|

#2

1st August 2015, 12:48 PM

| |||

| |||

| Re: Basics of Banking Certification from IIBF

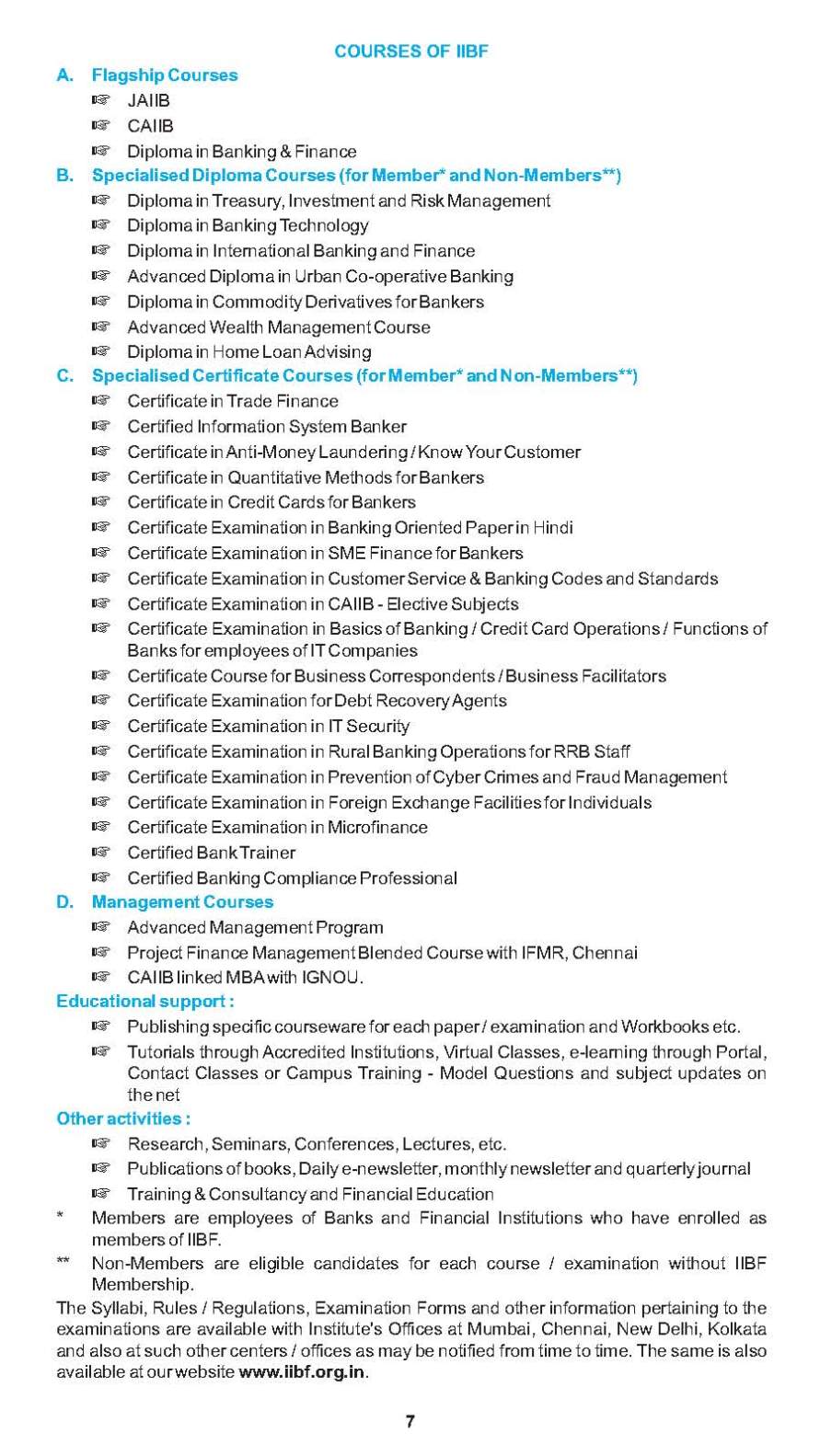

As you want I am here telling you about the eligibility for Certification in Basics of Banking course of Indian Institute of Banking & Finance (IIBF) . Eligibility for Certification in Basics of Banking course: Candidate must be employees of IT and BPO Companies / DSA / DMA providing banking and finance related services. (a) Fresh entrants (b) Persons posted in banking and finance domain / projects Candidate must be Graduates. Syllabus for the course: Course - I : Certification in Basics of Banking I) Overview - Structure of the Financial system and the Constituents - RBI, Commercial banks, Financial Institutions, NBFCs, Indian capital market , Mutual funds, Merchant banks, Insurance companies, etc. - Brief overview of their roles and functions. - Meaning and Objectives of Banking / Banks & Intermediation - Savings - Credit - Types of Banking Institutions - Principles of Banking - intermediation, liquidity, profitability, solvency, trust, etc. - Meanings & Definition of Banking - Under British Law, Indian Law, Under USA Law. - Structure of Banking - Evolution, Ownership, size, structure and composition of the industry - Regulatory requirements - Bank Rate / Banker's Bank - Comparative structure of banking in developed Economies like USA, UK etc. - similarities and contrasts. - Basics of International Banking, retail banking and wholesale banking - Organization structure of a typical global Bank - at high level - Wholesale, Retail, ALM & Treasury, etc. - within these the product development, marketing, sales, operations, credit, etc. Also cover enterprise wide divisions like Risk, Audit & Compliance, IT, Finance, HRD, Facilities, Corporate Communications, etc. - Global Banking - Recent trends II) Brief on Activities at a Bank : - Deposits : - Deposits - different types of deposits (transaction / non-transaction, interest bearing / non interest bearing) - usage & need of deposits at a bank - liquidity management. - Types of Interest Rates - fixed, floating, etc. - Basic Operational flow for setting up & managing deposits. The details of the prescribed syllabus which is indicative are furnished below. However, keeping in view the professional nature of examinations, all matters falling within the realm of the subject concerned will have to be studied by the candidate as questions can be asked on all relevant matters under the subject. Candidates appearing for the Examination should particularly prepare themselves for answering questions that may be asked on the latest developments taking place under the various subjects of the said examination although those topics may not have been specifically included in the syllabus. The Institute also reserves to itself the right to vary the syllabus / rules / fee structure from time to time. Any alterations made will be notified from time to time. Further, questions based on current developments in banking and finance may be asked. Candidates are advised to refer to financial news papers / periodicals more particularly "IIBF VISION" and "BANK QUEST" published by the Institute. - Lending : - Broad categories of lending - Working Capital, Long Term, Project Finance, etc. - Types of Interest Rates - fixed, floating, etc. - Concepts of secured / unsecured & collateral management - Value chain in loan delivery - (wholesale) Credit Appraisal and sanction - processing / delivery - monitoring - recovery procedures, security and documentation procedures - stamping (make generic) - Value chain in loan delivery (retail) - Need for credit reports & computation of credit scores - based on these template based appraisal and approval - processing / delivery - monitoring - recovery procedures, security and documentation procedures - Transaction & Other Services: - Account related services - Opening, Servicing (Statements / Reporting, Standing instructions, etc.), Closing. - High level discussion on evolution of Servicing at Banks - from Brick & Mortar to ATMs, mobiles, Internet Banking, etc. - Payment and Collection procedures- clearing house fundamentals (ACH) - electronic funds transfer - negotiable instruments, RTGS, etc. - Remittance facilities - forex, etc. Brief note on SWIFT. - Trade Finance Services - need for Trade Finance desks, risks in international trade & brief overview of Letters of Credit and Guarantees products. Business process for an LC transaction to be explained. - Cash Management Services - need for CMS - collections, payments & pooling / sweeping / liquidity management offerings to Corporate customers. - Treasury Services - Forex & Fixed Income overview, Asset Liability Management overview - money markets / risks involved, etc. - Institutional Banking - need for correspondent banking - definition of Nostro, Vostro - Corporate Finance - Broad overview of need & activities (Advisory, IPO, Capital Structuring, etc.) - Bankcards - types of cards- charge cards, debit cards, credit cards, co-branded cards, smart cards etc. - basic business process for a credit card transaction could be explained. III) Legal aspects & Risk Management - Basic laws affecting Banking Operations - Compliance requirements - Best Practices - KYC principles - Nature of the business - Relations with Customers - Types of Risk - Credit, Market (Interest / Liquidity), Operational, etc. Brief on processes in Banks to control & manage Risks e.g. Market Risk Desk, Credit Analysis, Credit Admin, etc. - Brief overview of Basel II stipulations for managing risk IV) Accounting : - Nature and purpose of accounting; principles - accounting standards and its definition and Scope - Basic Accountancy Procedures - account categories - debit and credit concepts - Understanding the P&L, Balance Sheet (definition of assets / liabilities), contingents - source & deployment of funds - revenue streams in a bank - Profit maximization - Net Interest Income, Non Interest Income, Cost to Income ratios, etc. - Core banking Solutions- Accounting in a computerized environment Basics of Banking Certification syllabus- IIBF         Contact detail: Indian Institute Of Banking & Finance Kohinoor City Commercial – II Tower-I, 2nd & 3rd Floor Kirol Road Off-L.B.S Marg Kurla- West MUMBAI - 400 070 |