| Re: CBSE 12 Class Accountancy Paper

Here is the list of few questions of CBSE 12 Class Accountancy Paper which you are looking for .

1.What is meant by issue of debentures as collateral security ?

2.D Ltd. invited applications for issuing 10,00,000 equity shares of < 10

each. The public applied for 8,55,000 shares. Can the company proceed

for the allotment of shares ? Give reason in support of your answer.

3.Distinguish between ‘Dissolution of partnership’ and ‘Dissolution of

partnership firm’ on the basis of Court’s intervention.

4. Give the meaning of ‘Reconstitution of a partnership firm’.

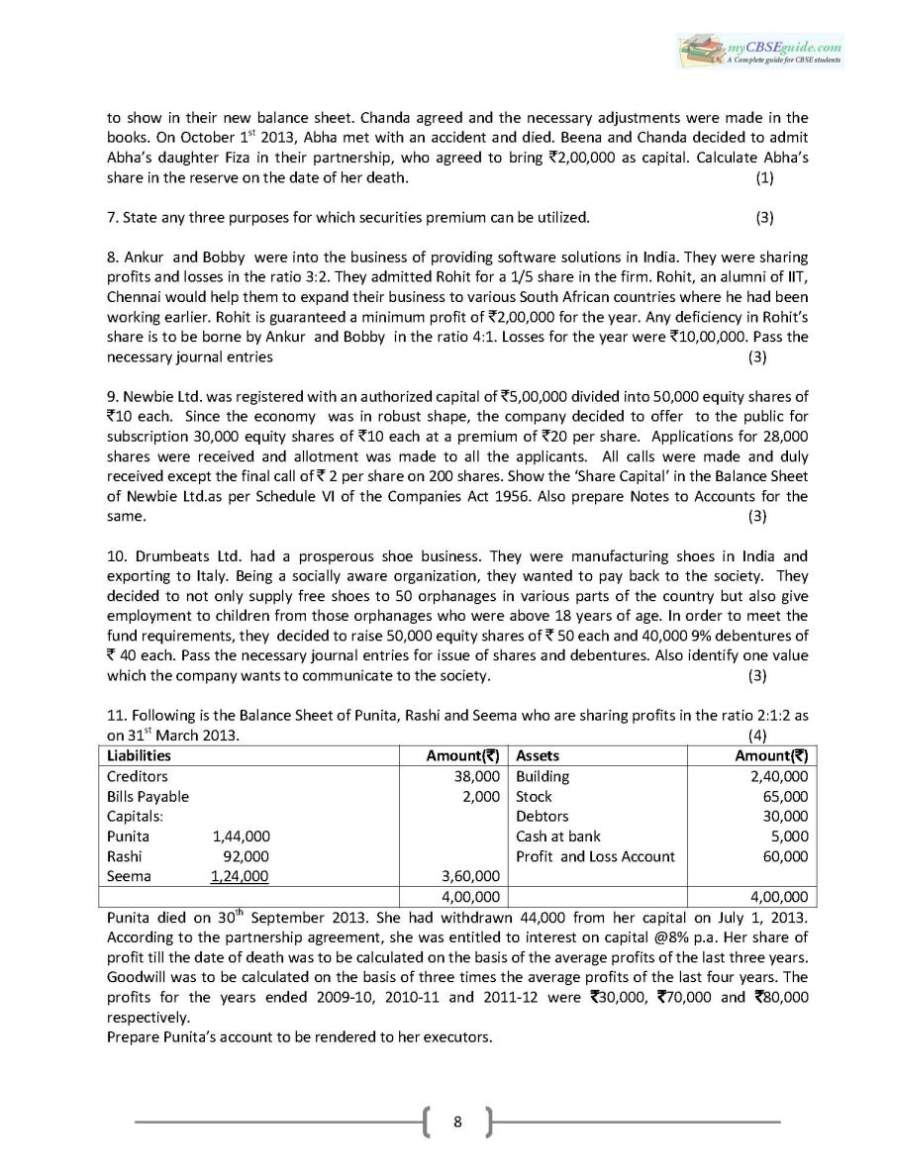

1. If a partner advances some loan to the firm, he is entitled for interest on loan. Do you think

he will get interest on such loan if there is loss in the firm? (1)

(Hint: Yes, because interest on partner’s loan is a charge against the profit)

2. State two financial rights acquired by a new partner. (1)

(Hint: Share in future profits and share in assets of the firm)

3. X and Y are partners with Rs. 1,50,000 and Rs.1,00,000 as their respective capitals. They admitted

Z as a new partner for 1/6th share in profits. What will be his share of capital if he has to bring

capital in proportion to his profit sharing ratio. (1)

(Hint: Rs. 50,000)

4. Vinod Limited invited applications for 20,000 shares of Rs.10 each. Applications were Received

for 25,000 shares. Name the kind of Subscription.

Give three alternatives for allotting shares. (1)

5. What is meant by Debenture? (1)

6. Following is the extract of the Balance Sheet of, Blue and Red as on March 31, 2007:

Liabilities Amount Assets Amount

Current Accounts :

Blue 1,00,000

Red 1,00,000

Capital Accounts :

Blue 10,00,000

Red 10,00,000

P/L Appropriation (31.3.07)

2,00,000

20,00,000

8,00,000

Sundry Assets 30,00,000

30,00,000 30,00,000

During the year Red’s drawings were Rs.30,000. Profits during 2007 is Rs.10,00,000.

Calculate interest on capital @ 5% per annum for the year ending March31, 2007. (3)

(Hint: Interest on Blue’s Capital Rs.50,000 and Red’s Capital Rs.50,000)

7. Explain dissolution of a firm by (i) Agreement and (ii) Notice. (3)

8. What entries would be passed for the following transactions on the dissolution of a firm,

if Sundry Assets and Outer Liabilities have already been transferred to Realisation A/c.

(a) There was an unrecorded Asset of Rs.5,000 which was taken over by C at Rs.4,000.

(b) Stock worth Rs.7,000 was taken over by partner B.

(c) Workmen’s Compensation paid to employees by the firm Rs.8,000.

(d) Sundry Creditors amounted to Rs.4,000 were paid off at a discount of 4%.

(e) There was a debit balance of Profit & Loss Account in the firm.

(f) Loss on Realisation was Rs.36,000 to be distributed among the partners in 3:2:1 ratio. (3)

9. A Partnership firm earned net profits during the last three years as follows:

Year 2008 Rs.38,000; Year 2009 Rs.44,000; Year 2010 Rs.50,000.

The Capital Employed in the firm throughout the above mentioned period has been Rs.80,000.

Having regard to the risk involved, 15% is considered to be a fair return on the capital. The

remuneration of all the partners during the period is estimated to be Rs.20,000 per annum.

Calculate goodwill on the basis of

(i) Two years purchase of super profits.

(ii) Capitalisation Method (4)

(Hint: (i) Rs.24,000 (ii) Rs.80,000)

10. A, B and C are partners in a trading firm. The firm has a fixed total capital of Rs.60,000 held

equally by all the partners. Under the partnership deed the partners were entitled to:

(a) A and B to a Salary of Rs.1,800 and Rs.1,600 per month respectively.

(b) In the event of death of a partner, goodwill was to be valued at 2 years purchase of the average

profits of the last 3 years.

(c) Profit upto the date of death based on the profits of the previous year.

(d) Partners were to be charged interest on drawings at 5% p.a. and allowed interest on capitals at

6% per annum.

B died on January 1st, 2011. His drawings to the date of death were Rs.2,000 and interest there on

was Rs.60. The profits for the three years ending March 31st 2008 Rs.21,200; 2009 Rs.3,200 (Dr.);

and in 2010 Rs.9,000 respectively.

Prepare B’s Capital A/c to calculate the amount to be paid to his executors. (6)

(Hint: B’s Executors A/c Rs.41,490)

11. (a) Ranbaxy Limited purchased a machinery worth Rs.5,00,000 from Laborate Pharmaceutical.

Rs.2,75,000 was paid by issue of 9% Preference Shares of Rs.100 each at a premium of 10%. The

balance was paid by cheque. Give necessary entries.

(b) On 1.1.2014 Govardhan Limited received in advance the first call of Rs.2 per share on 10,000

equity shares. The first call was made due on 15.2.2014. journalise the transaction and transfer the

advance to first call account by opening a calls in advance account. (4)

12. Registered capital of Sunshine Limited is Rs.5,00,000 divided in 50,000 Equity Shares of Rs.10

each. Out of these 50,000 shares, company issued 10,000 shares to Luxmi Machines Limited as

fully paid as purchase consideration for a Machinery acquired. Remaining 40,000 shares were

offered to the public but applications were received for 36,000 shares only, full allotment was

made to the applicants. Company called Rs.6 per share and received the entire amount except a

call of Rs.3 per share on 6,000 shares.

How would you show the relevant items in the Company’s Balance Sheet? (4)

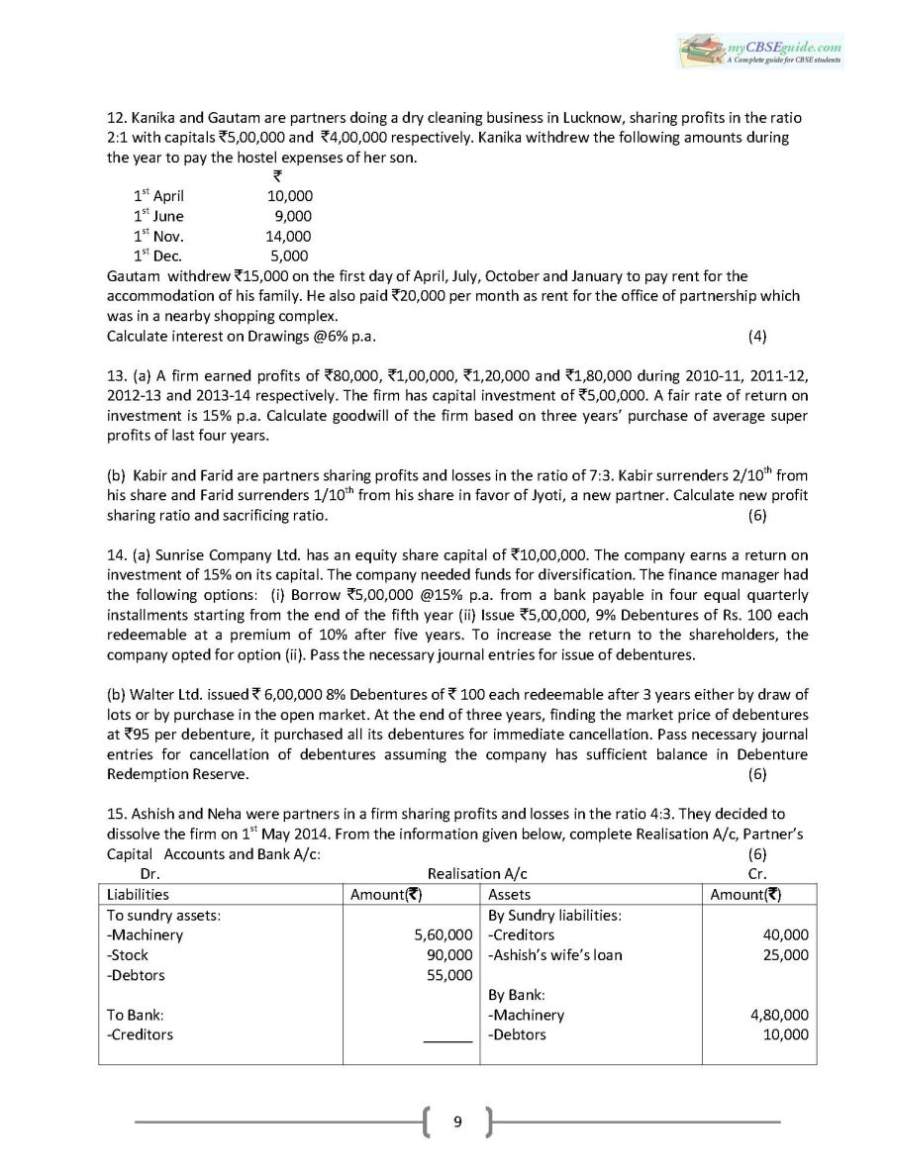

13. Himanshu and Jayant were partners in a firm sharing profits in the ratio of 3:2. Their fixed capitals

on 1-4-2013 were : Himanshu Rs.6,00,000 and Jayant Rs.12,00,000. They agreed to allow interest

on capitals @12% per annum and to charge on drawings @15% per annum. Himanshu will get a

commission of Rs.10,000 after charging interest on capital (if any profit available). The firm

earned a profit, before all above adjustments, Rs.1,80,000 for the year ended 31.3.2014. The

drawings of Himanshu and Jayant were Rs.18,000 and Rs.30,000 respectively. Prepare P/L

Appropriation Account if interest on capital is treated as a charge and will be allowed even if the

firm incurs a loss. (6)

(Hint: Loss to Himanshu Rs.19,440 and Jayant Rs.12,960)

14. On January 1, 2004, Vinod Limited company made an issue of 1,000, 6% debentures of Rs.1,000

each at Rs.960 per debenture. The terms of issue provided for the redemption of 200 debentures

every year starting from the end of 2005 either by purchase or draw of lot at par at the company’s

option. Discount was written off in the same year against the available profit balance. On

31.12.2005 the company purchased for cancellation, debentures of the face value of Rs.80,000 at

Rs.9.50 per debenture and of the face value of Rs.1,20,000 at Rs.900 per debenture.

Journalise the above transactions i.e. issue, redemption, profit on cancellation and discount written

off etc. (6)

15. Rainbow Limited issued prospectus inviting applications of 4,000 Equity Shares of Rs.10 each at a

premium of Rs.4 per share payable as follows:

On Applications Rs.2 ; On Allotment Rs.7 (including premium);

First call Rs.3 and Second Call Rs.2 per share.

Applications were received for 6,000 shares and allotment made on pro-rata basis to the applicants

for 4,800 shares, the remaining applications being refused. Money received in excess on

Applications was adjusted towards allotment.

Mr. M to whom 80 Shares were allotted failed to pay the allotment and first call money so his

shares were forfeited.

Mr. N the holder of 120 shares, failed to pay two calls. So his shares were forfeited.

Of the shares forfeited 160 shares were reissued to Mr.SK credited as fully paid up for Rs.8 per

share. The whole share of Mr. M included. Give journal entries. (8)

(Hint: Capital Reserve Rs.272)

For information , here is the attachment

|