|

#2

18th August 2014, 09:14 AM

| |||

| |||

| Re: Chartered Accountant course duration

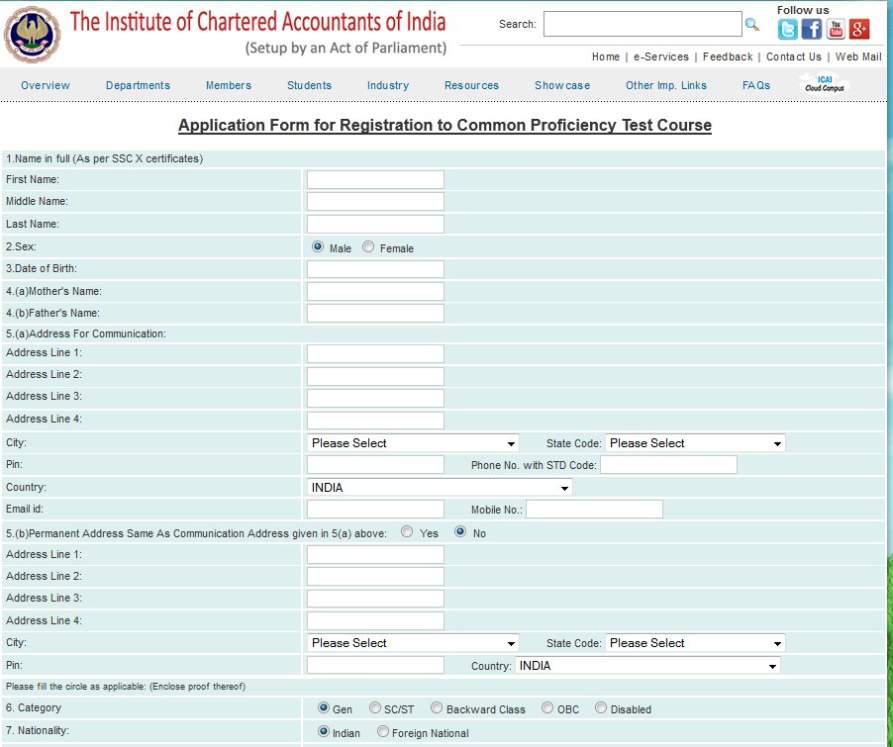

As you want to get the Chartered Accountant course duration so here it is for you: Duration-- According to ICAI the total duration to complete your CA course is 5 years. The duration will depend you how quickly you are able to clear each level. Curriculum of CA course Subjects for Professional course I Paper 1- Fundamentals of Accounting Paper 2 - Mathematics & Statistics Paper 3 - Economics Paper 4 - Business Communication and Organization and Management Professional Competency Course (PCC) Group I Paper 1 - Accounting Paper 2 - Auditing Paper 3 - Business and Corporate Laws Group II Paper 4 - Cost Accounting and Financial Management Paper 5 - Income Tax & Central Sales Tax Paper 6 - Information Technology Final Course Group I Paper 1 - Advanced Accounting Paper 2 - Management Accounting & Financial Analysis Paper 3 - Advanced Auditing Paper 4 - Corporate Laws & Secretarial Practice Group II Paper 5 - Cost Management Paper 6 - Management Information and Control Systems Paper 7 - Direct Taxes Paper 8 - Indirect Taxes Online Registration Process for CPT: (1). Firstly go to the official website of Institute of Charted Accountants of India which looks like this image:  (2). Now on this page at the top you will find some tabs and from those tabs choose the tab of “Students” and from this tab choose the tab of “Cloud Campus” (3). Now you will move to the next page and on that page choose the tab of “Cloud Campus” (4). Now you will move to the next page and on that page choose the tab of “CA Course” from the top of the page (5). Now you will move to he next page and on that page choose the tab of “CA Course” and from this tab choose the tab of “Common Proficiency Test” and from this tab choose the tab of “Online Registration (6). Now you will be directed to the next page which looks like this image:  Now on this page you will have to do the registration Contact Details: The Institute of Charted Accountants of India Block A, 29, Block A, Sector 62, Noida, Uttar Pradesh 201307 0120 304 5961 India Map Location: [MAP]https://www.google.co.in/maps?q=The+Institute+of+Chartered+Accountants+of+I ndia,+Block+A,+Block+A,+Industrial+Area,+Sector+62 ,+Noida,+Uttar+Pradesh,+India&hl=en&ll=28.634329,7 7.359672&spn=0.019022,0.026093&sll=21.125498,81.91 4063&sspn=20.602762,26.71875&oq=The+Institute+of+C hartered+Accountants+of+India&hq=The+Institute+of+ Chartered+Accountants+of+India,+Block+A,&hnear=Blo ck+A,+Industrial+Area,+Sector+62,+Noida,+Gautam+Bu ddh+Nagar,+Uttar+Pradesh&t=m&z=15&iwloc=A[/MAP] |