|

#2

25th August 2015, 12:41 PM

| |||

| |||

| Re: GDR Citibank

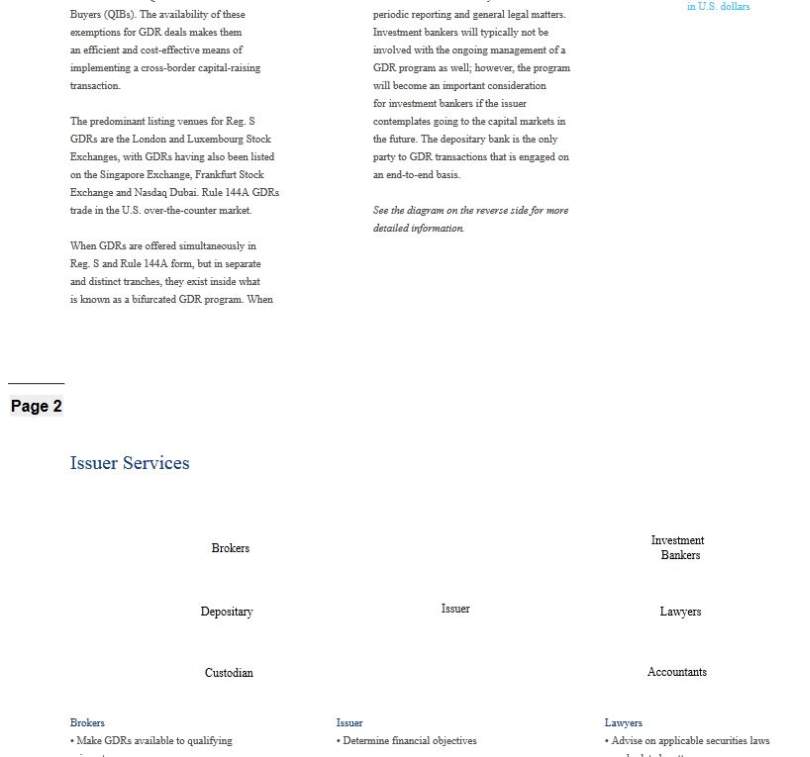

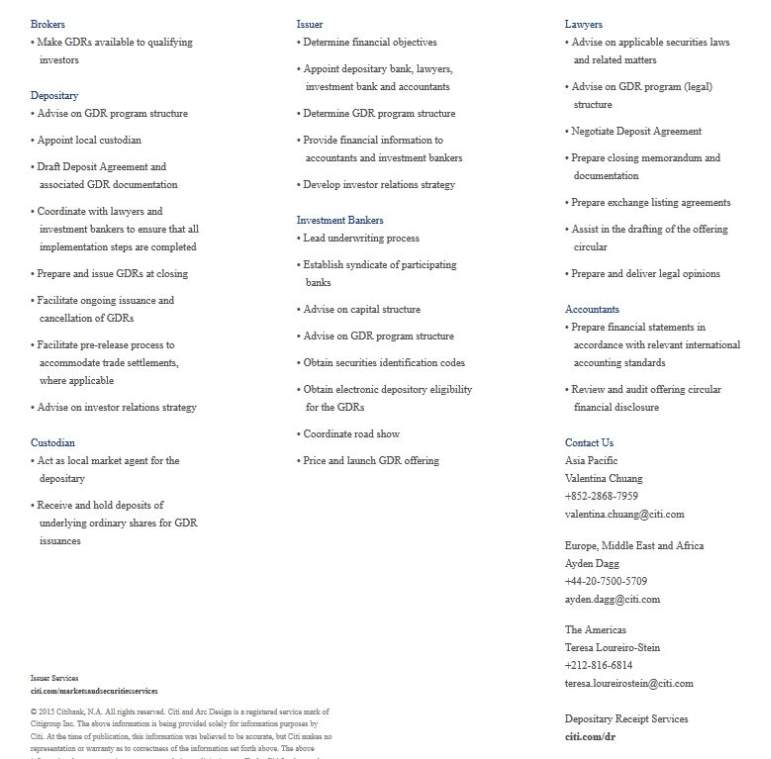

Yes Citibank has facility of GDR or Global Depositary Receipt that is a negotiable instrument issued by a depositary bank in international markets — typically in Europe and generally made available to institutional investors both outside and within the U.S. — that evidences ownership of shares in a non-U.S. company, enabling the company (issuer) to access investors in capital markets outside its home country GDR Primary Benefits Issuers • Access capital in international markets • Conduct a securities offering in an efficient and cost-effective manner • Expand market for shares, potentially enhancing overall liquidity • Broaden and diversify shareholder base Investors • Globalize/diversify investment portfolio • Trade, clear and settle according to home market conventions • Eliminate cross-border custody/safekeeping charges • Receive dividend payments in U.S. dollars Citibank GDR info    |