|

#2

5th August 2015, 12:21 PM

| |||

| |||

| Re: Central Bank Of India NRI Account Opening Form

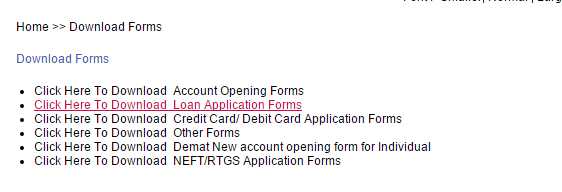

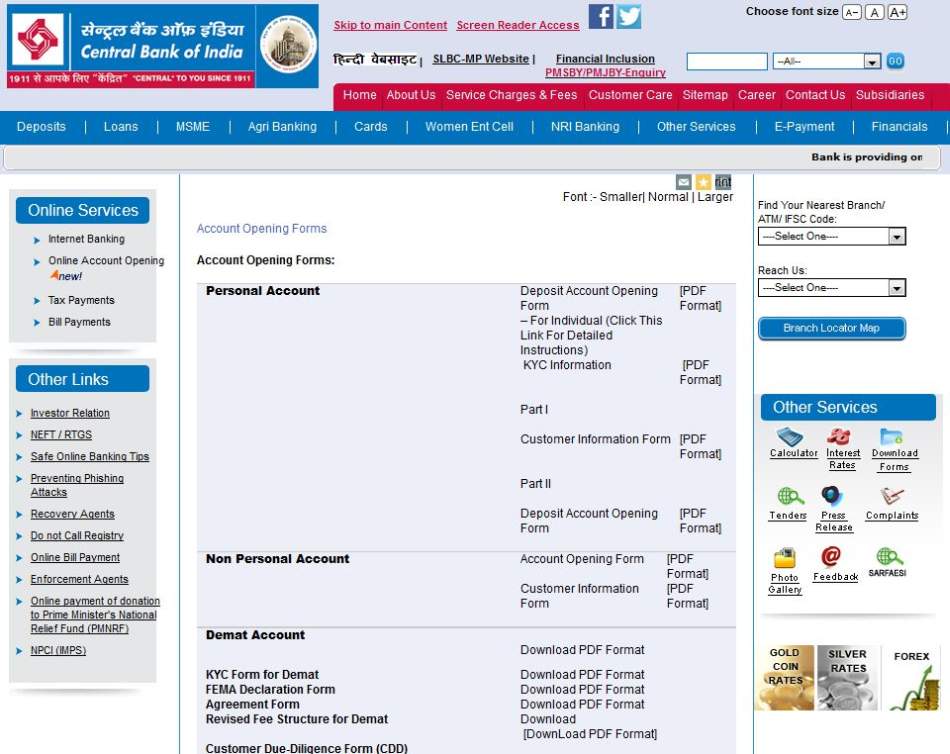

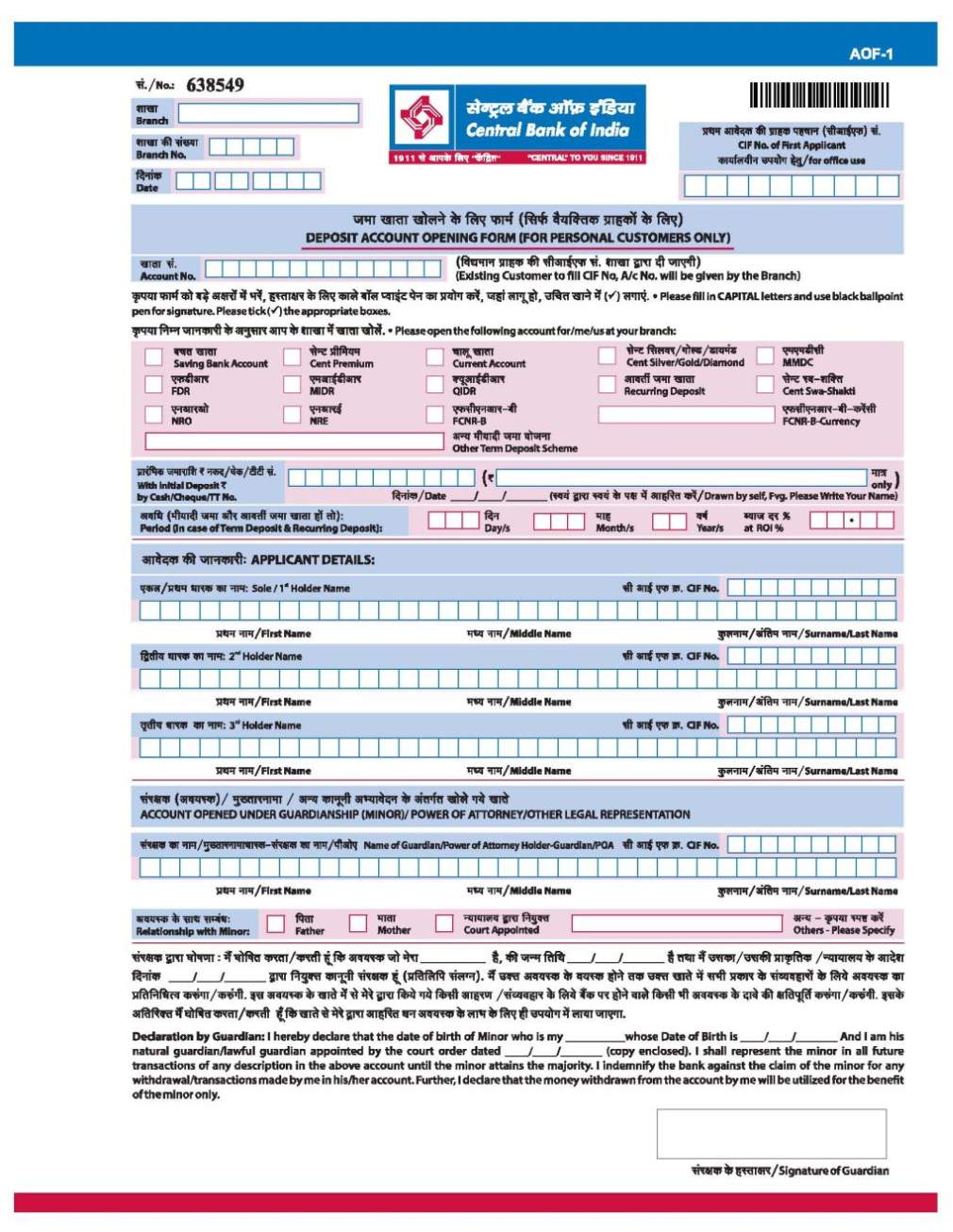

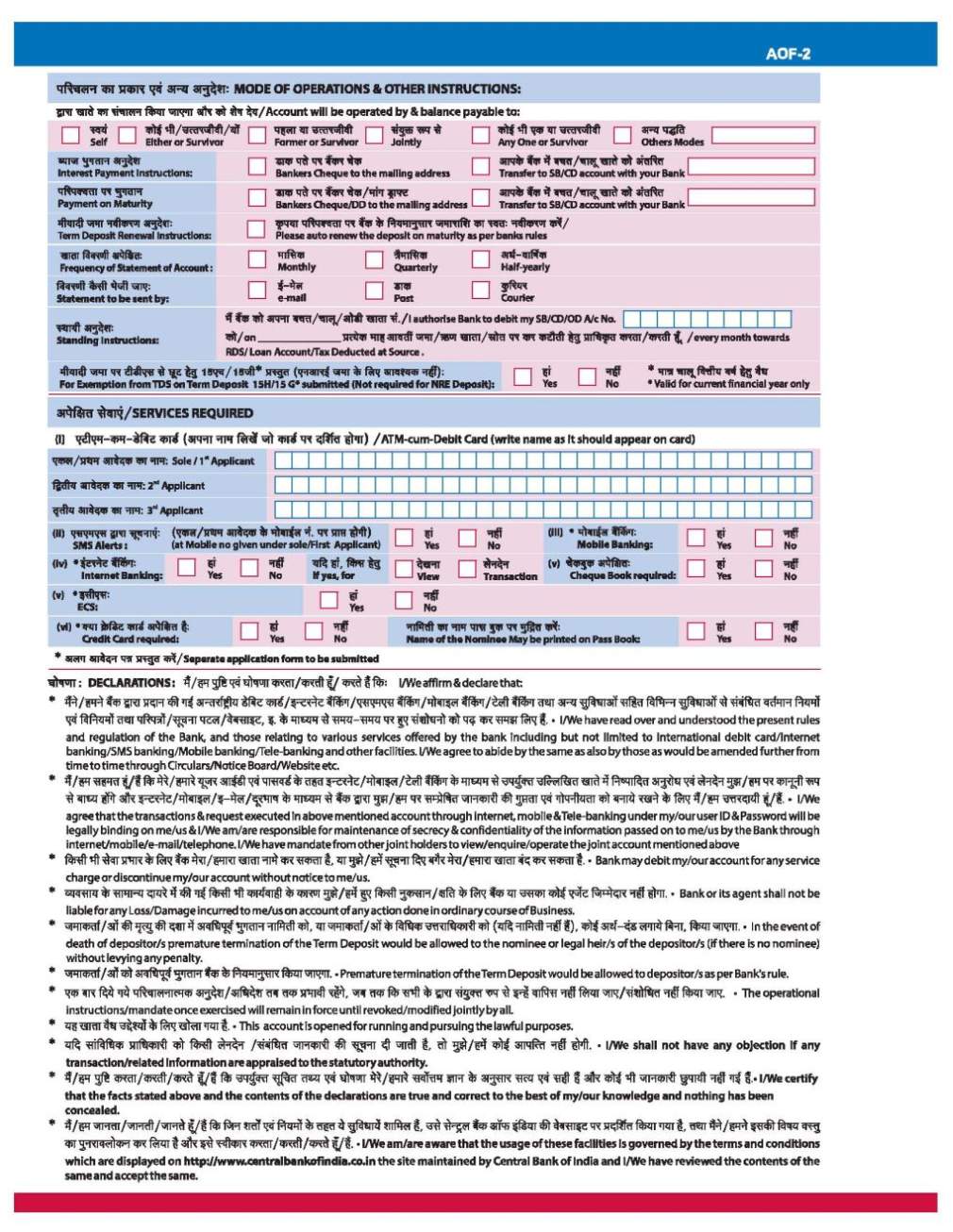

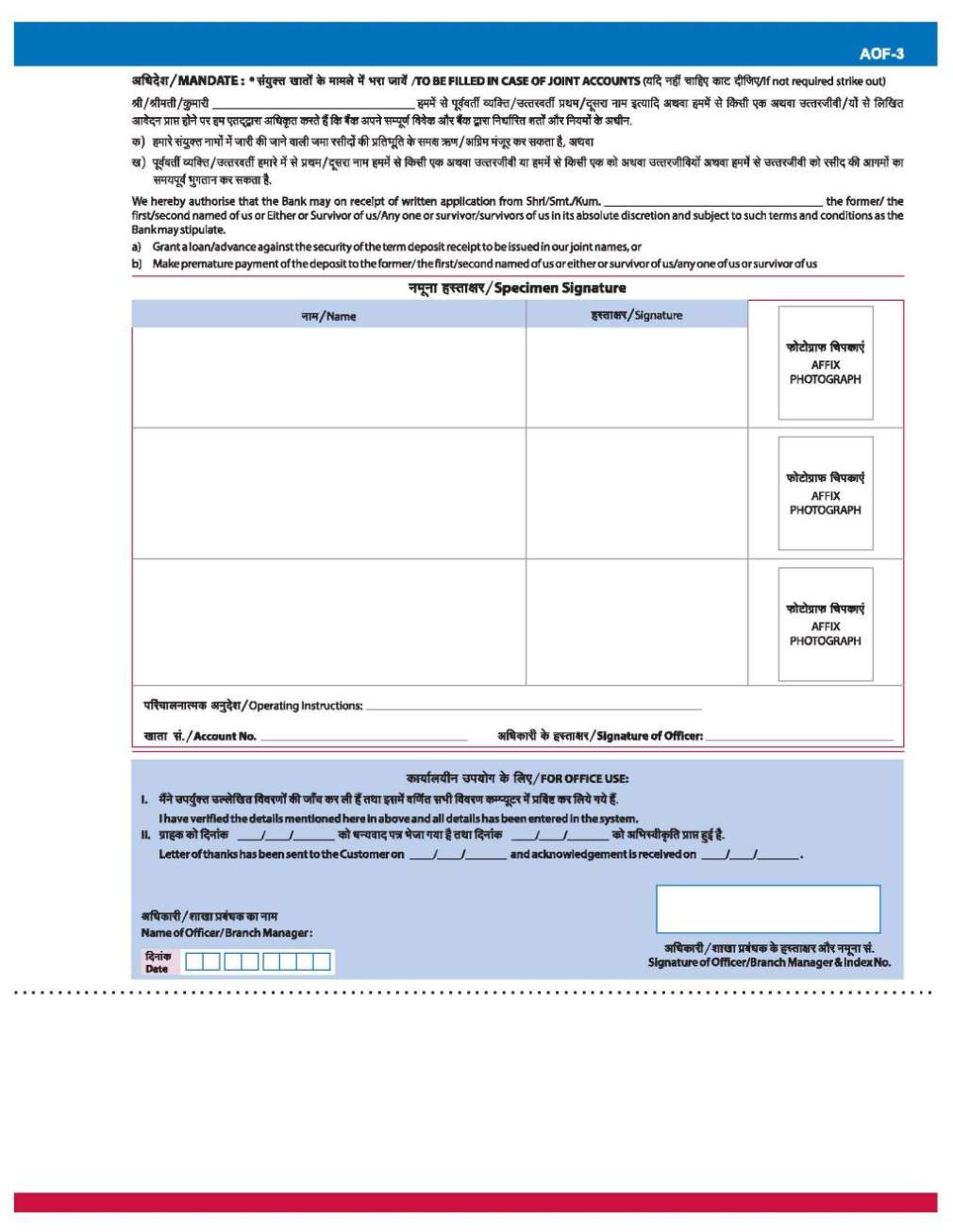

As you want to get Account Opening Form so for it you need to do which I have mention here Go to the Central Bank Of India official site The click on download form option give in online service segment in right bottom side When you will click there a page will open from where you can download any form personal or non personal account https://www.centralbankofindia.co.in...loadforms_id=1 here I am providing Central Bank Of India Personal Account form Central Bank Of India Personal Account form      |