| Re: Bank of Baroda Family Floater

Bank of Baroda is one of the leading public sector banks of India. It was founded on 20 July, 1908. It’s headquarter is located in Vadodara, India. Its products include Credit cards, consumer banking, corporate banking, finance and insurance, investment banking, mortgage loans, private banking, private equity, wealth management.

Features about Baroda Health

It is a Medical Insurance Scheme, available only to account holders of Bank of Baroda, which takes care of the hospitalization costs experienced by the customer up to the amount of sum insured, in respect of the following eventualities.

Any illness / disease

Accidental injury and/ or any ailment

Any surgery that is required in respect of any disease or accident that has arisen during the policy period

The minimum hospitalization should be for 24 hours

Benefits:

Very low premium

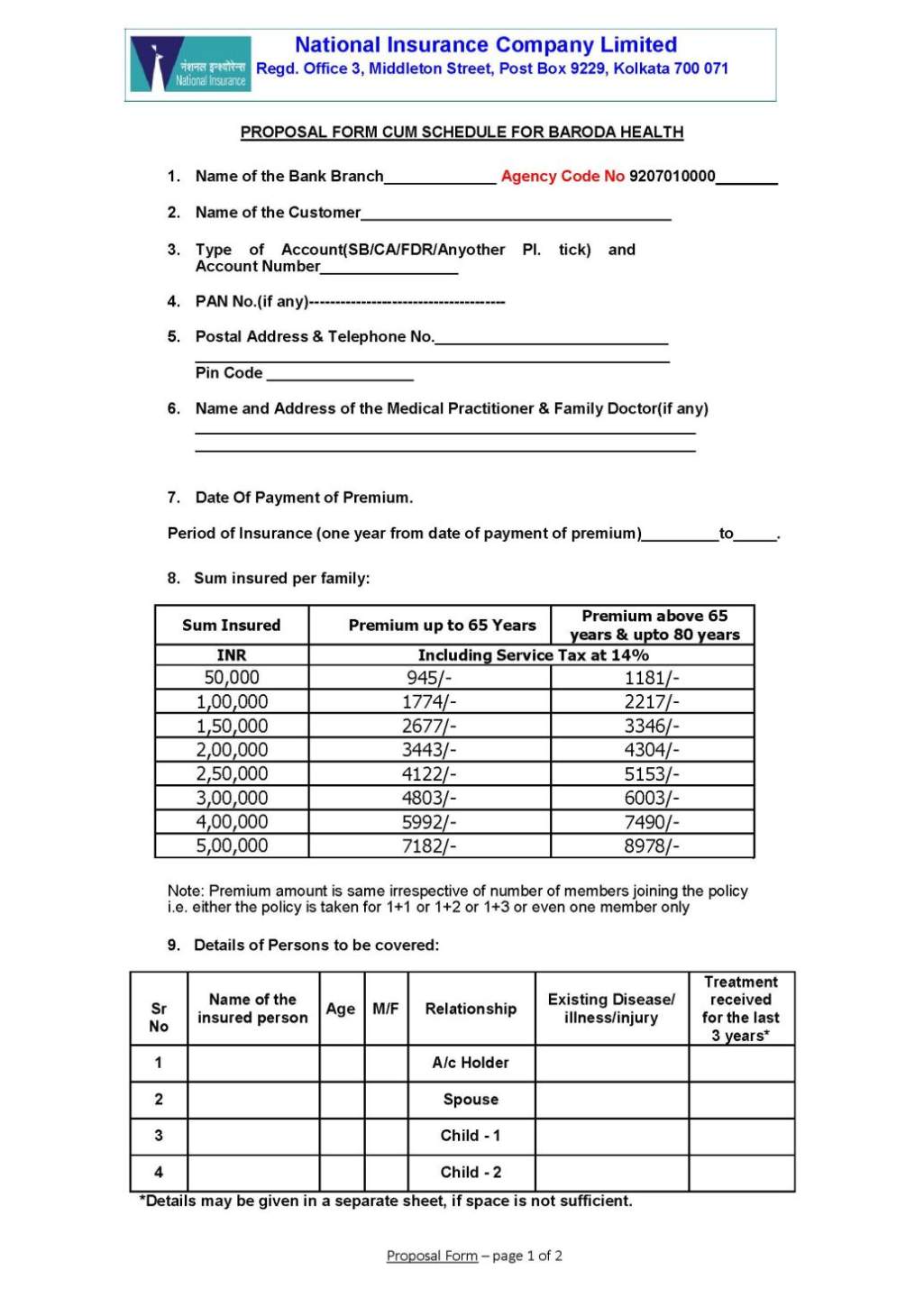

In this co-branded product, single premium (generally payable for a single person) is payable and Medical Health insurance cover is available to family of -4- (self, spouse and 2 dependent children) up to the amount insured without any additional premium.

A member or all the members in insured family can avail hospitalization benefits during the policy period, to the extent of aggregate sum not exceeding the sum insured.

Premium paid is eligible for Income Tax exemption under Section 80 D as per Income Tax Rules.

Salient features:

No medical examination required for beginning of health cover.

Pre-existing ailments also get coverage after 3 continuous claim-free policy years.

Coverage options available: 8 slabs ranging from Rs. 50,000/- to Rs. 5,00,000/- per family of 1+3.

Upper age limit of first named person is permissible upto 80 years

The insured individuals get cashless hospitalization facility also in the selected hospitals through TPAs.

Scope of Cover:

Room, Boarding expenses as provided by the Hospital / Nursing Home.

Nursing expenses

Surgeon, Anaesthetist, Medical Practitioner, Consultants, Specialists Fees

Anaesthesia, Blood, Oxygen, Operation Theatre Charges, Surgical appliances, Medicines & Drugs, Diagnostic Materials and X-Ray, Dialysis, Chemotherapy, Radiotherapy, Cost of pacemaker, Artificial Limbs and cost of organs and similar expenses.

For more details you can visit your nearest local branch.

|