|

#3

25th March 2016, 02:24 PM

| |||

| |||

| Re: Break Even Analysis MBA

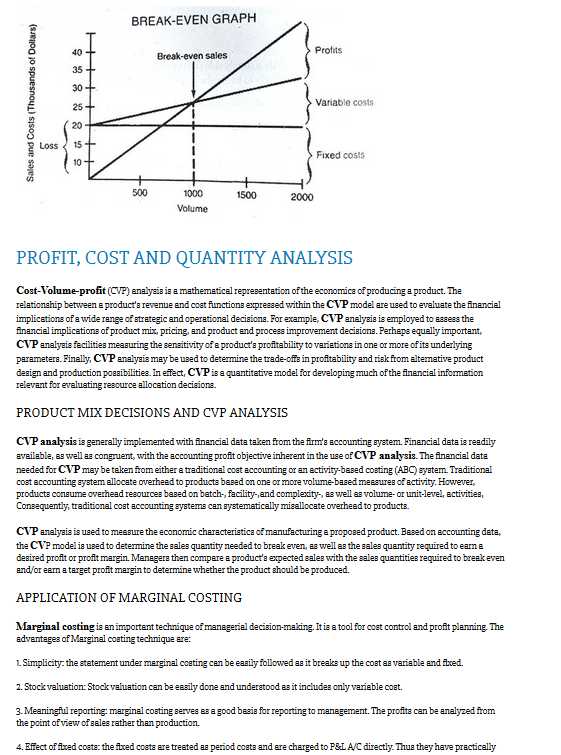

Hey buddy the Break even analysis is used to determine when your business will be able to cover all its expenses and begin to make a profit. It is important to identify your startup costs, which will help you determine your sales revenue needed to pay ongoing business expenses. To be profitable in business, it is important to know what your break-even point is. Your break-even point is the point at which total revenue equals total costs or expenses. At this point there is no profit or loss - in other words, you 'break even'.     Common example For example, suppose that your fixed costs for producing 100,000 widgets were Rs.30,000 a year. Your variable costs are Rs.2.20 materials, Rs.4.00 labour, and Rs.0.80 overhead, for a total of Rs.7.00. If you choose a selling price of $12.00 for each widget, then: Rs.30,000 divided by (Rs.12.00 - 7.00) equals 6000 units. This is the number of widgets that have to be sold at a selling price of Rs.12.00 before your business will start to make a profit. Back Points Break-even analysis is only a supply side (i.e. costs only) analysis, as it tells you nothing about what sales are actually likely to be for the product at these various prices. It assumes that fixed costs (FC) are constant. Although, this is true in the short run, an increase in the scale of production is likely to cause fixed costs to rise. It assumes average variable costs are constant per unit of output, at least in the range of likely quantities of sales. (i.e. linearity) |