|

#2

23rd August 2014, 09:28 AM

| |||

| |||

| Re: CA Exam For Science Background Students or Not

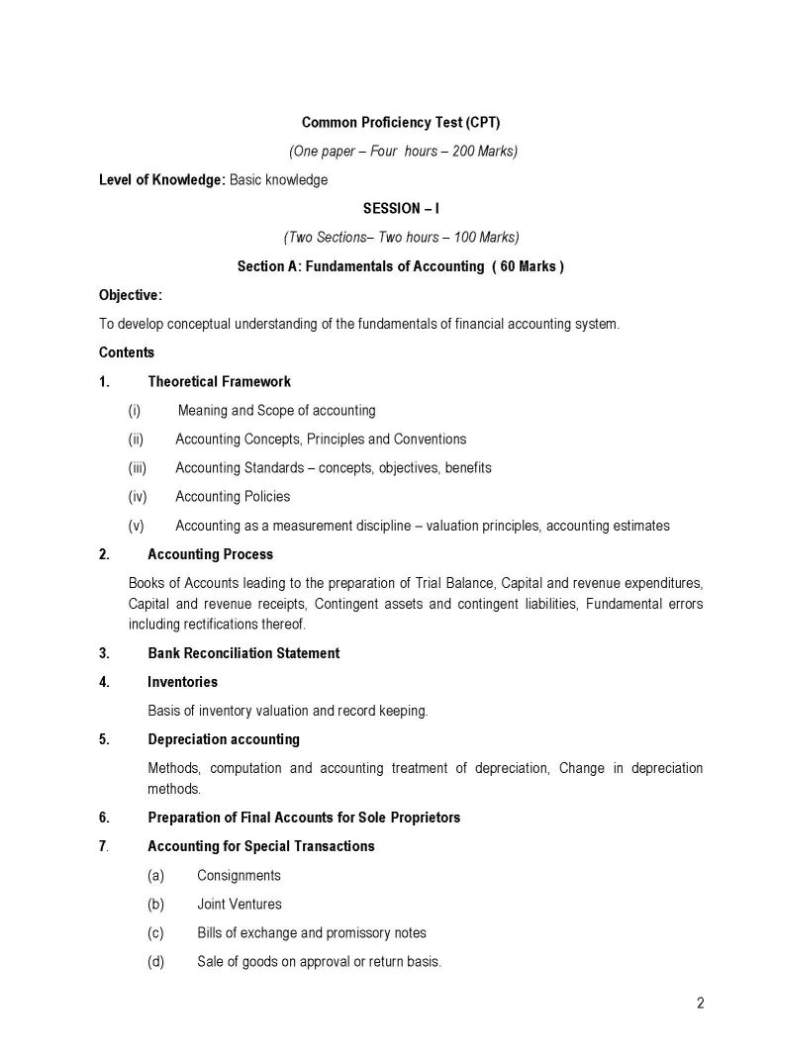

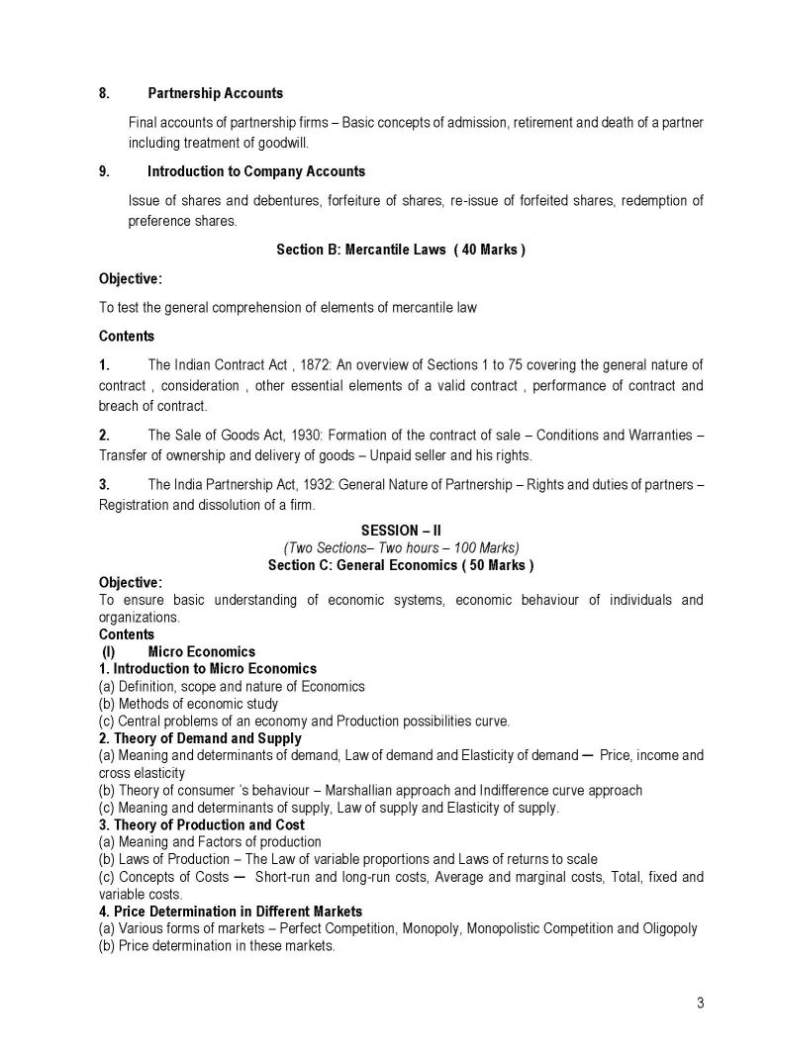

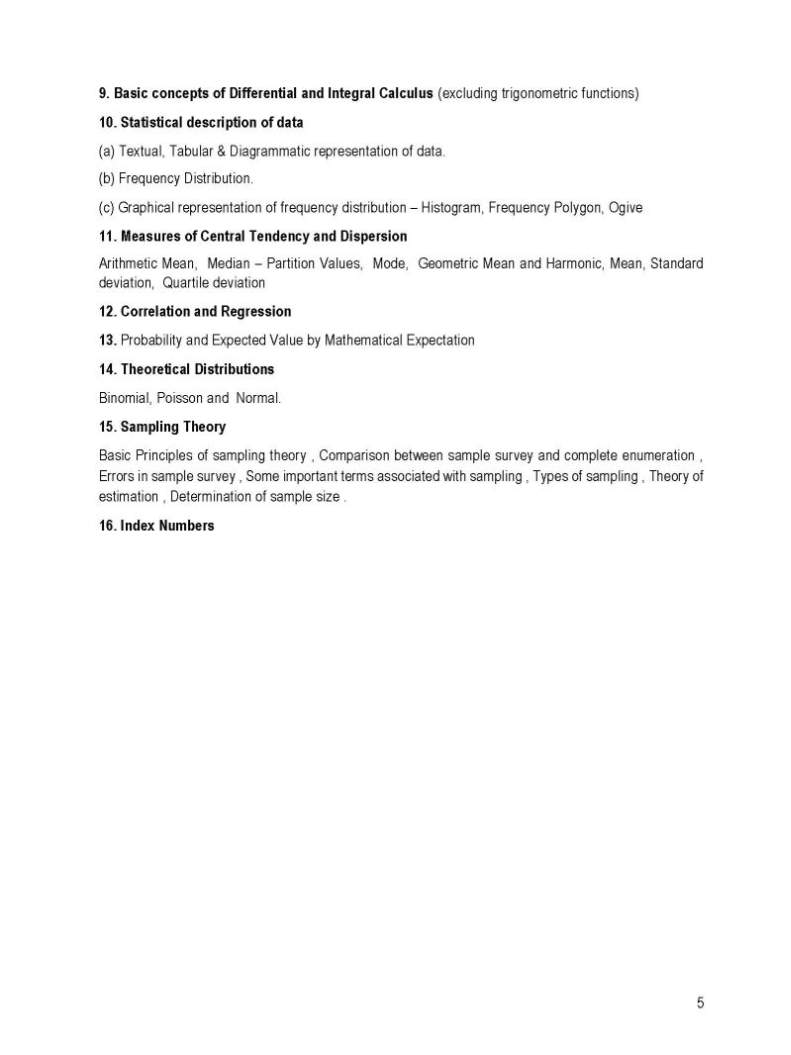

Yes students from science background can apply for admission in Chartered Accountancy course offered by Institute of Chartered Accountants For admission in Chartered Accountancy course you have to pass CPT entrance examination. Qualification for CPT ; You must have +2 (or) are equivalent to +2 course with any stream. And no percentage is required for this course. CA CPT age limit : There is no maximum age limit for to write the CA CPT test.. Important dates : The Exam Form for Common Proficiency Test Dec 2014 Attempt would be available from 7th October 2014 (10:00 AM) onwards the last date of submission of the same is 28th Oct 2014 (05:30 PM). Common Proficiency Test (Paper- Pencil Mode) will be held on 14th December 2014 Sunday There are 3 levels in CA Foundation Intermediate Final CPT exam fee : Course Test Centre In Exam Fee CPT India INR 500/- CPT Kathmandu (Nepal) INR 850/- CPT Abu Dhabi (UAE), Bahrain, Doha (Qatar), Dubai USD 150 CPT exam syllabus : CPT – One Paper, Two Sessions ( 200 Marks Total ) Session I: Section A: Fundamentals of Accounting (60 Marks) Section B: Mercantile Laws (40 Marks) Session II: Section C: General Economics (50 Marks) Section D: Quantitative Aptitude (50 Marks) Section A: Fundamentals of Accounting ( 60 Marks ) 1. Theoretical Framework (i) Meaning and Scope of accounting (ii) Accounting Concepts, Principles and Conventions (iii) Accounting Standards – concepts, objectives, benefits (iv) Accounting Policies (v) Accounting as a measurement discipline – valuation principles, accounting estimates 2. Accounting Process Books of Accounts leading to the preparation of Trial Balance, Capital and revenue expenditures, Capital and revenue receipts, Contingent assets and contingent liabilities, Fundamental errors including rectifications thereof. 3. Bank Reconciliation Statement 4. Inventories Basis of inventory valuation and record keeping. 5. Depreciation accounting Methods, computation and accounting treatment of depreciation, Change in depreciation methods. 6. Preparation of Final Accounts for Sole Proprietors 7. Accounting for Special Transactions (a) Consignments (b) Joint Ventures (c) Bills of exchange and promissory notes (d) Sale of goods on approval or return basis.     Contact detail:- Institute of Chartered Accountants of India IP Estate, New Delhi, Delhi (state) 110002 011 2337 0055 |