|

#4

15th December 2015, 11:31 AM

| |||

| |||

| Re: Andhra Pragathi Grameena Bank Gudur

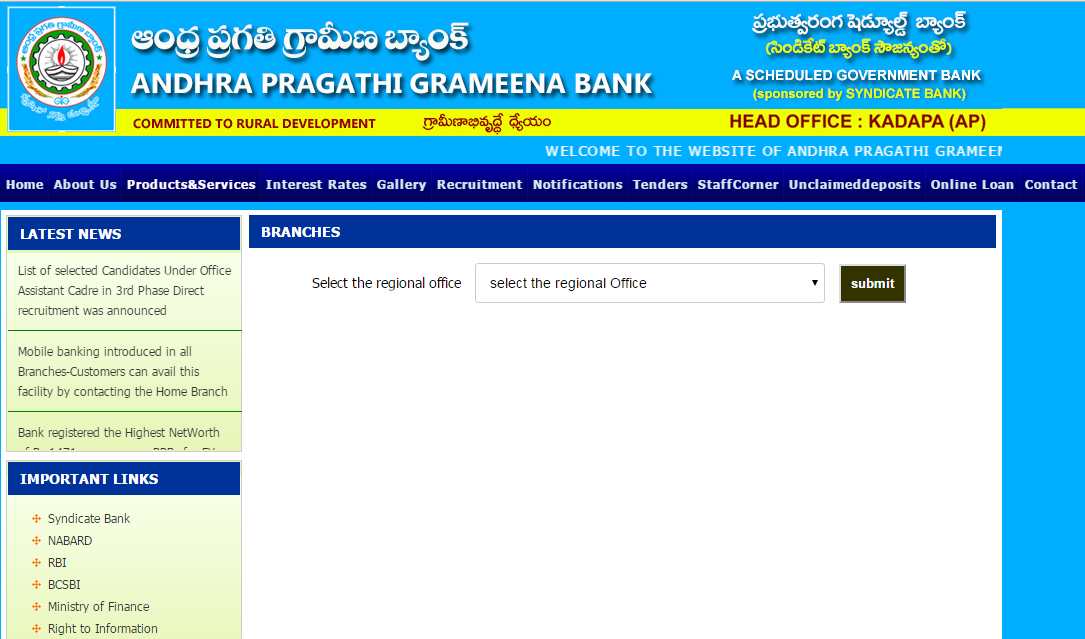

Please follow the below process to get the address for the Gudur branch of Andhra Pragathi Grameena Bank: Please visit the official site of Andhra Pragathi Grameena Bank which looks like the image below  On the right of the page you will find the section for Important Information, under this section you will find link for Branch locator. Please click on it, a new page will load which looks like the image below  This page has a drop down menu with region where the branches are available. Please select the appropriate region and click submit. Another drop down menu with all the branches for the selected region will be available. Please select the desired branch for which you will need the details and click submit. The details will be displayed. Please follow the above process for future as well. Address: Andhra Pragathi Grameena Bank Guduru (n) Main Branch Ics Road, Gudur Mandal Nellore District. Pin 524101 |