|

#3

18th March 2020, 05:47 PM

| |||

| |||

| Re: Bachelor of Accounting and Finance Mumbai University

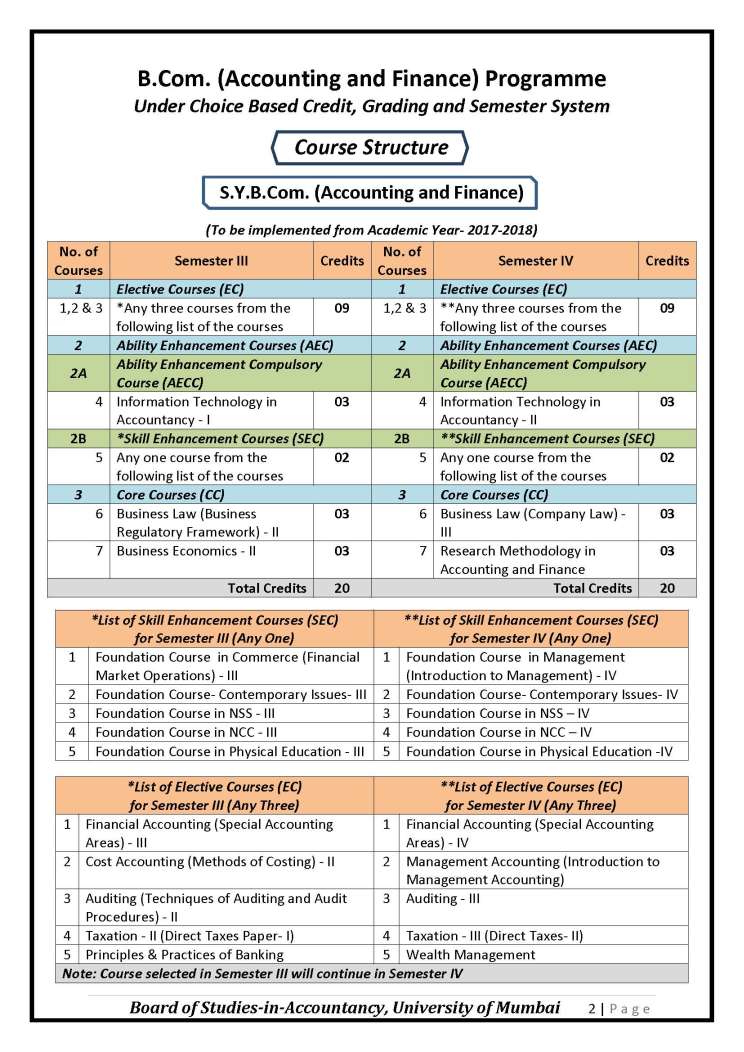

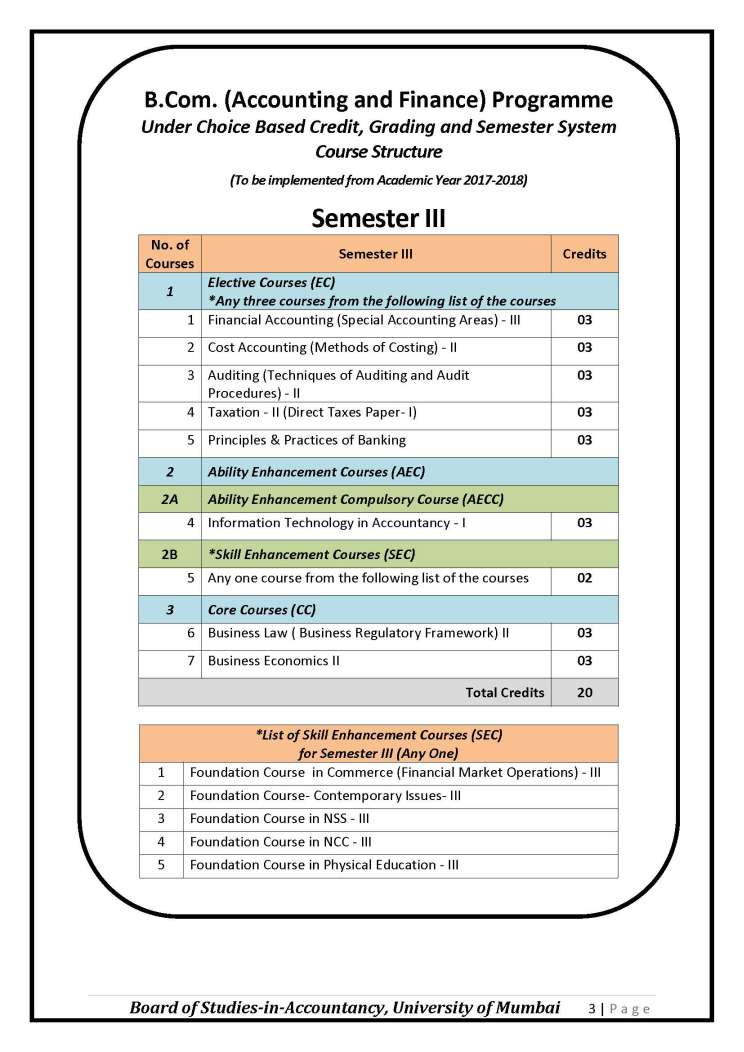

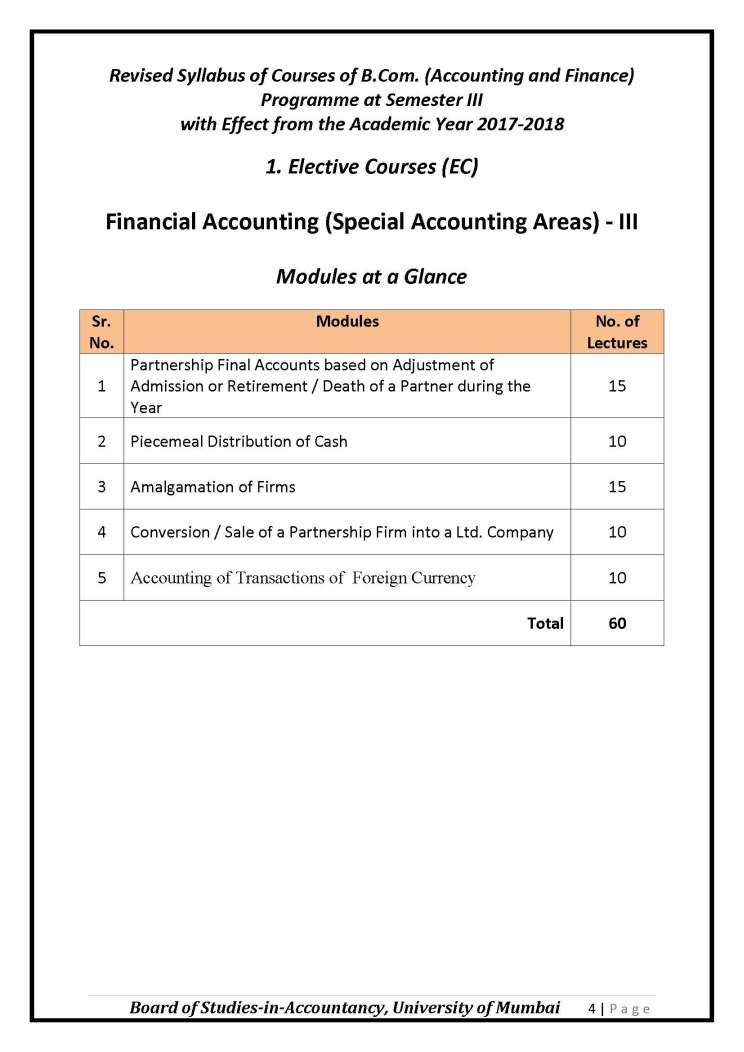

The syllabus for Bachelor of Commerce (Accounting & Finance) Second Year - Semester III and IV - offered by University of Mumbai is as follows: Financial Accounting (Special Accounting Areas) - III Modules / Units 1 Partnership Final Accounts based on Adjustment of Admission or Retirement/ Death of a Partner during the Year Simple final accounts questions to demonstrate the effect on final Accounts when a partner is admitted during the year or when partner Retires / dies during the year Allocation of gross profit prior to and after admission / retirement / death when stock on the date of admission / retirement is not given and apportionment of other expenses based on time / Sales/other given basis Ascertainment of gross profit prior to and after admission/retirement / death when stock on the date of admission / retirement is given and apportionment of other expenses based on time / Sales / other given basis Excluding Questions where admission / retirement / death takes place in the same year 2 Piecemeal Distribution of Cash Excess Capital Method only Asset taken over by a partner Treatment of past profits or past losses in the Balance sheet Contingent liabilities / Realization expenses/amount kept aside for expenses and adjustment of actual Treatment of secured liabilities Treatment of preferential liabilities like Govt. dues / labour dues etc Excluding: Insolvency of partner and Maximum Loss Method 3 Amalgamation of Firms Realization method only Calculation of purchase consideration Journal/ledger accounts of old firms Preparing Balance sheet of new firm Adjustment of goodwill in the new firm Realignment of capitals in the new firm by current accounts / cash or a combination thereof Excluding : Common transactions between the amalgamating firms 4 Conversion / Sale of a Partnership Firm into a Ltd. Company Realisation method only Calculation of New Purchase consideration, Journal / Ledger Accounts of old firms. Preparing Balance sheet of new company 5 Accounting of Transactions of Foreign Currency In relation to purchase and sale of goods, services and assets and loan and credit transactions Computation and treatment of exchange rate differences Syllabus B Com (Accounting & Finance) Second Year University of Mumbai     |