|

#2

7th June 2016, 03:55 PM

| |||

| |||

| Re: Bank Of America FSA Eligible Expenses

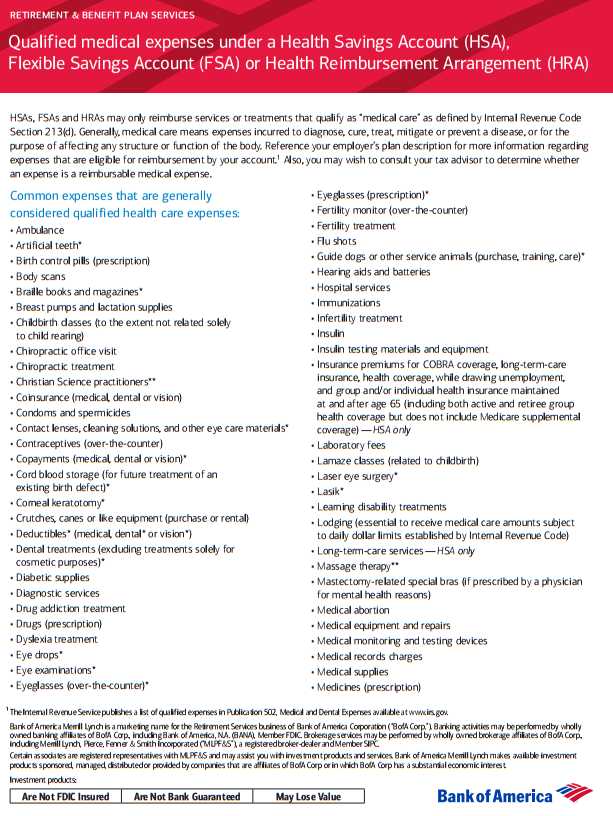

The bank of America is provides a Health FSAs services or treatments that qualify as “medical care” as defined by Internal Revenue Code Section 213(d). Medical care means expenses incurred to diagnose, cure, treat, mitigate or prevent a disease, or for the purpose of affecting any structure or function of the body. Dependent care FSA-eligible expenses include: Adult care expenses Child care expenses: daycare, after school care, nanny, etc. Bank Of America FSA Eligible Expenses   Some FSA eligible expanses are: Common expenses that are generally considered qualified health care expenses: Ambulance Artificial teeth Birth control pills (prescription) Body scans Braille books and magazines Breast pumps and lactation supplies Childbirth classes (to the extent not related solely to child rearing) Chiropractic office visit Chiropractic treatment Christian Science practitioners Co-insurance (medical, dental or vision) Condoms and spermicides Contact lenses, cleaning solutions, and other eye care materials Contraceptives (over-the-counter) Copayments (medical, dental or vision) Cord blood storage (for future treatment of an existing birth defect) Corneal keratotomy Crutches, canes or like equipment (purchase or rental) Deductibles (medical, dental or vision) Dental treatments (excluding treatments solely for cosmetic purposes) Diabetic supplies Diagnostic services Drug addiction treatment Drugs (prescription) Dyslexia treatment Eye drops Eye examinations Eyeglasses (over-the-counter) Eyeglasses (prescription) Fertility monitor (over-the-counter) Fertility treatment Flu shots Guide dogs or other service animals (purchase, training, care) Hearing aids and batteries Hospital services Immunizations Infertility treatment Insulin |