|

#2

6th February 2017, 04:27 PM

| |||

| |||

| Re: AICEIA Vizag

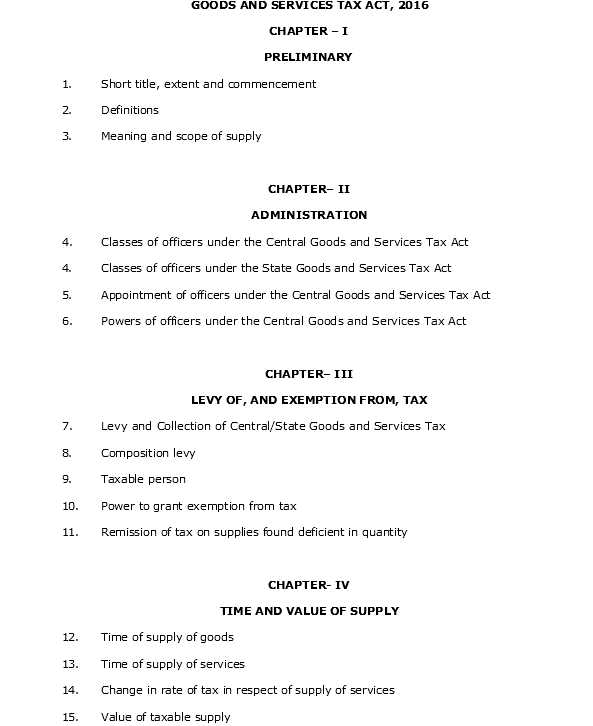

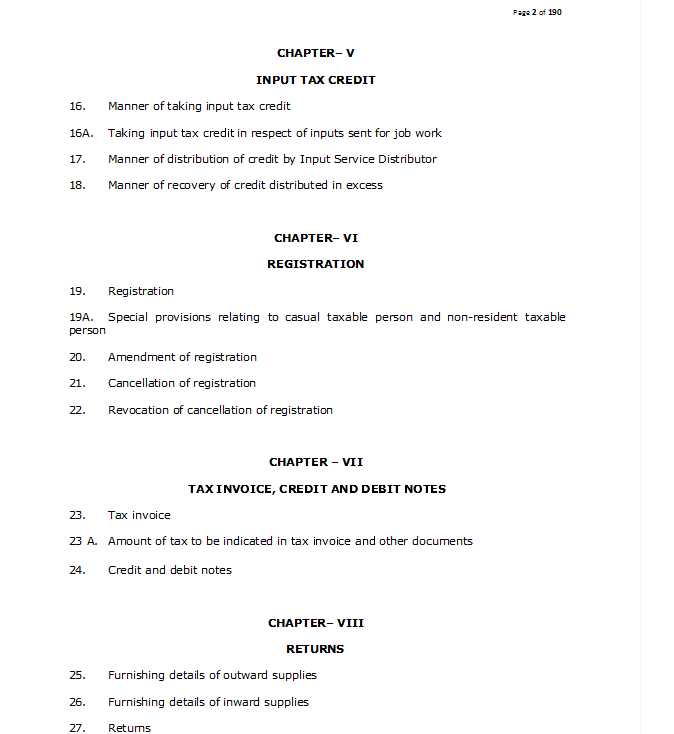

As you are looking to get details about Model GST Law of All India Central Excise Inspectors' Association Vizag (AICEIA), so here are following details: All India Central Excise Inspectors' Association Vizag (AICEIA) Model GST Law GOODS AND SERVICES TAX ACT, 2016 CHAPTER – I PRELIMINARY 1. Short title, extent and commencement 2. Definitions 3. Meaning and scope of supply CHAPTER– II ADMINISTRATION 4. Classes of officers under the State Goods and Services Tax Act 5. Appointment of officers under the Central Goods and Services Tax Act 6. Powers of officers under the Central Goods and Services Tax Act CHAPTER– III LEVY OF, AND EXEMPTION FROM, TAX 7. Levy and Collection of Central/State Goods and Services Tax 8. Composition levy 9. Taxable person 10. Power to grant exemption from tax 11. Remission of tax on supplies found deficient in quantity CHAPTER- IV TIME AND VALUE OF SUPPLY 12. Time of supply of goods 13. Time of supply of services 14. Change in rate of tax in respect of supply of services 15. Value of taxable supply INPUT TAX CREDIT 16. Manner of taking input tax credit 16A. Taking input tax credit in respect of inputs sent for job work 17. Manner of distribution of credit by Input Service Distributor 18. Manner of recovery of credit distributed in excess CHAPTER– VI REGISTRATION 19. Registration 19A. Special provisions relating to casual taxable person and non-resident taxable person 20. Amendment of registration 21. Cancellation of registration 22. Revocation of cancellation of registration CHAPTER – VII TAX INVOICE, CREDIT AND DEBIT NOTES 23. Tax invoice 23 A. Amount of tax to be indicated in tax invoice and other documents 24. Credit and debit notes CHAPTER– VIII RETURNS 25. Furnishing details of outward supplies 26. Furnishing details of inward supplies 27. Returns 27A. First Return 28. Claim of input tax credit and provisional acceptance thereof   To get complete details, download the file....... scribd.com/document/317760144/ModelGSTLaw-draft-pdf#fullscreen&from_embed Contacts All India Central Excise Inspectors' Association Visakhapatnam Email to :inspvizag@gmail.com |