|

#2

5th November 2015, 12:23 PM

| |||

| |||

| Re: Capital Budgeting Project for MBA

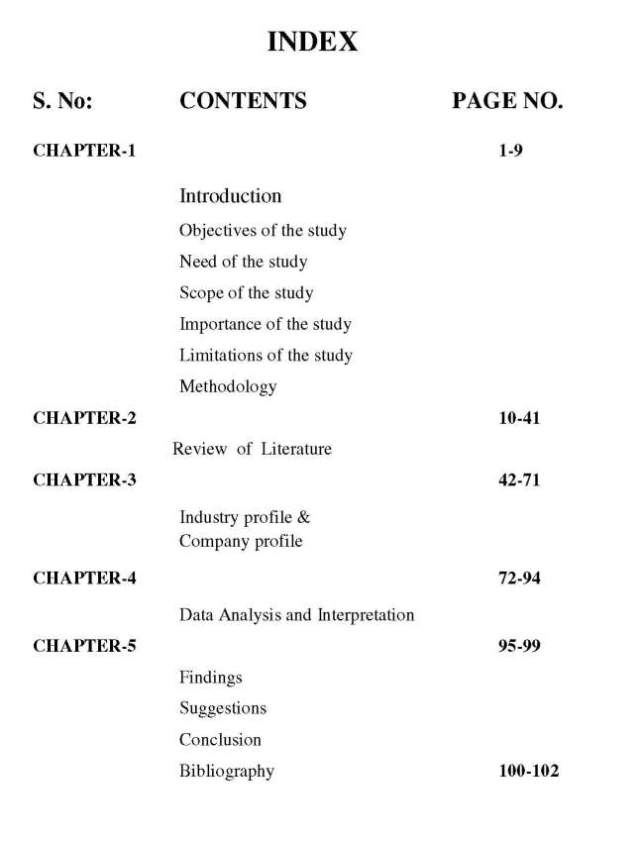

As you want to get project on Capital Budgeting for MBA Students, so here I am providing a project. I am putting some content from file of project here. Project Name “A STUDY ON CAPITAL BUDGETING AT DR.REDDY’S LABORATORIES LIMITED” INDEX CHAPTER-1 Introduction Objectives of the study Need of the study Scope of the study Importance of the study Limitations of the study Methodology CHAPTER-2 Review of Literature CHAPTER-3 Industry profile & Company profile CHAPTER-4 Data Analysis and Interpretation CHAPTER-5 Findings Suggestions Conclusion Bibliography INTRODUCTION Capital budgeting is an essential part of every company’s financial management. Capital budgeting is a required managerial tool. One duty of financial manager is to choose investment with satisfactory cash flows with high returns. Therefore a financial manager must be able to decide whether an investment is worth undertaking and able to decide and be able to choose intelligently between two or more alternatives. Capital budgeting involves the planning and control of capital expenditure. It is the process of deciding whether or not to commit resources to a particular long term project whose benefits are to be realized over a period of time. A capital budgeting decision is defined as the firms decision to invest its current funds efficiently in the long-term assets in anticipation of an expected flow of benefits over a series of years. The firm’s investment decisions would generally include expansion, acquisition, modernization, and replacement of the long-term assets. They are the assessment of future events, which are difficult to predict. It is really complex problem to estimate the future cash flow of an investment. The investment decision of a firm is generally know as Capital Budgeting or Capital Expenditure Decision. Capital budgeting is also known as “Investment Decision Making”, “Capital Expenditure Decisions”, “Planning Capital Expenditure” and “Analysis of Capital Expenditure. Project on Capital Budgeting      Last edited by sumit; 14th December 2019 at 10:06 AM. |