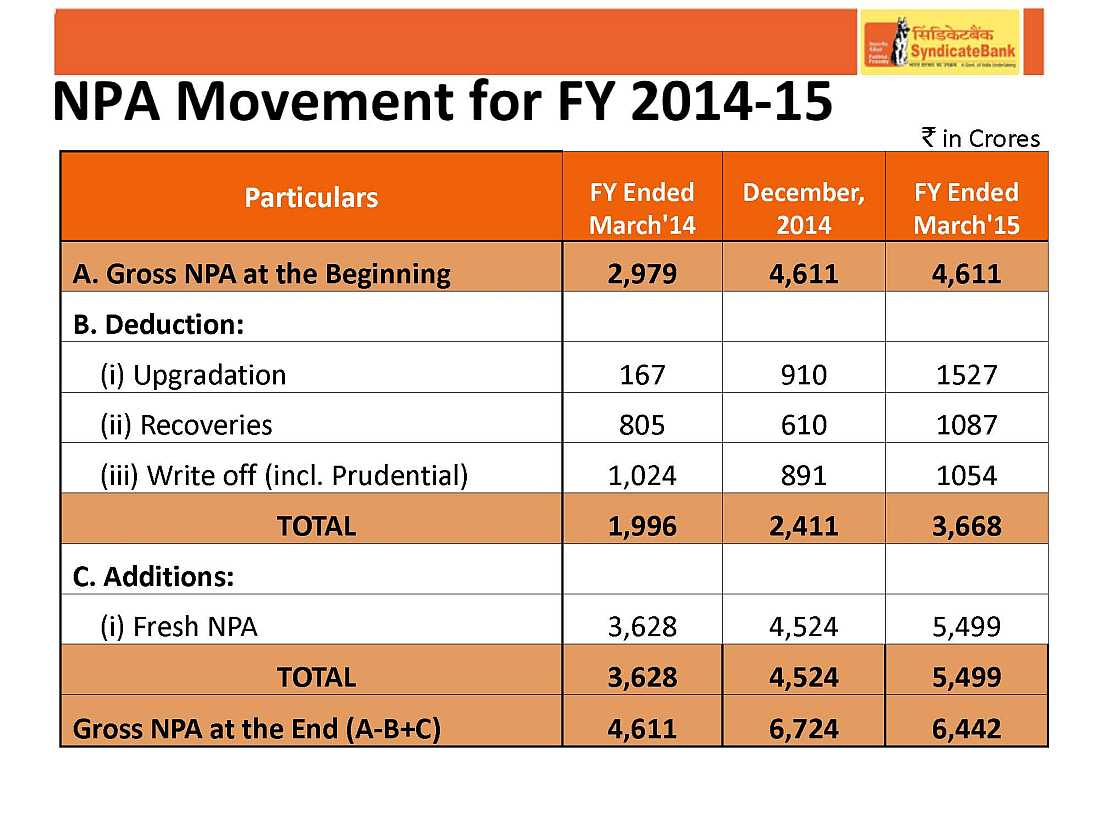

Gross NPA is the total number of NPAs of the bank simply added. Banks would continuously assess this by evaluating the loan payments and decide the NPAs. When the NPA occurs, it is not just an interest income loss to the bank, but a principal loss as well. In an ideal and healthy scenario, the Net or Gross NPA mean of the all the banks should be close to zero. If an individual bank has Net NPA in negative, then that is a good sign. In practice one would see the Net NPA or Gross NPA as a percentage. Usually it is calculated on the total lending done for that year. Gross NPA of Syndicate Bank March, 2014 June, 2014 Sept, 2014 Dec, 2014 Mar, 2015 Gross NPA Ratio 2.62 2.97 3.43 3.60 3.13 Gross NPA March, 2015 - Syndicate Bank      |