|

#2

1st November 2015, 10:14 AM

| |||

| |||

| Re: Central Bank of India BPLR Rate

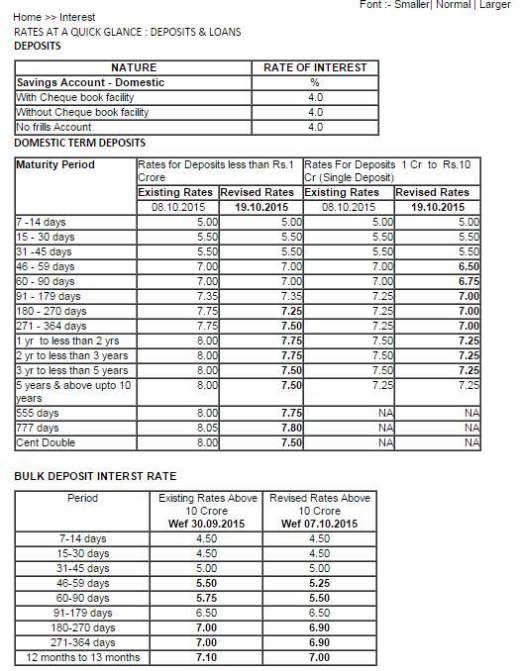

Central Banks in India has switched to Base Rate system from Benchmark Prime Lending Rate (BPLR) system from July 01, 2010. Base Rate includes elements of the lending rates that are common across all categories of borrowers. Loans Base Rate of Banks, BPLR of Banks in India B.P.L.R ( w.e.f 01.08.2011 ) 15.00% p.a Base Rate (BR) w.e.f. 08.10.2015 9.70% Deposits Nature Rate of Interest Savings Account - Domestic % With Cheque book facility 4.0 Without Cheque book facility 4.0 No frills Account 4.0 Domestic Term Deposits Maturity Period Rates for Deposits less than Rs.1 Crore Rates For Deposits 1 Cr to Rs.10 Cr (Single Deposit) Existing Rates Revised Rates Existing Rates Revised Rates 08.10.2015 19.10.2015 8.10.2015 19.10.2015 7 -14 days 5.00 5.00 5.00 5.00 15 - 30 days 5.50 5.50 5.50 5.50 31 -45 days 5.50 5.50 5.50 5.50 46 - 59 days 7.00 7.00 7.00 6.50 60 - 90 days 7.00 7.00 7.00 6.75 91 - 179 days 7.35 7.35 7.25 7.00 180 - 270 days 7.75 7.25 7.25 7.00 271 - 364 days 7.75 7.50 7.25 7.00 1 yr to less than 2 yrs 8.00 7.75 7.50 7.25 2 yr to less than 3 years 8.00 7.75 7.50 7.25 3 yr to less than 5 years 8.00 7.50 7.50 7.25 5 years & above upto 10 years 8.00 7.50 7.25 7.25 555 days 8.00 7.75 NA NA 777 days 8.05 7.80 NA NA Cent Double 8.00 7.50 NA NA Central Bank of India BPLR Rate  |