|

#2

16th December 2015, 12:46 PM

| |||

| |||

| Re: Bank of Baroda DTAA

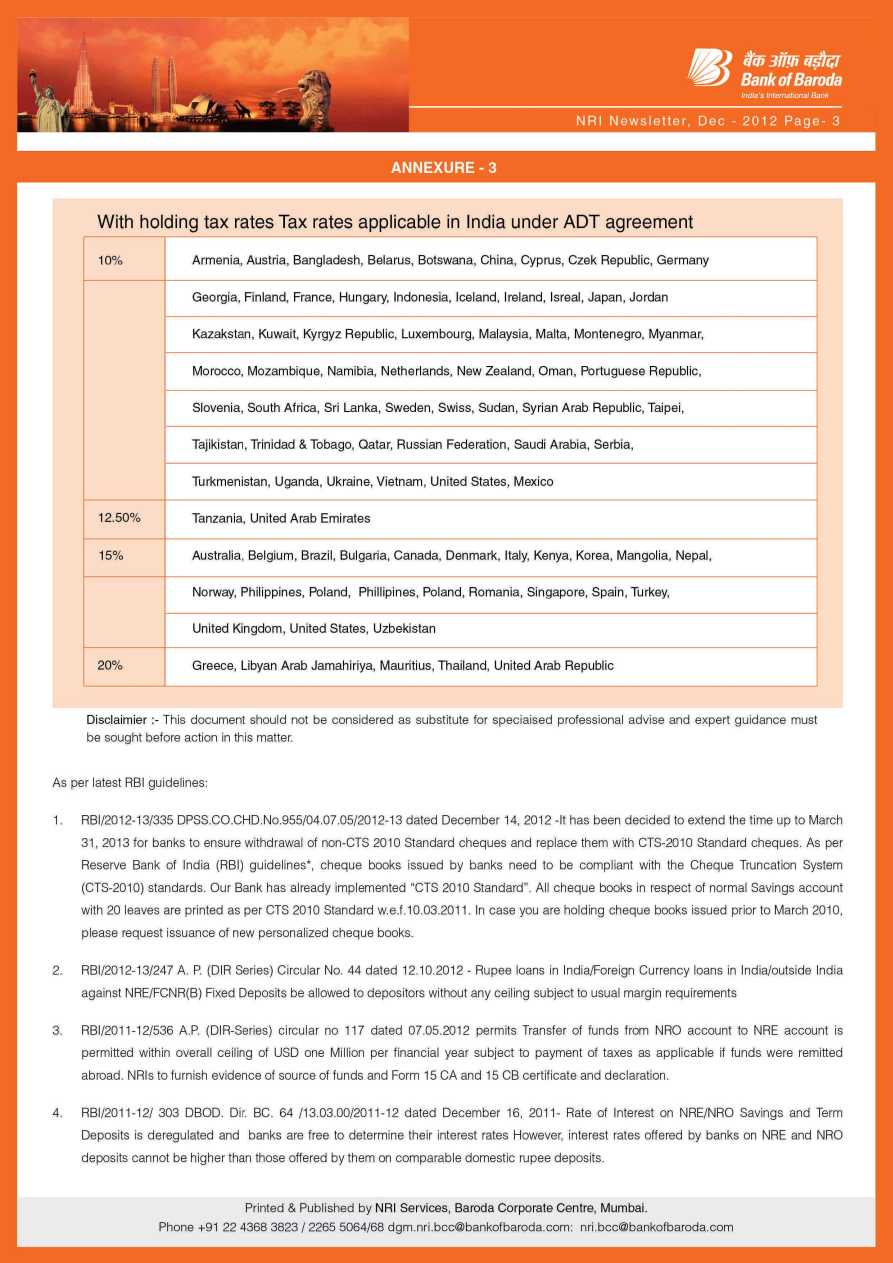

Detailed to NRI's, a NRO-SB account is opened by release from abroad or by legitimate dues in rupees of the account holder in India. The existing domestic A/C of the resident converted into NRO A/C on the taking up business/ employment/ immigration abroad. Overseas Corporate Bodies (OCB) cannot have any non-resident accounts in BOB. Key Benefits • Close relatives (resident0 can become joint account holders • Avail of remittance facilities • Avail of Cheque Book facility • Provision for nomination Terms & Conditions • The Principal funds are entirely non-reparable while the interest is reparable after deduction of tax at source. • NRO FD/SB: 30.90% withholding tax plus applicable surcharge is applicable in NRO FD/SB accounts where DTAA is not applicable or the NRI depositor is not in a position to provide required documents/formalities for availing rebate in withholding tax. Surcharge is applicable @2.5% of TDS/Tax amount to Foreign Company if the Company has net income exceeding Rs.1/-crore. Bank of Baroda DTAA     |